Skip to content

Payment prioritizationCapped returnsRisk insurance or guaranteesSubsidized technical assistanceFirst-loss mechanismsTaking junior or subordinated positions (tranches) in the debt/equity structure

Home: Investment intermediaries

Home: Investment intermediaries

Mobilizing $billions in cheap growth capital for the alternative protein industry

Problem: Why catalytic capital and blended finance matter

The alt protein industry needs trillions of dollars of infrastructure investment over the next few decades in order to significantly displace animal proteins.

Food and agriculture are the largest human-made systems on the planet. Transitioning the food system away from animal proteins entails reorienting millions of tons of processing, storage, and transportation capacity; reordering supply chains and commodity markets; retraining farmers and food industry workers; expanding or retrofitting billions of metric tons of manufacturing capacity; and changing the crops that are grown on over 4 billion acres globally.

Figure 1: Alt proteins need solutions like , which provides vehicles for institutional capital to invest in sustainable real assets like factories and other infrastructure.

Much like other impact industries such as biotech, biofuels, electric vehicles, and clean energy, alternative proteins are a promising solution to pressing global challenges but require front-loaded costs in the form of R&D, capital expenses for manufacturing facilities and equipment, and working capital to cover operating expenses during scaling.

Alt protein companies have primarily relied on venture capital financing to date. Since venture capital seeks high returns, it is usually poorly suited for investments in infrastructure, which typically has higher upfront CapEx costs, lower appreciation upside potential, and generates steady returns over a long time period of 10–20+ years. This means infrastructure needs long-term, low cost capital, which in turn means reducing risk as much as possible, for as long as possible.

So far, most alternative protein companies have faced challenges obtaining private equity and debt financing, as they cannot afford to scale up beyond the strength of their balance sheets, cashflow, and credit histories, which are often insufficient for risk-averse lenders and PE investors. Capital is easy and inexpensive to obtain if you are a qualified user of the banking system, but most alt protein companies are still too small and too young to qualify.

Solution: Catalytic capital in blended finance structures

What are catalytic capital and blended finance?

Catalytic capital is financing from philanthropic, public-sector, and private impact investors that accepts lower returns, more flexible terms, longer timeframes, and/or higher risk than conventional investing in order to fund high-impact organizations. Blended finance is the use of catalytic capital to improve projects’ risk-return profiles to match the requirements of market-rate investors, thereby increasing private sector investment into high-impact opportunities.

Figure 2: Catalytic development funding (concessional capital) mobilizes commercial (market-rate) investment via blended finance structures.

Blended finance typically structures investments so that impact-focused investors (the catalytic capital providers) bear the majority of the investment risk. This reduces the perceived risk of investment and offsets the financial downsides faced by traditional investors. Typically this de-risking structure might involve philanthropic entities providing concessions, including:

Blended finance is an increasingly common strategy in the poverty reduction, public health, and sustainable development ecosystems. According to , blended finance has mobilized approximately $142 billion in capital towards sustainable development in developing countries to-date, and over 1300 public, private, and philanthropic investors have participated in one or more blended finance transactions.

Structured finance

Catalytic capital in a blended finance vehicle is essentially a ー utilizing tranching, credit enhancement, and/or securitization to create different risk/return investment opportunities that are tailored to different types of investors based on their unique objectives (whether financial return, social impact, or a blend of both) and other mandates (risk tolerances, time to maturity, return expectations, allocation limits, etc).

The same pool of underlying assets can be split into multiple tranches (layers) based on characteristics such as loss order, risk, and expected yield. A blended finance structure utilized a similar mechanism, with public or philanthropic capital taking the junior/subordinate (lower) tranches in order to de-risk investment from market-rate investors higher up in the capital stack. Image source: .

How would it work in the alt protein industry?

