Skip to content

Hypothesis1: There is a sufficient demand for a new solution aimed specifically at Gulf region for Sanction/PEP/KYC/AML checks, both from Gulf residing companies as well as outside fintech/regtech/traditional finance institutions.Validation1: Customer survey of potential Gulf region interested Risk Management Executives, please see Validation2: Competition landscape detail survey of overall market situation and potential Product SOM as per are positive, SOM of clients with average annual spend of 15755$ led us to SOM boundaries establishment of between $ and $ annually.Expertiment1: Customer survey of potential outside companies will wait till we ship out the first version of the product in order to combine and already monetize/generate leads for monetization hypothesis. Hypothesis2: A new solution build using latest direct customer test’s, RPA’s and Agile SAFE methodologies can be tested in a sufficient way while generating initial revenue / leads for larger scale B2B contracts. All of that can archived within a reasonable time frame and with gradual build approach of several milestones.Validation3: Product features of valid competition disassembly together with unique selling proposition of the product allow for gradual release of the functions over several milestones, with KPI definition for each milestone. Validation4: We have been able to identify three milestones with complete product proposition to run through as part of experiment in this hypothesis expertiment:Value PropositionTarget MarketOKRIMPACTMETRICSAssumption1: A various business model based on the competition differentiation will be interesting enough for potential clients to test the service in a freemium mode. As such, two key metrics (KPI’s) based on overall E2E user flow of 6 stages can be measured:KPI1: Leads Found: Marketing MetricKPI2: Leads Engaged: Marketing MetricKPI3: Product Visitors: Marketing MetricKPI4: Product Users: Sales MetricKPI5: Product Customers: Sales MetricKPI6: MOZN B2B Leads: Sales MetricExperiment2: We need to test the overall hypothesis of milestoned approach and lead conversion at the initial product derivated from Milestone1 close and operations run. E2E conversion of the optimum product path should take us above industry standard of 5-6% from Marketing to Sales Metric, ie from KPI3 to KPI4, while KPI6 would be interesting side metric to watch.

Problem:Expensive and regionally unreliable enterprise KYC/AML/PEP check solutions are not providing adequate service on region specific verifications. Manual verification that replaces them is not cost effective/apllicable for large scale operations.Solution:SaaS Cloud or Hybrid on Premise solution can provide a collaborative, integrated & real time window into multiple region specific databases and match the individuals that must go through detail screening and/or should be automatically declined.Customers:Different models might apply, but basically there are three types of business model to consider:Outsiders wanting to check potential business partners without any regional specific knowledge.Fintech/Finance/Banking B2B customers that will want a deeper integration.B2C regional users serving as tool promotion and potential data/algo feed?Key Metrics To Consider:SalesCRR (Customer Retention Rate)MRR (Monthly Reoccuring Revenue)EBITDAACV (Average Client Value)Virality factorCOGS (Cost of Goods Sold)YoY GrowthCAC (Customer Acquisition Cost)LTV (Lifetime Customer Value)Market:TAM: $31B, CAGR: 12.8%Global Online Identity MarketSAM: $7.5B, CAGR: 9.6%Global Compliance Solutions as part of TAMSOM: 447M, CAGR ???Easy within reach customers without much specifics, API first feasible, Region interested Competition:Old Players: Custom Builds: Upstarts: GTM:Free Model: Partnerships: RPA LeadGen: Sales Force: Unfair Advantages:Regional Knowledge for SOM dominanceProven Data Science Team BehindUSP:Free Basic ModelAccuracy of Matching & Data SourcesEasy API First on boarding processArabic/Latin/Other NLP translationAdditional Information Streams

Distribution & Sales

One of the most powerful ways to get distribution is to combine the three strategies of leveraging existing networks, automation and virality. · Johny Fiala

Market size & Industry

Are you going after a billion dollar market? · Johny Fiala

Revenue Planning

The more money you make customer, the better. · Johny Fiala

Go To Market

Network effects generate positive feedback loops that result in superlinear growth · Johny Fiala

Product Market Fit

Every company needs to overcome lack of product/market fit. · Johny Fiala

Operational scalability

What are some existing human or infrastructure limitations on scalability? · Johny Fiala

