Skip to content

We are excited to announce the latest updates to our mobile app! Our team has been working hard to bring you these new features and improvements to enhance your experience as members of Staff and our Customers at large.

For the next 6 weeks, the Technology & Marketing Teams will work closely to educate you and our users on these changes.

Here are the key highlights of the update:

Updates_

Feature/Change

Short Description

Why did we do this?

How does this affect Internal users(Staff Members)?

Notes

Feature/Change

Short Description

Why did we do this?

How does this affect Internal users(Staff Members)?

Notes

Account Tiers

All users will now be placed in appropriate tiers based on the kyc documents they provide.

This also means that all uploaded documents will be reviewed and verified either by our automated system or manually by a KYC Officer.

There are four tiers which are: Tier 0, Tier 1, Tier 2 and Tier 3

You can read more here

This helps us mitigate against fraud and stay compliant with regulatory requirements

The Risk team would have to occasionally approve documents or IDs users submit on the mobile app.

If you upload a document as a member of staff on behalf of a customer, they will not get automatically approved until reviewed.

Transaction Limits

Now users can transfer up to 5 million per day and per transaction once they upgrade to tier 3 after signing an indemnity clause and providing all relevant KYC info.

This is an upgrade from the maximum of 1 million cumulative daily limit they’re currently restricted to.

This enables SMEs and borrowers who typically take loans up to 5 million transact on the mobile app.

You should be able to assist users who wish to transact up to this limit do so seamlessly by advising them on the necessary details they need to submit

PayForMe

This extension of loan friends enables users to ask users to pay their bills now and they can pay them later.

Users can also pay bills on behalf of their friends and this is booked as a loan repayable to the lender on the due date.

Users can pay bills such as airtime, data, cable and electricity bills. We’re looking to add more billers soonest

We did this based on the premise that lenders are more likely to help their friends pay their bills directly than loan out money.

This also helps expand our revenue lines as a business and makes loan friends easier to sell

Do your friends pay your bills? I mean, we all have the shirt but really, do they?

You should use this feature and also encourage your friends to use it too.

Updated User Interface

We’ve updated the look and feel of the app and brought the wallet balance card to the Home page.

We basically put the most important features in the face of the customer

We did this to get the user excited when s/he opens the app.

We hope this encourages you to sell and recommend the app even more to your friends and family.

Wema Virtual Accounts

In addition to Providus bank wallet accounts assigned to some users today on the app, we have partnered with Wema bank to extend virtual accounts to our users.

Users can only have one virtual account. Either from Providus or Wema. No user will be able to have 2 accounts.

This increases the number of available virtual accounts we can give to our existing and new users alike

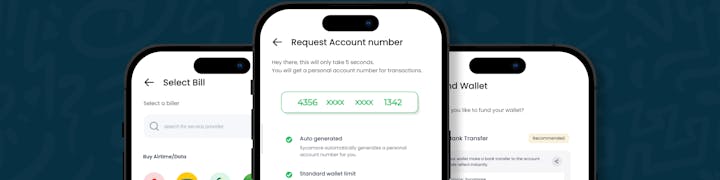

Request Account Number

Every new or existing user without a virtual account can now request for one when they want to fund their wallets.

A Wema or Providus account is generated for the user instantly based on their choice.

What’s more? users can even customize the last 7 digits of their Wema bank account number.

To give the user more control and make it easier for them to fund their accounts so they can then carry ut basic transactions

This also helps us reduce our reliance on paystack for a number of users without wallets to fund their accounts.

Afterall, transfers are the most reliable forms of payments.

This means that you can now encourage more borrowers and investors to use their wallets to access loans or invest with is.

This will help reduce the workload of finance or collections with confirming repayments or inflows.

Tags

Who needs account numbers when you’ve got tags?

All users are now expected to have tags. Tags are unique strings of words to be created by every user for ease of identification.

Every user will be now be asked to create a tag at sign up.

Existing users without a tag will also be prompted to create a tag

Tags can be Oluwiz, tundemoni and others

We did this to personalize the customer’s experience.

Transfer Narration

Users can now add narrations to their transfers.

Adding a narration to a transfer isn’t forced by the way

We realized transfers are incomplete without narrations to track them later.

Transfer to a Tag

Users can simply transfer to another Sycamore user by inputting their tags.

Sycamore to Sycamore Transfers are free; no fees.

To make transfers between Sycamore users less tedious

Why transfer to 839385848 when you can simply transfer to segun?

Transfer Beneficiaries Revamp

Users no longer have to save a beneficiary before making transfers.

Users can now simply transfer to any third party but still have the choice to save them as a beneficiary should that be necessary

What’s more? Users have full control over naming the beneficiaries for easy use next time.

They asked and we listened.

Transfer to a Sycamore Account

For flexibility, we maintained the ability to make Sycamore to Sycamore transfers using the recipient’s account number.

The only list of banks to choose from are Wema and Providus

For Sycamore users who may not have tags yet

In case segun doesn’t like to share his tag

Recent Transfers

Users can now easily repeat their transfers done in the last 24 hours in one click.

You know what’s better? The recent transfers are grouped by categories(tags, sycamore account and other banks)

Transfers should never be tedious

Wallet Statement

Now users can request for their wallet statements and receive a link in their emails to download it in pdf format.

Its as simple as selecting a date range and hitting the request button.

They asked and we listened

You asked and we listened.

