Skip to content

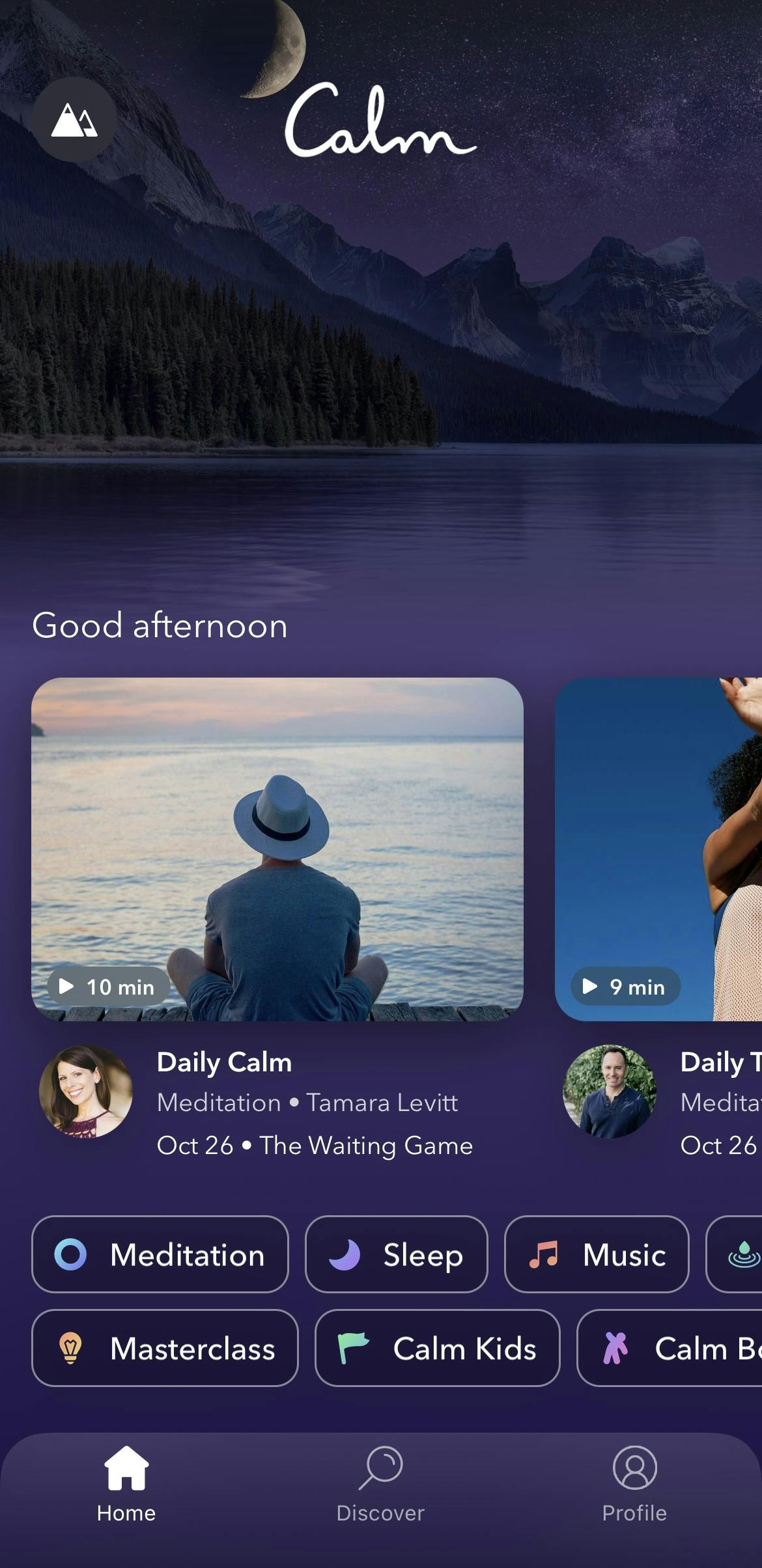

1) Are you solving a problem that has personal relevance?Will you still care about your product, your company, and your customers after getting beaten down for a year straight?Is the north star mission important enough to you that you will put potentially put everything else in your life second for it?Examples of north star missions:Robinhood's mission is democratizing financeCalm's mission is normalizing self-care and meditationEight Sleep's mission is improving quality and tracking of sleepIs the problem worth solving to YOU?Not everyone is going to start a company that reduces carbon emissions across the globe like TeslaIt's okay if you're building a B2B sales tool, as long as it matters deeply to you!But if you're just in it to get rich or get famous, it's probably not going to work out!2) Can you build a great product?Do you have these skills:Developer (knowing how to build something)Product manager (knowing what to build, and how to get there)UX/UI designer (knowing what experience the user wants, and how to make it great)If not, you can learn these types of skills for free on the internet → there are no excuses Or you can try out no-code/low-code solutions, and see if you can get to a "Minimum Viable Product" or MVP without using hard codeWe run a ton of low-code stuff at LAUNCH!We use Notion, Zapier, Typeform, Bubble, Squarespace, etc.3) Can you recruit elite talent to join your team?Can you recruit one or multiple co-founders that balance out your skillset?Example: if you are non-technical but great at sales and vision you probably want to find a technical co-founder that's can handle productIf you can't build a product, can you convince people to work for you that can?Is your opportunity large enough that you can convince world-class engineers, designers, salespeople, etc. to come work for you?Some things that attract high-end talent:Equity: That's how you can compete with big tech salariesLarge opportunities: Uber, Airbnb, Stripe, ShopifyMeaningful work: Tesla (EVs), Blokable (Housing), etc.4) Do you understand your ideal customer?The first step in delighting your ideal customer is knowing who they areBeing able to identify the makeup of your most engaged cohort of customers could be the difference between finding product-market fit and running out of moneyHow is your customer solving the problem today?What do you offer that is superior? Why will they make the switch?Things to look for: demographics, average time spent on site/in app, how you acquired them, are they likely to recommend your product to a friend?Do you have domain expertise in your industry?This is a controversial issues among investors:Some investors look for domain expertise in a first-time founderHowever, other investors () actually believe domain expertise is overrated and could be negatively correlated with outlier successKeith thinks that the greatest innovations typically come from outsiders, since industry insiders are usually entrenched in a limited way of doing thingsJason calls this "fresh eyes on a problem"Also: your ideal customer might wind up NOT being who you thought they'd be - if that's the case, are you flexible enough to pivot and still succeed?5) How much personal runway do you have?People underestimate how long it takes to either A) raise money or B) get profitableAsk yourself: What is your personal burn rate? Can you optimize it to extend personal runway long enough?How you can hack this: Build a side project on nights and weekends before leaving your day jobIf you aren't technical, try no-code solutions to see if you can create a minimum viable productIf you can get to any amount of revenue while still in "side hustle phase" - that's amazing!Then you can start doing calculations like "When I hit X dollars in profit, that will be ~70% of my salary and I can quit my job and make up the difference"6) How much are you willing to sacrifice? How resilient are you?Before you quit your job to start a company, do a self-assessment on your personal resiliency1) Practice mindfulness (mindfulness helps with building self-awareness, which is key to emotional resilience, according to the CNBC article)2) Breathe slowly and deeply3) Build a robust emotional vocabulary (distinguish between different emotions in yourself and others so you are less likely to react without thinking)4) Reflect on situations (take responsibility and articulate what you learned and how that will make you wiser in the future)5) Reframe your mindset (view setbacks as challenges instead of threats)6) Search for meaning (reframe suffering to create greater meaning for yourself and your team)7) Forgive (break psychological ties that tie you to your past)8) Engage your support network (the CNBC article notes that "research shows extroverted individuals tend to be more resilient because they’re more likely to reach out to others when they need help" so introverts should be extra mindful of this)9) Express gratitude (gratitude can redirect negative emotions)10) Take control of your outcomes (YOU control your destiny)7) Do you have a bias towards action?Complacent people do not make great foundersIf you enjoy a casual working environment, don't like working long hours, prefer not to work nights and weekends... than being a founder is NOT for youAs a founder, you will be forced to put out fires from Sunday morning to Saturday night, and everything in between8) Do you need a boss?Some people need oversight, direction and someone else telling them what to doThose people can still be good employees, and can knock off tasks and help your business once you start hitting scaleHowever many successful founders were NOT great employees, and in fact many were tough to manageIf you're somebody who takes comfort in having someone above you who could take responsibility and give you a direction, you might not be fit to be a founder9) Do you make excuses?There are a lot of people who think they have what it takesBut they tend to be hesitant in getting started - often coming up with excuses: They are willing to start companies if you give them moneyThey will start companies if they find a developer to work for freeThey are willing to start companies, but only if they can make the same money they made at GoogleThese are NOT signals of a great founderGreat founders start building now, no excuses!10) Can you build the startup flywheel?Product, Customers, TeamCan you:Build a great product?Is it well designed, or is the product clunky and ugly? Do you have a product at all?Delight your customers?Do you even know who their customers are?Do you know the pain point they're solving?Build a great team?Can you recruit and hire a team? If the founder can't do these simple things then this is probably not a founder that is going to win

11) Pick a business model that easily aligns with your product or service and customersYour business model will depend on the type of product or service you're offeringToday we're going to go through the most popular business models for tech startups, which models investors love and which ones they avoidExamples:Imagine if Uber charged a monthly subscription for unlimited rides instead of a marketplace solution... would they have still succeeded?Companies that sell business software should NOT sell it as a one-off, you should always sell it as a subscription so you can have recurring revenue and reduce your churn12) Keep it simple: FOCUS on a single business modelOne mistake founders make (besides picking the wrong model) is trying to do too muchWhen founders get unfocused, that's very dangerous for a startupBusinesses with multiple streams of revenue can get clunky with less chance of outlier success than focused business models from the startExample of single business models (at the start):Uber → marketplace, takes a percentage of every rideCalm → subscription for meditationSlack → subscription for messaging appSpotify → subscription for musicPro-tip: Here is one way in which you can use to different business models to prop up your startup in the early days:You can use service-based revenues to build out your SaaS businessWe see this all the time with early-stage startups, and it's a great way to get quick capital to grow your recurring revenue businessHOWEVER... make sure you differentiate "service-based" from "subscription-based" when you're talking to investors!Competent investors will always ask about the "quality of revenue"13) Do you understand why investors love SaaS (Software-as-a-Service)?Because it allows startups to increase revenue on a recurring basis, while keep fixed costs relatively consistentWhat is SaaS? It's when a business charges a monthly or yearly price per seat for business softwareThis business model creates "recurring revenue" for a startup, which investors love because you start every new payment cycle with almost 100% of your revenue from the last cycleIf you sell on a "bottom-up" basis (meaning you sell into an organization from the lower level employees, not top-down from the VP level) your