Skip to content

ii

Nett Present Value (NPV)

Nett Present Value (NPV)

calculate outcomes based on years, amount and interest rates

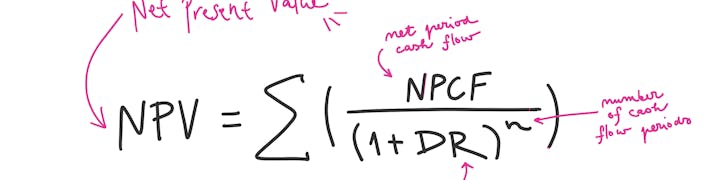

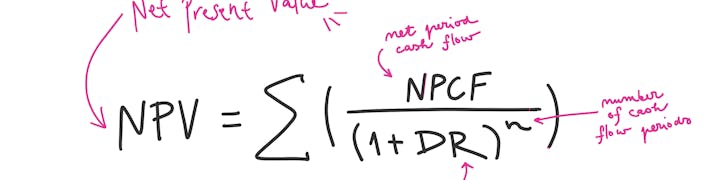

Net Present Value (NPV) is a financial metric used to determine the profitability of an investment or project. It calculates the present value of cash inflows and outflows over a specific time period, taking into account the time value of money. The concept behind NPV is that a dollar received in the future is worth less than a dollar received today, due to factors such as inflation and the opportunity cost of capital.

Add row

amount

percentage

years

nett present value

discount

compound interest

return

amount

percentage

years

nett present value

discount

compound interest

return

€5,000.00

2%

3

€4,711.61

-€288.39

€5,306.04

€288.39

€1,000.00

4%

5

€821.93

-€178.07

€1,216.65

€178.07

€50,000.00

1%

8

€46,174.16

-€3,825.84

€54,142.84

€3,825.84

€10,000.00

3%

13

€6,809.51

-€3,190.49

€14,685.34

€3,190.49

€20,000.00

2%

21

€13,195.52

-€6,804.48

€30,313.33

€6,804.48

€500.00

5%

20

€188.44

-€311.56

€1,326.65

€311.56

€2,500.00

4%

17

€1,283.43

-€1,216.57

€4,869.75

€1,216.57

€75,000.00

1%

13

€65,899.69

-€9,100.31

€85,357.00

€9,100.31

€15,000.00

3%

10

€11,161.41

-€3,838.59

€20,158.75

€3,838.59

€30,000.00

7%

5

€21,389.59

-€8,610.41

€42,076.55

€8,610.41

€100,000.00

2.5%

10

€78,119.84

-€21,880.16

€128,008.45

€21,880.16

There are no rows in this table

To calculate NPV, the cash flows are discounted back to their present values using a predetermined discount rate or cost of capital. If the NPV is positive, it indicates that the investment is expected to generate a return greater than the discount rate and is considered financially viable. Conversely, if the NPV is negative, it suggests that the investment may not be profitable.

NPV is a widely used financial tool for evaluating investment opportunities and making informed decisions. It helps in determining whether an investment will create value for the company or individual and provides a basis for comparing different investment options.

Total amount: distributed over periods based on the percentages entered.

3

→ | the money value today for these periods you see below

The total period is 11.35 year

3

Name

percentage

startDate

endDate

years

btn

theAmount

Delta

Name

percentage

startDate

endDate

years

btn

theAmount

Delta

Period 1

3.5%

9/8/2023

10/15/2027

4.101

Get result for Period 1

€68,045.29

-€68,045.29

Period 2

4%

10/16/2027

1/15/2030

2.249

Get result for Period 2

€71,734.57

-€71,734.57

Period 3

5%

1/15/2030

1/16/2035

5.003

Get result for Period 3

€78,352.62

-€78,352.62

There are no rows in this table

Want to print your doc?

This is not the way.

This is not the way.

Try clicking the ··· in the right corner or using a keyboard shortcut (

CtrlP

) instead.