Skip to content

Catalysing an Impact Investment Ecosystem: A Policymaker’s Toolkit Policy & Advocacy Enabling ventures to leverage technology for impact Demand of Capital It analyses the different enabling elements across the lifecycle of impact-tech, and focuses on recommendations to improve the global tech-for-good ecosystem Investing for a better world Supply of Capital It focuses on recommendations to strengthen the financial services value chain to meet the sustainable development goals Widening & Deepening the Market for Impact Market Builders It outlines the why and what of impact investing and presents a theory of change for widening participation and deepening practice with practical guidance on actors and levers

Exemplary overview of infrastructure finance for social developmentFinancial Times IFC awardsSocial impact bondshttps://toplink.weforum.org/ project/blended-finance-networkhttps://www.goodfinance.org.uk/tools-and-resourcesCoalition for Green CapitalReview Catalytic capital asana project, including funds to start, investor donors, etc.Government backed sustainability bondsAlternative investment management firmsMaybe the hybrid Dana Farber donate/invest fund / (Not only is this a fascinating case study, but alternative protein should be their fifth pillar!Working capital, supply chain finance, reverse factoring, revolving credit facility

Need membership to access this resource:

Fund design (they are sharing their paperwork February 15 2021)Bridges Fund MGMT has already invested in vegetarian companyLaunching business/industrial parks that are targeted to alt proteins, like at former malls (Bridges Fund Management has done this)This is the physical instantiation of the top ideasResearch institute systemInput characterizationBioFungibleCatalytic capitalManufacturingCluster

Go through their full list for ideas and researchRabobankResponsAbilityAXA, ArdianCan be public/private partnershipsCalvert Impact CapitalCeniarth

Gates, MacArthur, Rockefeller, Ceniarth, etc.Mention design funding grants from Rockefeller, ConvergenceTo arrange for a bespoke knowledge exchange for your organization, email Aakif Merchant at . share with GFI Brazil as an interesting case study Share with Jen, also This depends on type of instrument: loan, equity, grant, guaranteeThis idea has some strong affinity with guaranteed offtakes, AMC's/guaranteed minimums, shared repurposable facilities/equipment,Ask GIIN report author or research person - slaughterhouse loansBlue OrchardSustainable Jobs Fund/ SJF VenturesSearch for project finance facility12.23: Map out this project and its workstreams, publications I need to write or get others to write, the topical cluster, action itemsPromote this to the alt protein communityPromote alt proteins as an investment asset class to impact, catalytic, and blended finance communityCreate own project in AsanaParse subtaskConduct research below12.24: After CE-SciTech meeting: Evaluate splitting out this section into its own documentPitch this idea to Blue HorizonCould launch this with Cass, get her help with researching this areaNew Energy Risk (NER) helps insure technical risk for breakthrough technologies to optimize cost of capital and accelerate time to market. We should talk to them12.25: Subtask, write 2-pager/proposal on catalytic capital for January PhaseGateJan: This should be presented to GWS, OPP, FAIRR,Jan: Work with MacArthur, Ford, Gates, Rockefeller, Omidyar, and others to show how alt proteins are an opportunity area for catalytic capital. Omidyar Network, Blue Haven Initiative and Candide Group, both family offices, have made substantial impact investments and done significant “catalytic” work. It can also be a corporation—PrudentialJoin MacArthur's Catalytic Capital Consortium, Rockefeller Zero Gap initiativeAs part of the initiative, MacArthur is dedicating up to $150 million in investments on a matching basis to approximately five funds or intermediaries that demonstrate a powerful use of catalytic capital across sectors and geographies:text=Insurance%20companies%20are%20often%20public,which%20take%20time%20to%20change.SecuritizationAO doing impact investment, look up their annual report, ESG

GIIN's researchRockefeller Zero Gap initiative

There was a "first global summit of all development banks" in early November, 2020. Following from that, I'm hoping to spend some time early in C1 2021 trying to figure out how to get GFI a seat at the table when their "Agriculture Cluster" next meets. Here's the Ag Cluster's statement on ""Blake did u analyze ICOs

Meatcoin

Prime roots is a great model for e-commerce (add crowdfunding)GIIN launched a Blended Finance Working Group

Join Convergence!