1. Hypothesis’s, Validations, Experiments & Assumptions

36160

363088480

569700800

2. Business Case Basics

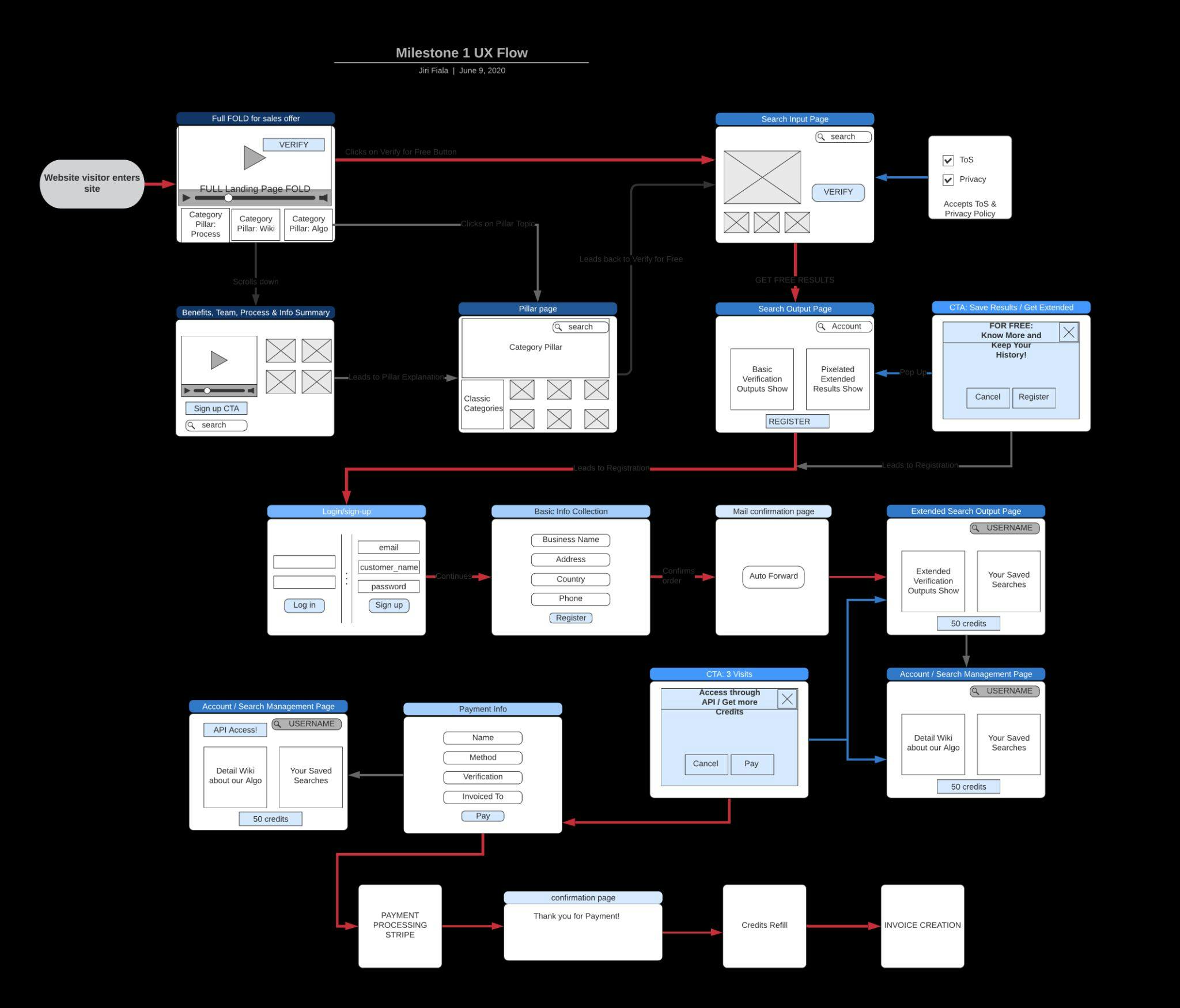

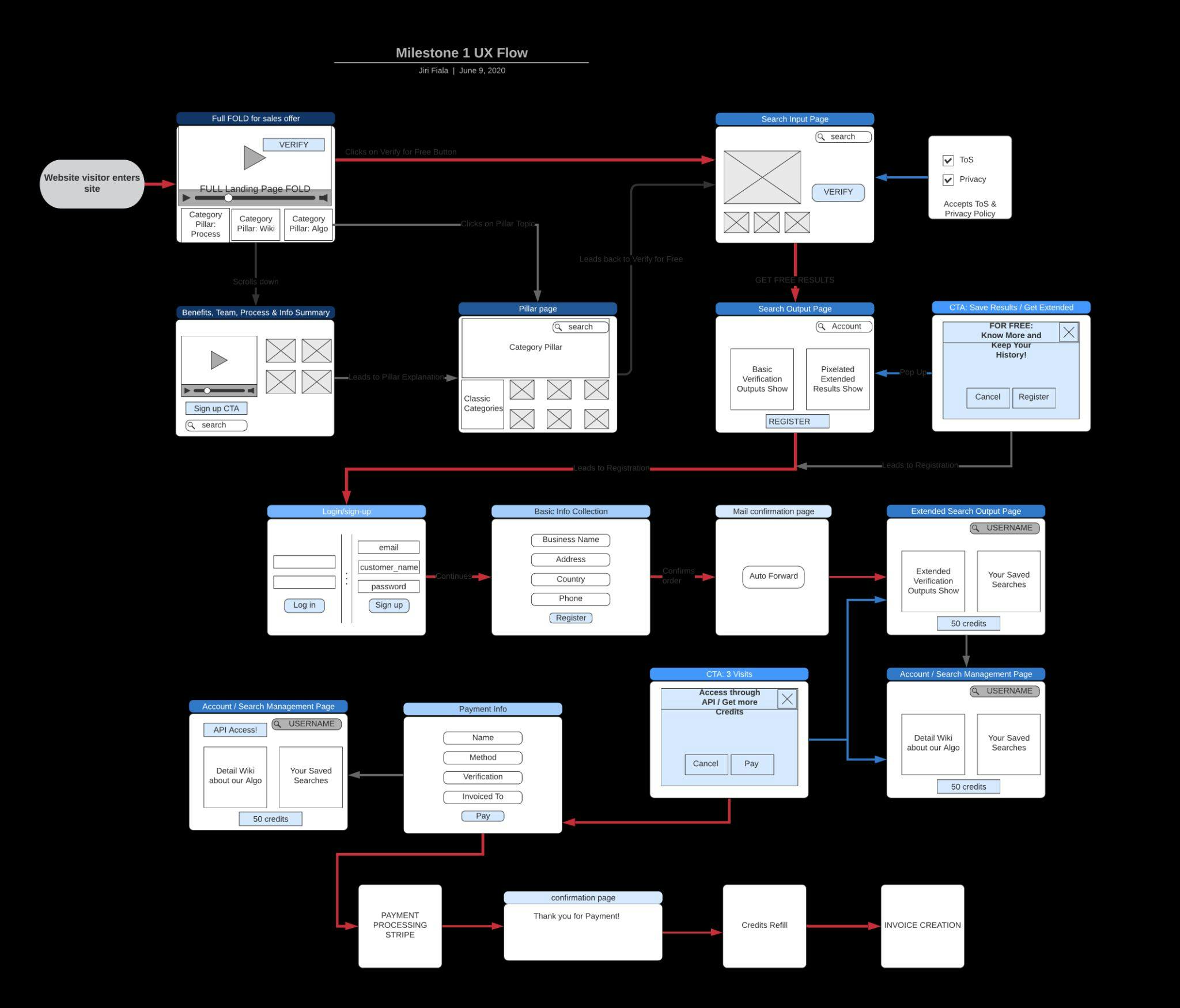

3. Customer Journey Milestone 1

4. Business Case Verification

Financials

$246,443

Sum

$111,575

Sum

9530

Sum

1048.3

Sum

335

Sum

$286,789.72

Sum

Want to print your doc?

This is not the way.

This is not the way.

Try clicking the ··· in the right corner or using a keyboard shortcut (

CtrlP

) instead.