product can spread through a company like wildfireExample: Slack, NotionWith bottom-up SaaS, you also can have a "cross-pollination" effect, where employees that get addicted to your product move to other companies and then infect THOSE companies with your product14) Do you understand why investors love the Fintech model (SaaS + Transactions)?This model combines the best parts of SaaS and transaction-based revenuesWhat is the Fintech model? It's when companies charge a SaaS fee AND take a percentage of each transaction (if your product enables transactions)This is a popular business model with Fintech companies like Stripe, Shopify, and PlaidWhy? Because 100% of revenue coming from transactions is not as ideal as having as a recurring SaaS componentThese companies typically charge a relatively affordable monthly or yearly SaaS fee and takes a small percentage of each transactionFor example: In Q2 2021 Shopify had $334M in subscription revenue and $785M in transaction-based revenue (they call it "merchant solutions revenue")Shopify had about a 30/70 split between SaaS and transaction-based revenueShopify's standard plan costs $79/month, and they charge 2.9% per transaction for merchants using Shopify's payments processor15) Do you understand why consumer subscriptions are coveted by investors?Subscriptions make a vertical with historically high churn rates much more investable by creating pricing lock-in and recurring revenueConsumer subscription are when companies charge a monthly or yearly fee for a consumer softwareExamples: Spotify, Calm, FitbodInteresting insight: Calm used to sell their app for a "one-off" price of $10 back in the early daysWhen they started to charge $5/month (or $60/year) instead of just $10 for life, they actually saw a jump in downloads and paying customersWhy? Because people love subscriptions, even though it makes no logical sense!The brain thinks "Hey, I can cancel this whenever I want." even though you'll likely paying 10x-100x the original purchase price over time!16) Do you understand why marketplaces are coveted by investors?Marketplaces are hard to get started, but even harder to stop when they hit scaleMarketplace businesses take a percentage of each transactionMarketplaces are two-sided, and the two sides traditionally consist of "buyers" and "sellers"These buyers and sellers can appear in many forms, depending on the vertical:Amazon has third-party sellers and buyers (obviously)Uber has drivers and ridersAirbnb has hosts and guestsRover has dog sitters and dog ownersHipcamp has private land owners and campersMarketplaces rely on the total amount of all transactions on the platform - typically called GMV (or Gross Merchandise Volume)The GMV in a marketplace determines the revenue that company will make, since companies typically take between 5-20% of the total transaction costThis differs by vertical as well:Uber and Airbnb refer to this metric as "Gross Bookings"In Q2 2021, Uber had $21.9B worth, and revenue was $3.9B (about 18% of Gross Bookings)In Q2 2021, Airbnb had $13.4B worth, and revenue was $1.3B (about 10% of Gross Bookings)Marketplaces eventually become "self-sustaining" once they hit scale!Craigslist, Amazon, eBay, etc.17) At the most basic level, why do investors love these four business models?The four models: SaaS, SaaS + Transactions, Consumer subscriptions, MarketplacesBecause they allow startups to capitalize on the scale-ability and high margins of selling softwareThe power of software: Instagram sold to Facebook for $1B with only 12 employeesWhat advantage does this provide the founder?Founders can keep fixed costs relatively similar while growing revenue rapidly due to simple and scaleable business modelsWhich means they can pour the profits back into building their businessBusiness models of Jason's outlier success:Calm (Consumer subscription), Uber (Marketplace), Superhuman (SaaS), Thumbtack (Marketplace), Grin (SaaS), LeadIQ (SaaS), Fitbod (Consumer subscription)18) Which business models do most venture capitalists stay away from?Typically these are not "venture scale" businesses, meaning they can't get to $100M in revenue in under 10 yearsDirect to Consumer or anything CPG (Consumer Packaged Goods)Lower margins and scales slower than softwareFor DTC, you need at least one of these differentiators:1) Elite product/brand (Ex: Eight Sleep, Warby Parker, Dollar Shave Club, Away Luggage)2) Elite acquisition strategy (Mastery of TikTok/Instagram/Facebook advertising, or organic)HardwareFamous saying: "Hardware