Might require its own white paper/2-pager

Research & analysisImpact scaleTractabilityNeglectednessStartup Venture involvementCommercial incumbent involvementGFI involvementWho do we talk to?Solution/resource developmentTargeted engagementEventsSplit into separate ideasSolutions we doSolutions we share via targeted engagementSolutions we publish publiclySolutions we do more research on

Capital providers > Developer > Pool/YieldCo (REIT) > Management company > TenantsWe could play in each part of this chainIf a developer bankrolled a project, the company could lease it, build to suit to leaseNote which funds we want to start are catalytic vs. non-catalyticCreate a topical cluster around these conceptsAri Nessel, interview him or someone who he knowsMerchant developer takes developer risk, then flips to low risk pool, REIT, REIT are lower risk pool, these developers, some REIT’s do some developing, but not aMII, catalytic capital, research instituteMalls have parking, public transport accessRepurposing studyMulti-tenant industrial, common, dividing walls is easy, designed as giant boxes that can be divided or subdivided easily, single tenant or multi-tenantIncubators, scaling network, companies start by sharing equipment early, then move to their own space over time . these are often PPP, economic development corporations. WeWork for manufacturing, industrial, this has to existCould we just lease existing buildings and then sub-lease out, like WeWork?who has a lot of excess industrial capacity? Churches. Malls. Malls are key.

Create a YieldCo, publicly traded company holding production infrastructure assets that are low-risk, predictable gains, she is great, the kind of person we need for this. ,Credit Suisse SDG 12 listed fundPension funds, SWF's focus on infrastructureLike Master Limited Partnerships (MLPs) and Real Estate Investment Trusts (REITs), YieldCos are pass-through stock entities designed to allow for generous dividend yields and, at least in theory, strong long-term dividend growth. YieldCo's are a renewable energy utility KEY IDEAWHAT THINGS DO WE WANT TO BE A UTILITY? EVERY PART OF THE CHAIN!

