Share

Explore

Early Adopters Hub - Investment

Mission driven, quality deal flow, at a great stage and price

Summary and Investment Thesis

Our thesis

Power law plus - It's the backup, not the strategy

Unicorns just happen - You can't predict or nurture

Reduce Failure Rate - Maximising returns by minimising 0s

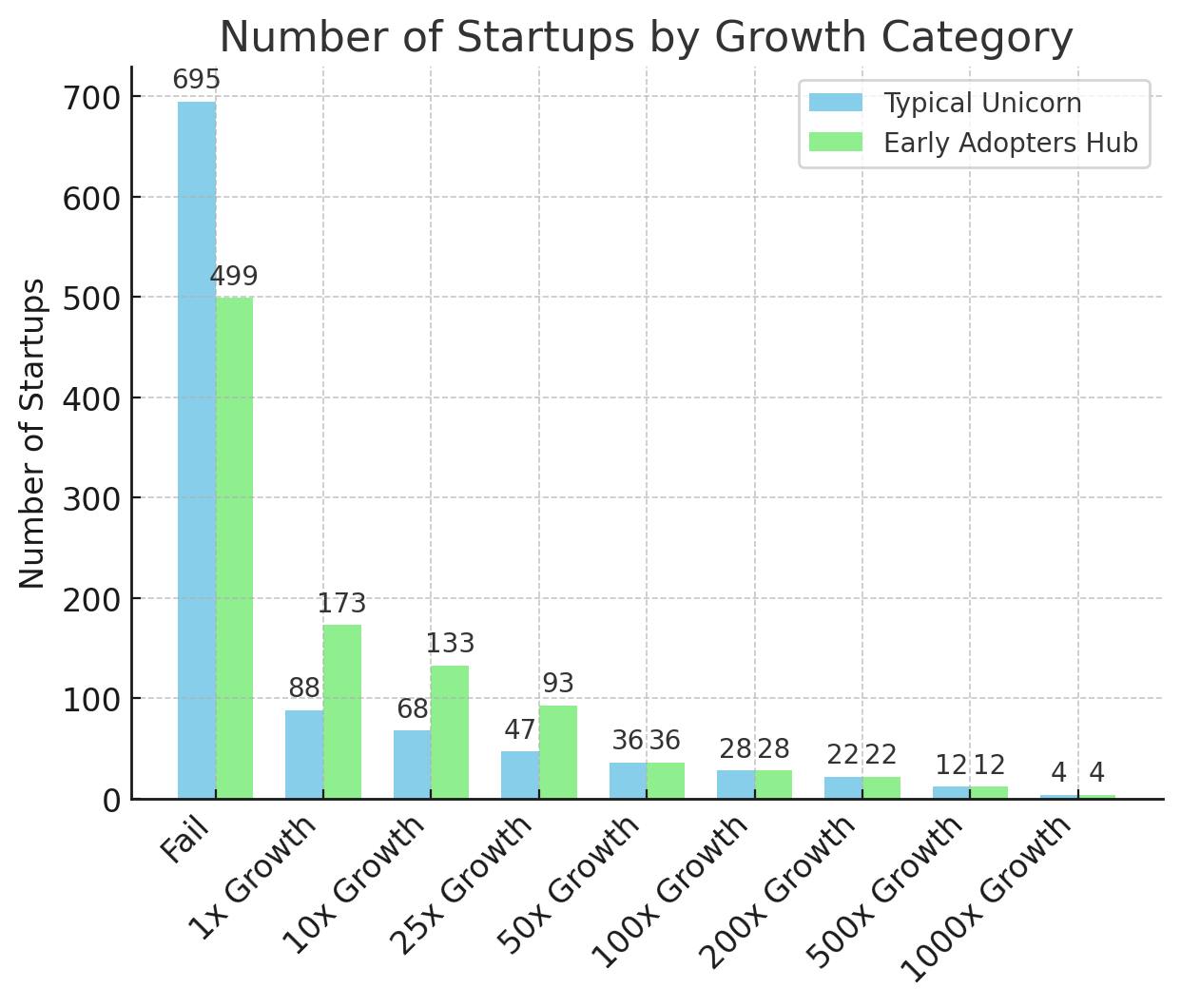

Graphs v1 - stats together on single graph

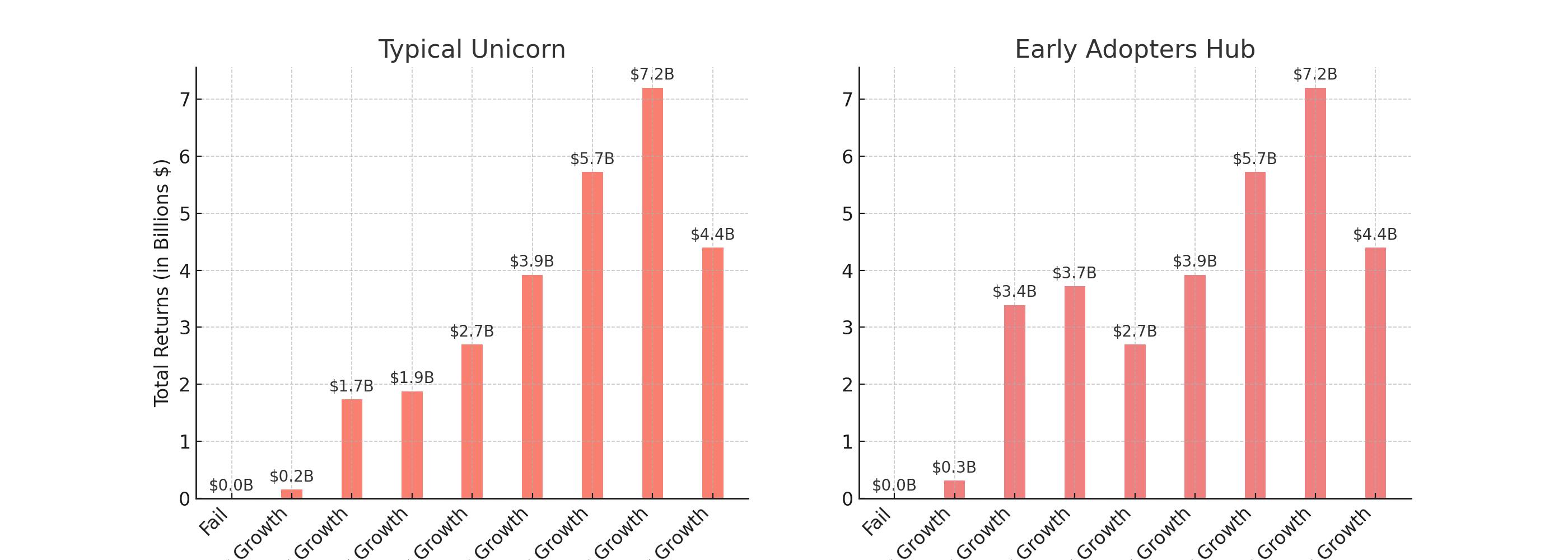

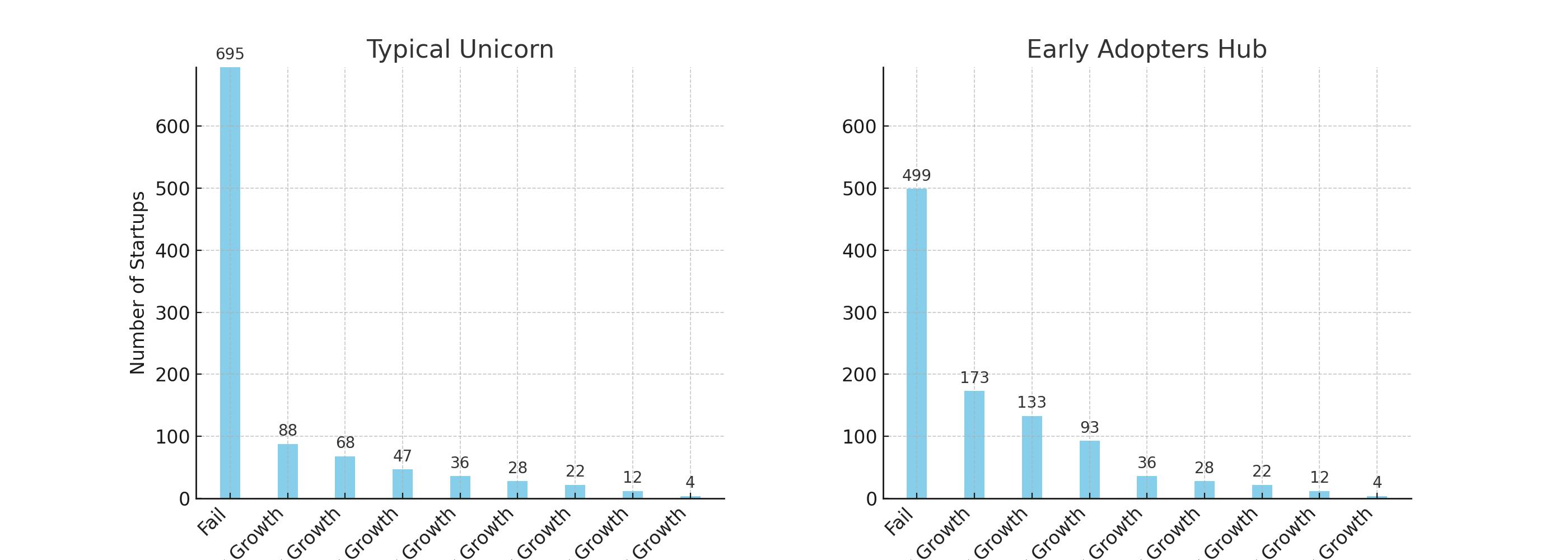

Graphs V2 - stats on separate graphs

Get in early - Price matters and significantly mitigates risk

Don't invest in ideas - Only validated ideas can be part of the portfolio

Unprecedented capital efficiency - Better valuations, less dilution, lower need for continuous raises

Niche focus - Compounding knowledge, network, and partnerships benefits

Objectives and future vision

Goal of investment and opportunity

Investment terms

Why an SPV?

