Skip to content

DevCo, PoolCo, YieldCo structuring, pooling

Solar DevCo, YieldCo, PoolCo models

Separating volatile activities (such as development,

, construction) from stable activities of operating assets can lower the

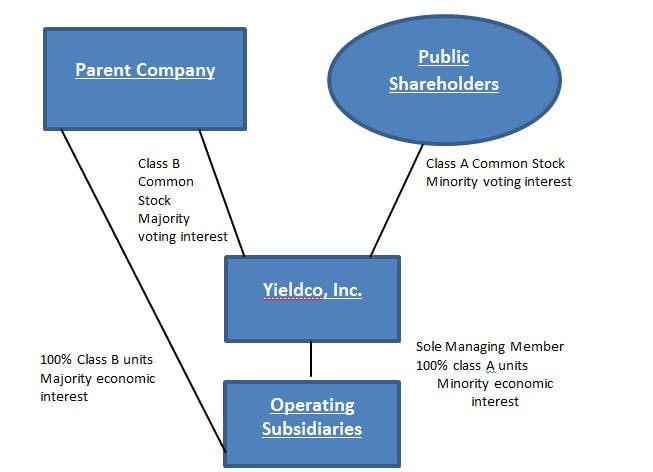

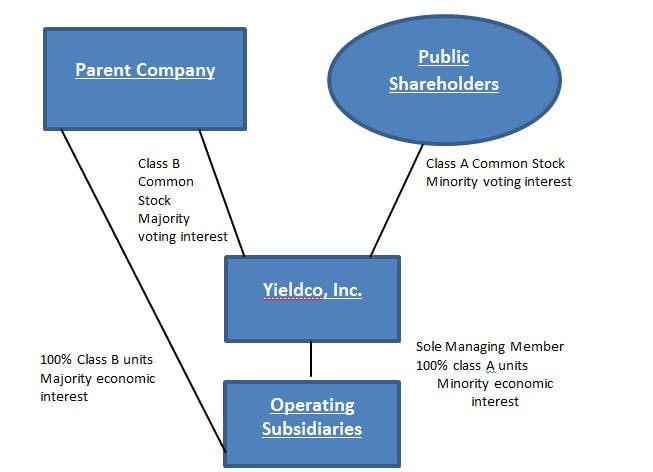

Completed solar projects are attractive for investors seeking dependable long-term cash flows. The challenge is how to resolve the lower cost of capital (less equity, more debt) for an operating plant with the higher cost of capital (more equity, little debt) for developers. One approach has been the use of “YieldCos”—entities that purchase completed projects and have balance sheets separate from the development company. Assuming they are focused on delivering low-risk, stable cash flows, these entities should enjoy a much lower cost of capital and higher levels of leverage, and thus could provide the liquidity developers need to grow. Similarly, solar-development companies, or “DevCos,” should be equity focused, with low levels of debt. Institutional investors want a healthy yield at low risk; solar developers want a dependable way to liquidate higher-cost equity capital to reinvest it in the next project

Several new ideas, including private “PoolCos” that invest on an asset-by-asset basis, look promising but have yet to be fully tested. They should also pursue forms of low-cost financing, such as project debt and trade credit (for example, from module manufacturers) to leverage equity returns.

Sources

Want to print your doc?

This is not the way.

This is not the way.

Try clicking the ··· in the right corner or using a keyboard shortcut (

CtrlP

) instead.