is hard"Historically low margin, and scales much slower than softwareRace to the bottomPro tip: If your hardware item has a software component, you can sell HaaS, or Hardware-as-a-Service, which is much more appetizing to investorsEx: Density, Cafe XAdvertisingMaking money through ads on your platformThis business model only works if you hit massive scale, which is why investors are typically skepticalExample: Google, Facebook, Amazon, Yelp, Twitter, SnapchatAdvertising budgets are also dependent on the economy, as major advertisers cut their ad budgets FIRST after there is a down turnService-basedNot venture scale, usually bad businesses for everyone except the founder19) How soon do you need to identify a business model after starting your company?Most great companies know how they will make money from the startHowever, your business model can change as new opportunities appear. Some of the greatest modern tech companies have changed their business model.Example: NetflixNetflix had TWO business model changesFirst, they went from mailing physical DVDs for a monthly fee to selling streaming software (their margins and user base increased dramatically)Second, Netflix used to "rent and distribute" 100% of their digital content when their streaming platform first launchedThey would sign deals with companies that owned the rights to content and pay to list that content on NetflixIn January 2013, Netflix CEO Reed Hastings released a memo to employees and investors announcing a commitment to producing original contentFrom the memo: "We don’t and can’t compete on breadth with Comcast, Sky, Amazon, Apple, Microsoft, Sony, or Google. For us to be hugely successful we have to be a focused passion brand. Starbucks, not 7-Eleven. Southwest, not United. HBO, not Dish."Netflix's first piece of original content, House of Cards, launched one month later in February 2013In Q1 2013 (the same quarter that Hastings released his memo) Netflix had $1B in revenue and only $3M in net incomeEight years and three months later, in Q2 2021 (their most recent quarter) Netflix had $7.3B in revenue and $1.3B in net incomeSo in the 8 years since Hastings letter, Netflix has ~7x'ed their revenue and grown their profit ~433x, largely due to their focus on producing original content!20) Pricing: How much should you charge?Charge too little and people don't think your product is good enough to buyCharge too little and you don't cover expensesCharge too much and people won't give it a shotCharge too much and potential customers might get "sticker shock" - which is why some SaaS companies don't list their prices publiclyCompare to competitionWhat are similar startups charging?How do you compare? Are you the affordable solution, or are you the premium offering?Know your metricsAt what number of customers and what price can you be profitable at your current burn rate?If you need 500 customers at $20/month to be breakeven, that seems very doable!If you need 3000 customers are $100/month, that might be a little harder, and you might want to lower your burn rate

21) Do you know who you're building for?How can a founder distinguish their "ideal" users vs their "first" usersFirst users: could be your friend from college, a neighbor, your grandma, etc.Ideal users: who your product ultimately solves the problem for, and who is willing to use it the most OR pay you the most moneyHere is an easy trick to identify early potential ideal customers:Segment your users into cohorts based on an engagement metric like time on site, rides taken (Uber), workouts registered (Peloton), etc.Focus on the top 10% of engaged usersAsk yourself: What do these users look like? What are their occupations? Where are they located? Why are they engaging with my product? How much time are they spending on the platform?Use this info to create a blueprint for a potential customerEx: Small business that needs help with web design, but doesn't need to hire a full time software engineerThis example would be a blueprint for an ideal customer of a marketplace of freelancersRemember: Winning founders understand their customers deeplySuperhuman has an innovative approach to focusing only on potential customers that fit their ICP:CEO Rahul Vohra only on-boards email "power users" due to his product's relatively high price point (~$360/year for an email client)Rahul knows if he onboards a customer who is not the right fit, that customer will likely have a bad experience, churn quickly, and the entire cycle of acquiring that customer will be a waste