Summary of investment mandate

Methodology - How do we achieve our goals?

Background - how we established our methodology and solution

Reach/attraction - where do we find startups to work with?

The engagement process - from introduction to presentation

Vetting/screening - converting that information into a filter

On-going collaboration - how we maximise the chance of success

Facilitating engagement with prospective customers - the accountants

Methodologies

Additional critical success factors

Bringing it all together

Risk and reward analysis

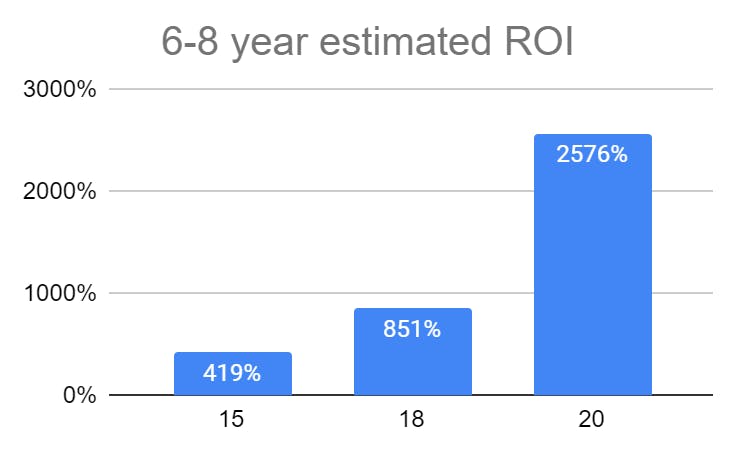

Reward - upside return potential

Risk - downside potential and mitigations

Risk

Mitigation

Risk

Mitigation

1

Unable to attract enough deal flow

Our track record demonstrates more than enough deal flow from previous years

2

Fewer startups exit than predicted

Our comprehensive offering of network, vetting, ongoing support and more should enable us to minimise this occurring

3

Exit value is smaller than anticipated on exit events

A healthy/significant enough deal flow should compensate/overcome any shortfall

4

Luck

By ensuring significant deal flow, the power law should minimise the effects of bad luck

5

The largest area of risk - as it’s unknown, it’s impossible to mitigate - if it weren’t unknown, it wouldn’t be a risk. Adaptability, resilience, attention to detail and the power law are our best defense

There are no rows in this table

Case studies and existing portfolio

Legal aspects

Objectives

Suggested structure - hypothesis 1

Suggested structure - hypothesis 2

Return on investment - how returns will be distributed

Protection

Additional notes for call with lawyer

Conclusion and next steps

Appendix

Want to print your doc?

This is not the way.

This is not the way.

Try clicking the ⋯ next to your doc name or using a keyboard shortcut (

CtrlP

) instead.