Relationship to other forms of investing

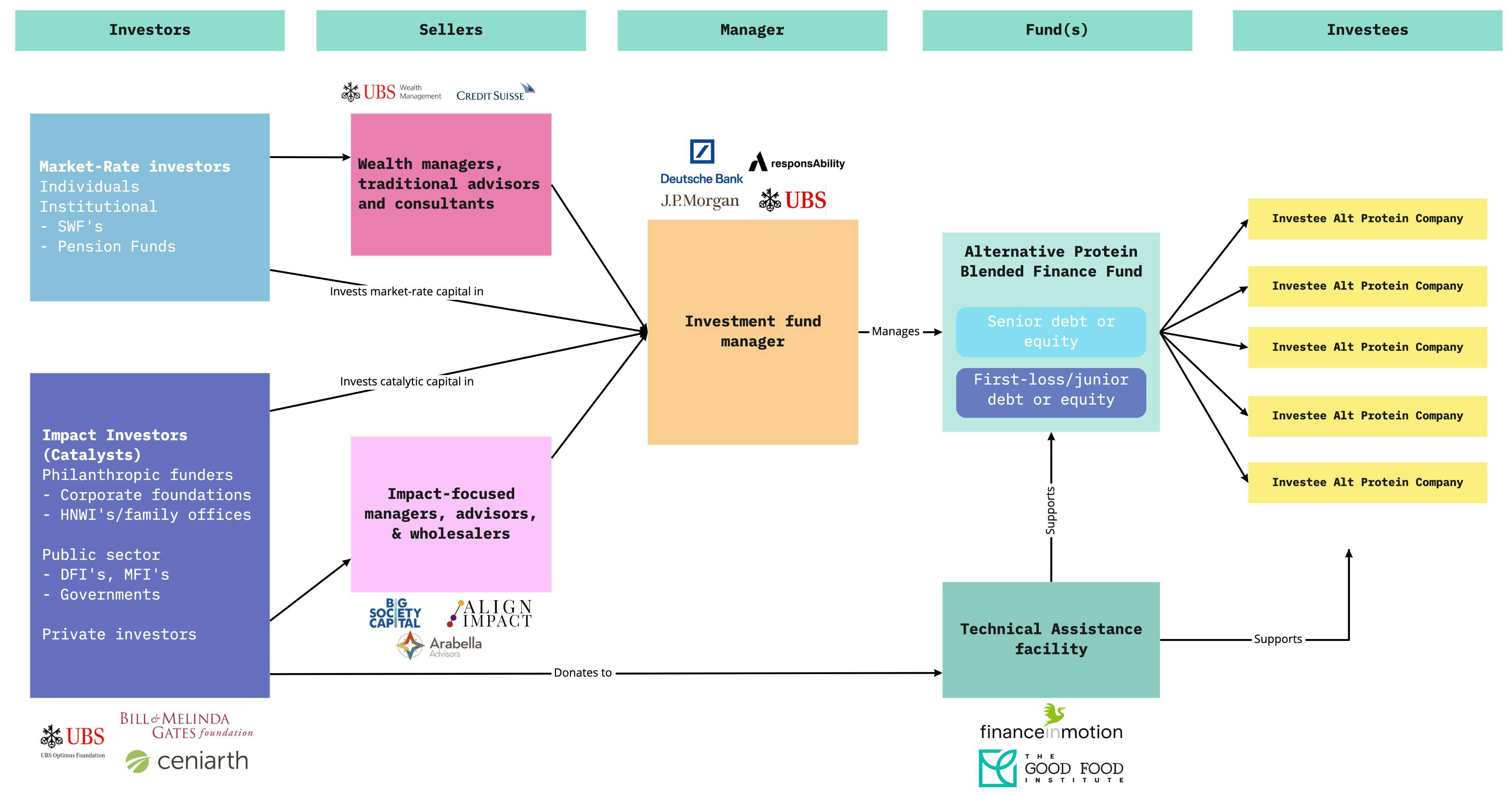

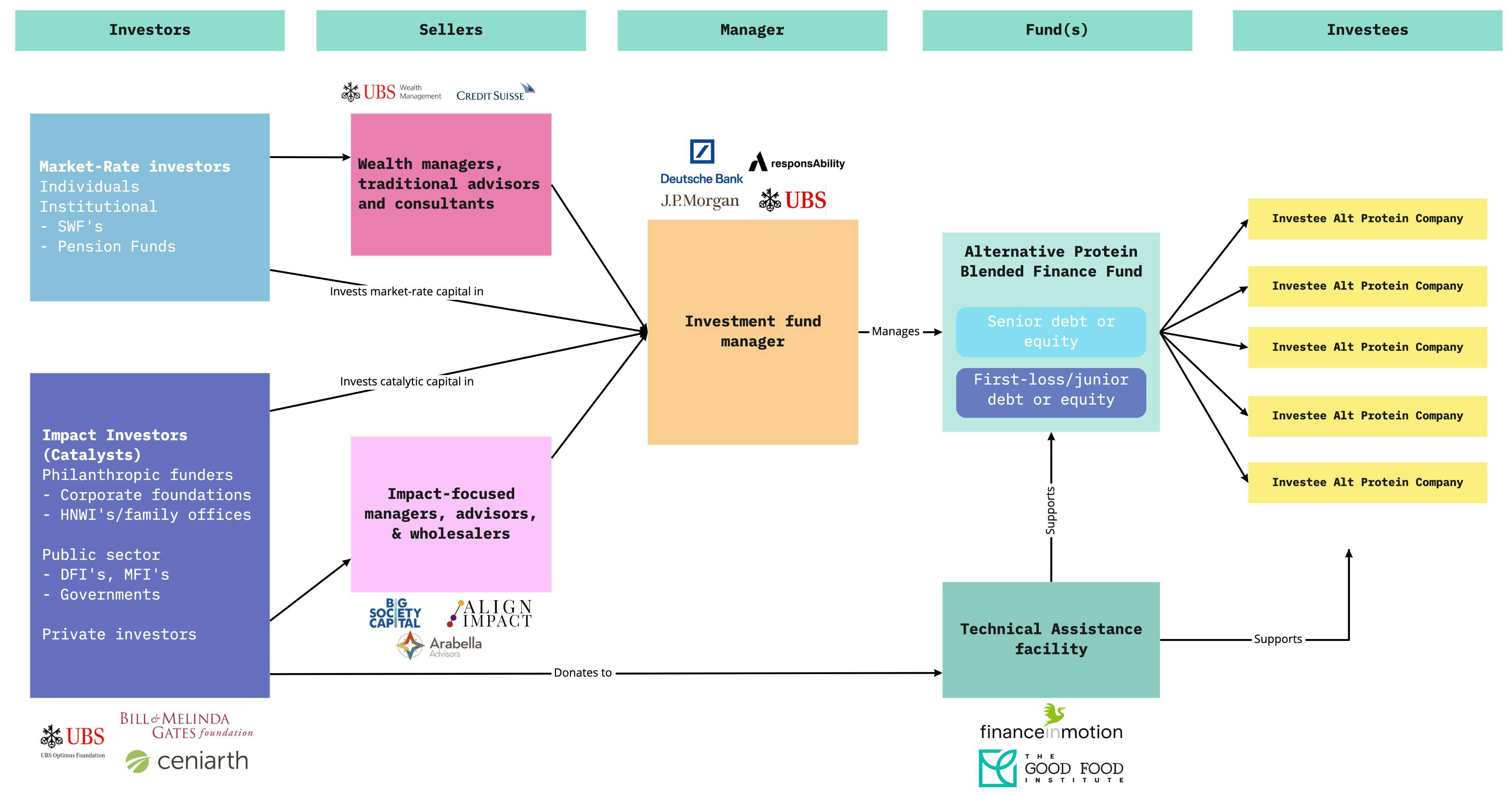

Logos included as examples only. Click icon in upper right to expand image.

Designing a blended transaction requires two distinct skill sets, one being financial expertise to develop the right financial structure with appropriate risk-return profiles for funders and investors, and the other, sector-specific expertise to determine interventions that can yield the desired development impact. Source: .

