Share

Explore

2021 KP People Report

2021 KP People Report

Metrics

Metrics

Annual Attrition ⏱

Recruiting Metrics 🗂

Average Cost of Hiring Talent

Candidate Experience 📌

DEIB Metrics 🌏

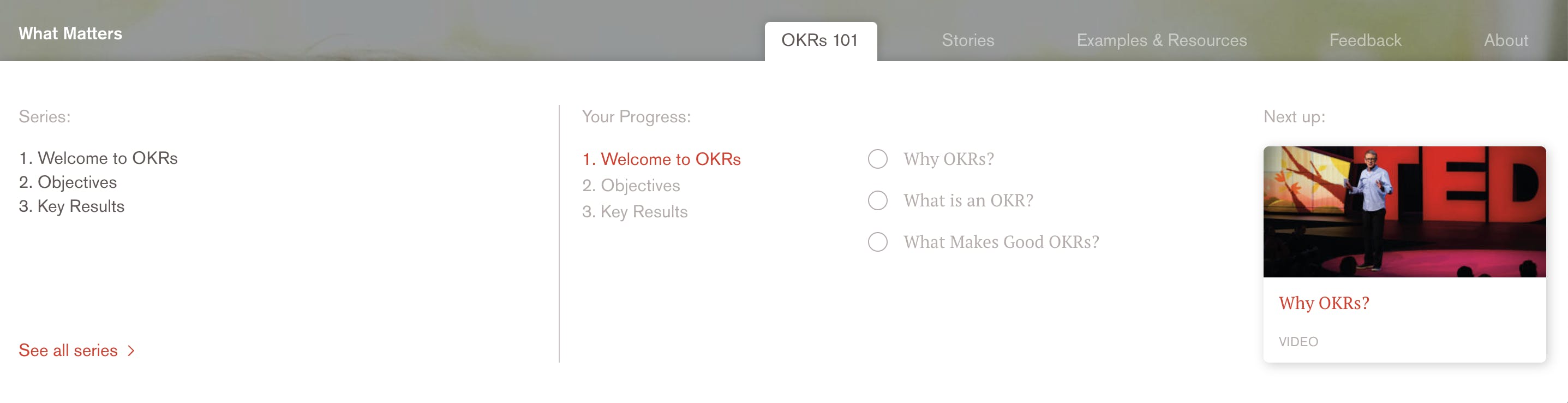

OKR (Objectives and Key Results) Cadence 📝

Company Spotlight 🔦: Pathlight

Employee Review Cycle 📆

Cadence of Employee Review Cycle

Want to print your doc?

This is not the way.

This is not the way.

Try clicking the ⋯ next to your doc name or using a keyboard shortcut (

CtrlP

) instead.