Research queue

Research queue

Uncategorized research

Updates to overview

file:///Users/zakweston/Desktop/The_State_of_Blended_Finance_2020.pdf

Reports from

Research using the Convergence resource library

Convergence has some upcoming workshops and events, submitted membership request

Work with development finance groups

Pull categories from BioFungible overview, table in Evernote

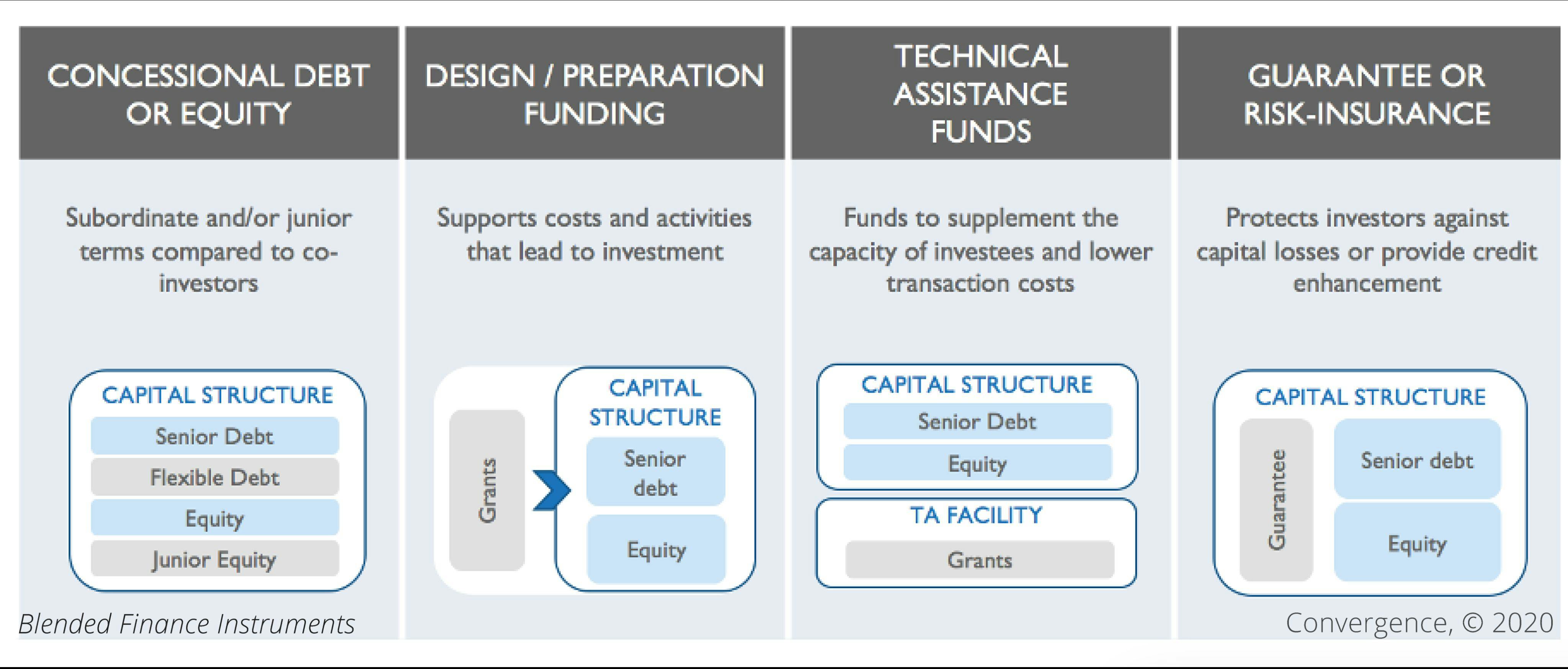

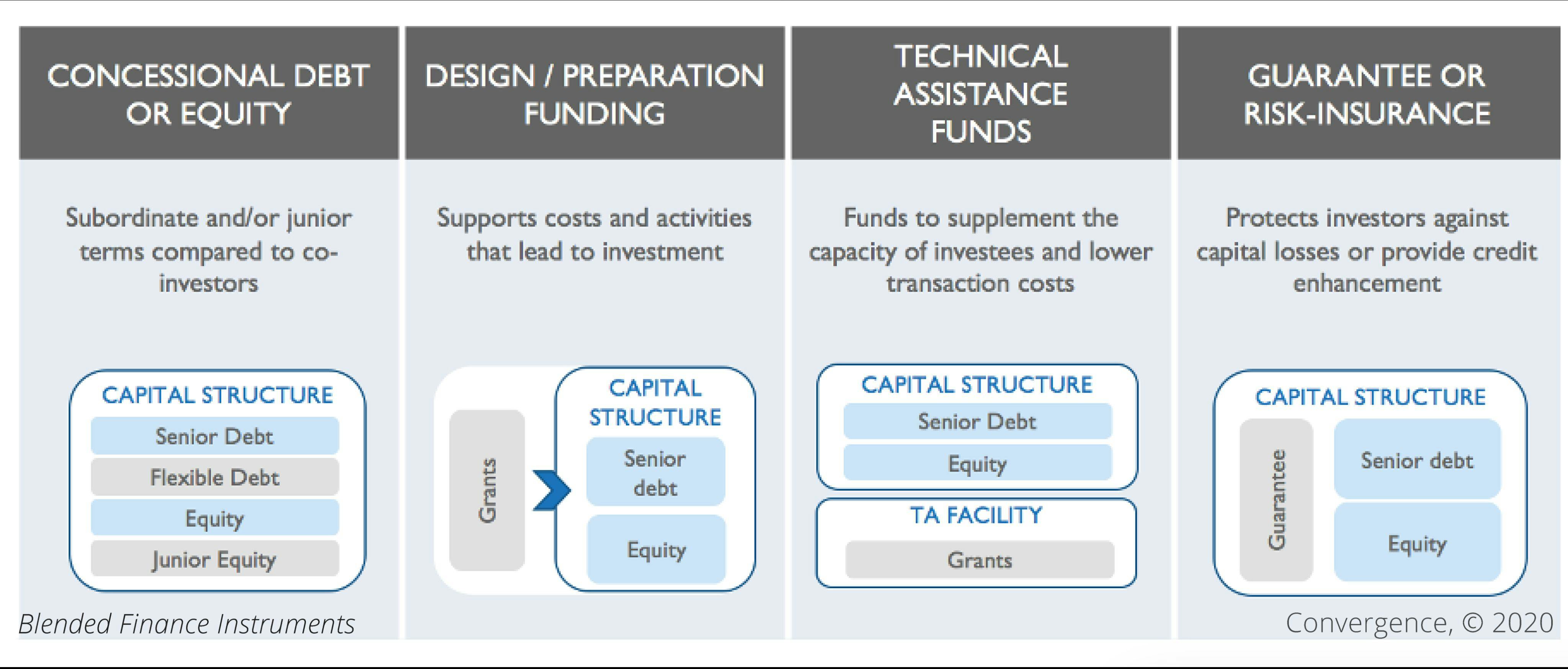

Designing a blended transaction requires two distinct skill sets, one being financial expertise to develop the right financial structure with appropriate risk-return profiles for funders and investors, and the other, sector-specific expertise to determine interventions that can yield the desired development impact. (Portuguese for Green Receivables Fund) - an organization with sector-specific knowledge needed to partner up with an institution bringing in the financial expertise.

Good Food Labs

This could be a model for GFRI, funded by donors and contracts

Alt protein finance labs

Alt Protein Labs

Protein Lab

GFI Labs

Identifying solutions and testing them, RCT, very EA friendly

We conduct studies of promising technical, policy, commercial model, financing, marketing, and other innovations to identify promising scaleable solutions to large-scale problems facing the alternative protein industry

Good explanations

(They work to build this field, would make an excellent interview)

How we might participate in social impact bonds, development impact bonds

Eventually we could launch a fund manager, our own funds, funds of funds,

Maybe we launch the fund of funds for the catalytic part of the the capital

How do non-profits generally participate and benefit? Informs GFI role