Impact: Leveraging mission-aligned investors

Catalytic capital in a blended finance structure utilizes the same principles as philanthropic donation matching from groups like . Instead of granting money outright, some donors will offer a matching gift that encourages other donors to give by providing an incentive to get their donations matched. Matching gifts are can be more effective than outright gifts because they effectively leverage the matching gift to catalyze additional donations.

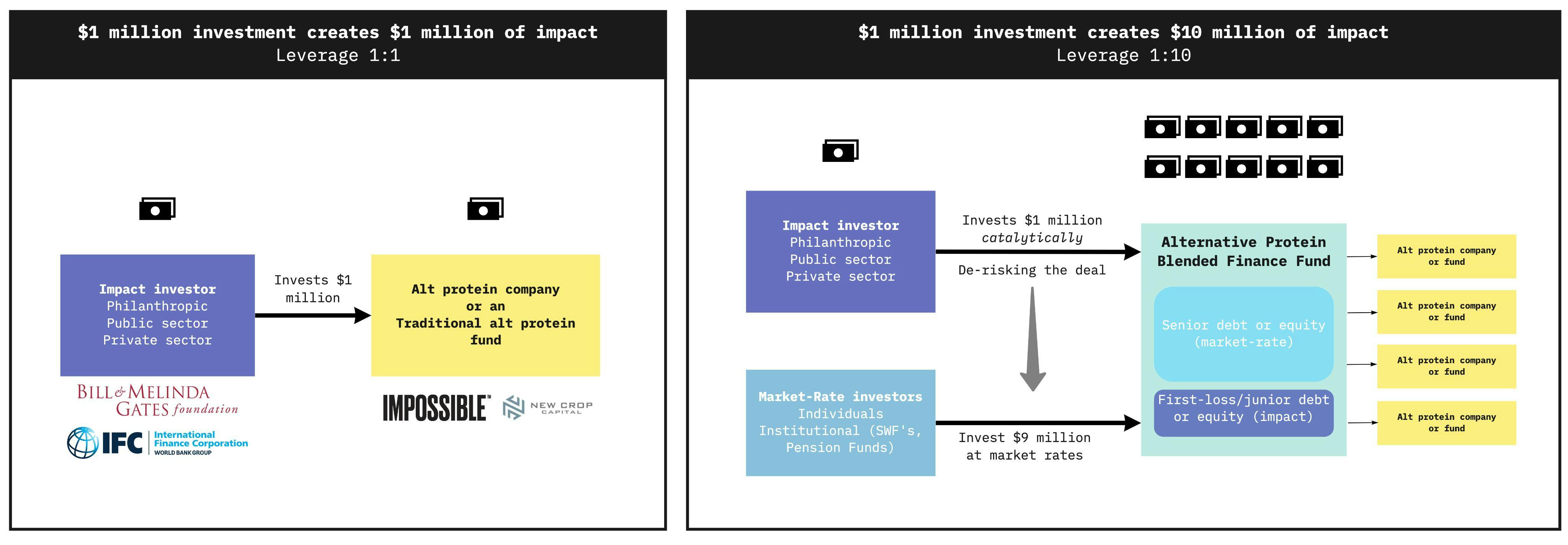

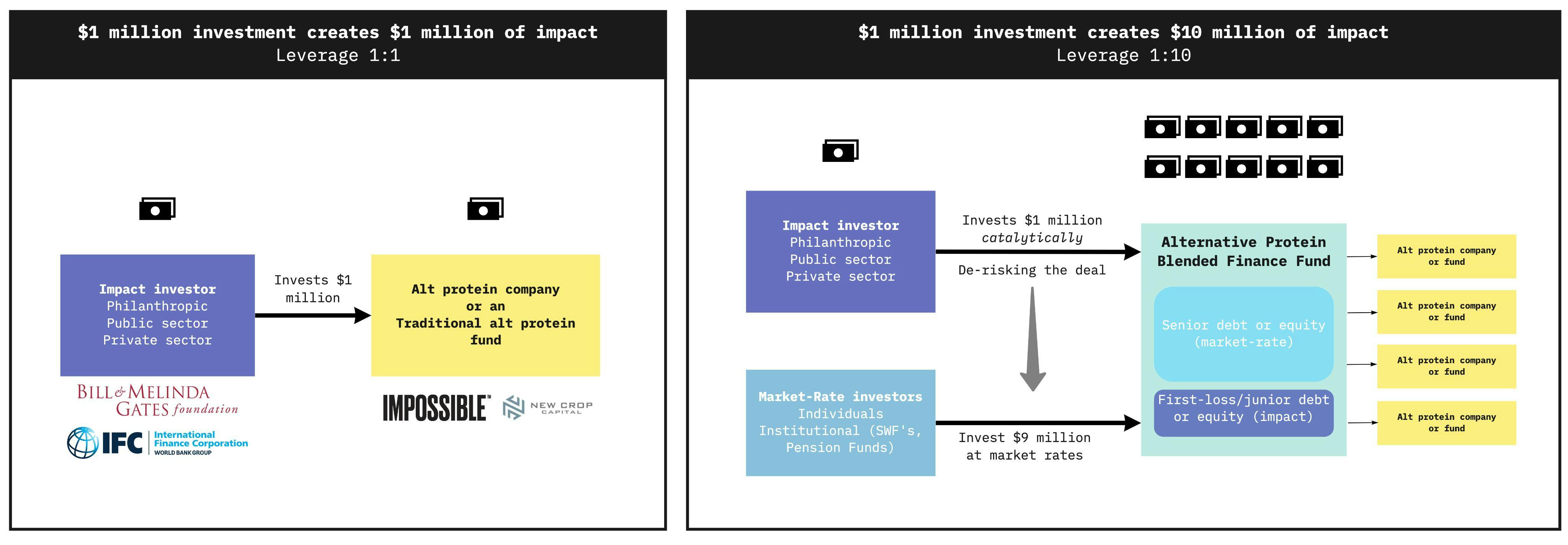

This structure leverages impact investment dollars more effectively than traditional impact financing. For example, if an impact investor like Bill Gates invests $1 million in Impossible Foods, that money is able to be utilized at 1:1 ratio. If Bill Gates invests that same $1 million as the catalytic capital in a blended finance structure (perhaps with a concessional first-loss mechanism), his investment de-risks the blended finance structure enough to allow market-rate investors to invest in the blended finance structure as senior debt/equity holders at a 1:10 ratio, counterfactually unlocking 10x more capital ($10 million total) than before.

Logos are for illustrative purposes only. Click icon in upper right to expand image.

Convergence pegs the average leverage ratio of impact capital to market-rate capital at 5x, while a of 74 blended-finance vehicles found that every dollar of public money invested typically attracts a further $1-20 in private investment. There have been examples of higher ratios: for the , the California Endowment invested $2.5 million in the first-loss pool, which helped leverage $125 million from other investors — a 50x impact leveraging.

Leverage ratios within alternative protein investments are likely to be at the higher end of these ranges (i.e. less catalytic capital would be required to mobilize a larger amount of market-rate capital) due to the ability to easily price risk of underlying assets and considering the proportion of blended finance transactions to date that have taken place in developing markets.

Case studies and examples

<section under construction>

Some of the early-stage venture capital investments made by impact investment groups like Open Philanthropy or New Crop Capital (now Unovis) may be examples of catalytic capital deployment. Although the terms of their investments in companies such as Impossible Foods, Beyond Meat, and Memphis Meats are unknown, it is possible that these impact investors accepted concessionary terms and junior/subordinated risk positions in order to incentivize non-impact investors (like traditional VC’s and corporate venture arms) to participate in the funding round.

Alternative protein blended finance funds would address major SDG coverage gaps, such as 15. Life On Land, 14. Life Below Water, and 12. Responsible Consumption. Source: Convergence

Further reading & sources

Want to print your doc?

This is not the way.

This is not the way.

Try clicking the ··· in the right corner or using a keyboard shortcut (

CtrlP

) instead.