Skip to content

It quite literally bankrolls the industry’s activities when they receive investment. Without investors, companies wouldn’t be able to expand their operations and develop new infrastructure of death. Yet this isn’t the main reason we argue for divestment. While selling of stock in Shell cleans our hands of complicity, it doesn’t immediately deprive them of money because some other investor will just by those shares up. Instead the importance of divestment as a tactic comes from chipping away at;The social license which comes with the perception that the fossil fuel industry is a viable and socially acceptable investment. The only thing separating a socially-castigated criminal and the fossil energy industry is the current consensus by Big Money that the latter is acceptable. Once we call the industry out for what it is: a murderous, deceptive scam which will willingly sacrifice anything for a little short-term profit, the idea that we’d invest in its false-promises of prosperity will be exposed for its lunacy.

Q: Why Divestment? What impact does it have on the fossil fuel industry anyways?Q: Won’t divestment hurt UW’s financial health?Q: Hold up. Where do we invest all that money then?Q: Is it even legal to divest?

Q: Why Divestment? What impact does it have on the fossil fuel industry anyways?Q: Won’t divestment hurt UW’s financial health?Q: Hold up. Where do we invest all that money then?Q: Is it even legal to divest?

Divesting the CEF

Divesting the CEF

Information about the Consolidated Endowment Fund and UW investments in Fossil Fuels.

Note* use the collapsing arrows to consolidate (pun intended) information.

🛢️The Money Pipeline

Of the many sources of money that the University relies on, our endowment is by far the largest, sitting at So how does it work and where does the money go?

Step I. The Donors

The story starts with donors who make contributions to the CEF. Donors—often alumni and —contribute with the expectation that their money will add to a large pool (managed by the University) that will be diligently invested into the market. The returns on that investment go back to the University to be spent on research, scholarships, campus infrastructure and other programs. The contribution itself remains invested in the market (think stocks, bonds, mutual funds, direct holdings, etc.), with the returns feeding a steady supply of money to the University. That means that, importantly, if donors make a contribution to the CEF, the University can’t just spend that money directly. With that in mind, investing smart is important to UW’s financial well being

Step II. The Investment

UW’s investment policy is dictated by the (BOR), a group of 10 influentials who govern the University’s decision making. They have vested the responsibility of managing the investment of the CEF to a private entity called UW Investment Management Company.

UWINCO invests most of the CEF into mutual funds: collections of stocks from various companies which are compiled by large investment managers such as BlackRock. Investment managers such as BlackRock sell these mutual fund packages to investors like UWINCO and often market them based on the focus, such as foreign realty companies or biotechnology, for example. Much of the information about the contents are considered a trade secret however.

Step III. The Money

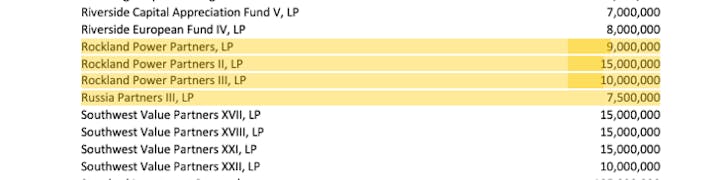

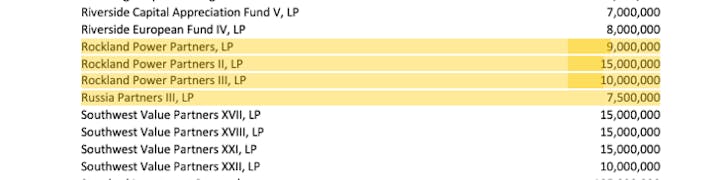

Despite the lack of clarity, here is what we do know from independent research, , and conversations with UWINCO:

The UW CEF has about $124M in fossil fuel assets (around 2.5% of the CEF).

→30% is directly invested in pipelines through Master Limited Partnerships (MLPs)

*These are public equities that we hold directly

→70% is in mixed holdings such as mutual funds.

*This is private and public equity that we don’t control as directly.

This money serves two important functions for companies in the fossil fuel industry:

In other words, we call for divestment because it signals to the world that what the fossil fuel industry is unacceptable, not because we actually think our action alone can stop it.

💸Divestment History:

UW has chosen some form of divestiture only a handful of times over the years: and only after strong outside pressure from activists. Here are some examples:

Timeline of Divestment at UW

The History of Divestment at UW

📈The ACSRI Divestment Process

❓FAQs

Q: But really: what does divestment even mean??

Divestment is a tactic used by stakeholders who are concerned with a publicly traded company’s actions. Like boycotts and sanctions, the purpose is to stop the flow of money that finances unethical behavior. Divesting from the fossil fuel industry simply means that we as a university will no longer invest in companies directly tied to the fossil fuel industry. Both a fiscally sound decision in reducing our risk exposure, and a symbolically powerful one in joining groups across the nation pushing for a clean and just transition to a more sustainable economy and energy grid. The UW has a chance to be one of the leaders in this field rather than one of the followers, the choice is ours and the world and future generations are watching.

Q: What is shareholder activism/shareholder engagement and why divest instead?

Mention divestment, and the first alternative that is usually presented is shareholder engagement (also called shareholder activism). In shareholder engagement, those that own stock in a company attempt to positively influence that company’s behavior to get them to reform their ways. This can include shareholder resolutions where shareholders propose changes and convince others to vote in favor, or all the way to hedge fund proxy contests to buy up more stake in a company.

This is potentially an effective method when the issue with a company is a management style or policy which the company currently practices that can be reformed. Convincing a company in the fossil fuel industry to reform their business practices is one thing. But shareholder activism fails for a few reasons

*The issue of fossil fuel companies is fundamental to the companies themselves. Simply making their products a bit less polluting or their practices a bit less GHG intensive won’t address the problem: the problem is the very notion of the extraction, combustion or processing of fossil fuels (not to mention the very unjust and unethical manner which it currently entails).

Want to print your doc?

This is not the way.

This is not the way.

Try clicking the ··· in the right corner or using a keyboard shortcut (

CtrlP

) instead.