We’re hoping to see more members of staff use Sycamore as their main account for transfers now.

News & Offers

Right on the home page, users will be able to see multiple banners with news and offers from Sycamore.

These banners are clickable and will redirect the customer to an external link or a feature within the app

To give our active users first hand information on our offerings and activities.

To make cross selling of our products easier

The marketing team will be able to put the company’s offerings in the face of the customer.

Other departments can also work with Marketing to put their communications where they’re active users will see them.

Paystack Charges to Customers

We will now be passing paystack charges to customers. For every time a user adds their card, funds their wallet using the oaystack widget, Sycamore is charged 1.5% of the amount + N100 capped at N2000.

Now when a user tries to fund their wallet using the ‘Pay Online’ option, they will be settled the amount less the charges.

This helps us reduce our overhead cost.

What’s more? Since users can now now generate an account number easily, there is a free alternative to the ‘Pay Online’ Option

Encourage your users to transact with their wallets to fund their wallets, repay their loans and start investment plans.

Bills Payment Beneficiaries

Users can now save beneficiaries per biller. These beneficiaries can be named for ease of use.

We did this to enhance the Bills Payment UX. We realized no one wants to keep their DSTV/GOTV’s IUC number handy at all times

Enhanced Transaction Receipt

We made changes to the look and feel of our transaction receipts.

We’ve also made it more descriptive to capture senders and beneficiaries

What’s more? even your transfer narrations will now be displayed on the receipt

Help users dispute transactions easily.

More Intuititive Transaction history

The transaction history list now shows only the sender for credit transactions and the beneficiary for debit transactions.

This is an improvement on the long narration text that shows now.

We did this to give users clarity on their transactions at first glance.

New Loan Friends Pricing

We have rejigged the pricing on loan friends. The lender will no longer be charged N50 per loan disbursed.

2.5% of the amount capped at N5,000 + N100 convenience fee if amount is above N4,999

Interest loans above N19,999 will still be charged 10% of the interest amount

We quickly realized N50 wasn’t going to cover all the cost required to recover the loan on behalf of the lender.

Summarily, we did this to make the product profitable and reduce cost.

We understand that this may impart cross selling loan friends as a feature. Hence, we wanted you to know why we did it.

Total Investment Portfolio

The investment page on the app has been rejigged.

Now investors will see their total balance of their active investments in Sycamore in one view.

We observed the earlier versions of the app doesn’t clearly give investors with more than one investment a good experience.

Investment Liquidation

We revamped the liquidation process on the app.

Now users can successfully request for a full or partial liquidation

We did this to promote a DIY(Do it yourself) model for investors on our channels.

We felt users should be able to raise a liquidation request without having to speak with an agent first

Members of the investment team will receive liquidation requests once a user triggers it on the app.

This can then be reviewed for possible approval or rejection.

Investment Topup

We revamped the topup process on the app.

Now users can successfully topup their active investments.

The interest rate of the old investment is maintained.

We did this to promote a DIY(Do it yourself) model for investors on our channels.

We felt users should be able to top-up their investments without having to speak with an agent first

This reduces the workload of the finance and investment teams in confirming topup requests and payments.

All you have to do is encourage your investors to the use the mobile app

Investment Rollover

We revamped the rollover process on the app.

Now users can successfully rollover their matured investments.

There are three rollover options:

We did this to promote a DIY(Do it yourself) model for investors on our channels.

We felt users should be able to rollover their investments without having to speak with an agent first

This reduces the workload of the finance and investment teams in confirming rollover requests and payments.

All you have to do is encourage your investors to the use the mobile app

Loan Liquidation

We have simplified the loan liquidation and repayment process on the mobile app.

Users will be able to see their full liquidation balance. If they choose to liquidate, the loan is closed immediately.

The liquidation balance updates daily

To simplify the liquidation experience.

This helps to reduce the back and forth between a customer and the remedial assets team when a user wants to liquidate their loan

Revamped Loan Application Process

For potential borrowers who do not fully submit all necessary KYC required to get their loan to a sales agent, we will persist a banner which will show them the outstanding requirements left for their loan to get reviewed

The banner will come up

To help users easily understand what is outstanding for their loans to leave the ‘processing’ stage.

This will help the Sales and CX teams easily direct users to the outstanding requirements on their loans.

We also hope this will reduce the amount of complaints from users who are not sure of how to get their loans out of ‘processing’

Updated Tour Screens

We’ve revamped the tour screens the user sees the first time the app is opened.

We did this to give the app a fresher feel and to improve our onboarding experience.

Walkthrough Screens

Users signing in to the new version for the first time will be taken through a short walkthrough on changes to expect in the new version.

For better UX and to put the most important features in the faces of our users

Delete Account

Users can now request for their account to be deleted and for their data to be expunged from our database

To fulfill NDPR requirements and also a requirement from Google and Apple to submit our app on the stores

We will empower the CX and internal control teams to easily review and approve or decline these delete requests when they come in.

It is expected that users with loans or investments are settled before their accounts are deleted

Revamped Profile Page

We have made it easier for users to make changes to their basic KYC information on their profile page

This is in response to complaints from users who couldn’t edit their details easily

We hope CX will get less complaints about this going forward

There are no rows in this table

Want to print your doc?

This is not the way.

This is not the way.

Try clicking the ⋯ next to your doc name or using a keyboard shortcut (

CtrlP

) instead.