Potential fund managers: UBS (any group that has lots of funds), OPP, Coller, Unovis, Blue Horizon, Siddhi, Align Impact, Big Society Capital, Arabella, impact investment wholesalers

GFI Dev team

We could spin out a broker/consultant/advisory firm that helps connect alt protein firms with the investment and finance products they need

We could literally get design grants to create Solutions!

In 2015, Blue Forest received an early-stage design grant from the Rockefeller Foundation’s newly launched Zero Gap Portfolio. Here, the Rockefeller Foundation was specifically looking for projects that were i) scalable and replicable across a broader market, ii) commercially viable, and iii) creative in their structuring approach. Rockefeller’s funding offered crucial support to Blue Forest as they continued to build out the model and identify investors.

Start an impact investment wholesaler for the alternative protein sector

The India Impact Fund of Funds plans to lend US$1 billion to debt funds that invest in social enterprises. The Fund seeks to fill an apparent gap in medium- to long-term unsecured debt. It will target a 9% return over its ten-year life. The Fund aims to raise US$600 million from finance-first investors (those that emphasize return) and US$400 million from impact-first investors (those that emphasize social goals and do not necessarily seek a commercial return). The Fund will approach financial institutions and members of the Indian diaspora as finance-first investors. It will approach foundations and development finance institutions as impact-first investors. It will ask the impact-first investors to take a first-loss position.

Tasks

Research to be done

Research on capital, funds, investors, investment structures and mechanisms

Capital

Want to print your doc?

This is not the way.

This is not the way.

Try clicking the ··· in the right corner or using a keyboard shortcut (

CtrlP

) instead.