of timeSuperhuman actually REJECTS potential customers if they are not a good fitInstead, Rahul chooses to only spend time onboarding and acquiring customers they know will love and utilize their product22) Can you explain your startup in one simple sentence?Call this "Jason's OSS Rule" - One Simple SentenceAny great company can explain what they do in one simple sentenceAt its core - what does your company do?No buzz words; just a clean, clear, and crisp sentence that anyone could understandInvestors see convoluted, buzz word-y company descriptions oftenHere are some examples with popular companies:Slack example:Bad job: "We're a future of work startup leveraging software and integrations to improve workplace communications for the long-term."Good job: "We sell chat software to startups."Coinbase example:Bad job: "We're leveraging the blockchain and decentralized technologies to allow any investor to get exposure into the world of cryptocurrency."Good job: "We help people invest in crypto."Uber example:Bad job: "We use AI and machine learning to connect riders and drivers, disrupting the worlds of transportation and mobility as we know it."Good job: "We help you get rides faster and cheaper."Something to keep in mind: Does all your branding align with your simple sentence? Is the messaging consistent across your website, Twitter, TikTok, etc.?Can every employee explain what you do in one simple sentence?Does your sales team speak clearly?Remember: Winning founders can explain their product simply Einstein famously said: "Everything should be made as simple as possible, but not simpler"Winning founders can do this in their explanation as well as with product developmentIf you can't say what your company does simply, your customers won't understand your value23) Do you know where to find more customers?Once you have your first 5 customers, you should immediately look for 10, then 50... Too often founders find their first group of customers and quit lookingThey often get lost building new features or assume the customers will keep comingWinning founders are obsessed with acquiring new customersIf you found a way to acquire customers that works - keep doing it!If you find oil, keep digging!So, how do founders go about finding users?What are a few customer acquisition strategies in the early days? Hangout where your users areIf you're selling developer tools to software engineers on a bottom-up basis... Post on hacker news and subreddits to try and get early users and feedbackAttend live events (like meetups) and talk to the users themselvesBuild in publicCreate a sense of community around your productBeing open and transparent on Twitter is becoming more popularIt is a great way to find users with word of mouthYou can also build publicly on Indie Hackers and engage that communityLeveraging your networkAre you solving a problem that your network suffers from?Do you have ideal customers you can easily reach out to? Alex Tew, co-founder Calm used a strategy to attract users by building an interesting viral site called - and it's still live today!The virality of the non-product drives traffic back to the productHe did this with Calm by creating a simple website that asked if you could sit still for 2 minutesIf you moved the mouse or touched keyboard it would say "Fail" People shared their scores, and he collected ~100k emails of engaged users (in a few days) before ever launching CalmThere is also the waitlist strategyObviously, you need serious demand in order to create a waitlist in the first placeCompanies like Superhuman have perfected the waitlistYou should create a waitlist if:You want to gauge the level of interestYou want to limit the amount of customers you're on boardingYou want to build up hype and demand for your productOnce you have a few hundred users on the waitlist, you can utilize growth hacks like:Enticing users to move up the waitlist by referring other people to sign up, which creates a virtuous cycle24) Do you have founder-product fit? Ask yourself "Are you using your own product?"Are your employees using your product? Do you truly understand the problem you are solving for the end user?There are several benefits to "eating your own dog food" 1. You can quickly help your team find bugs before impacting customers2. It strengthens your relationship with the customerEveryone at your company understands the customer experience You'll build credibility by knowing all the work flows and pain points3. It keeps your company on the same pageEngineering gets to hear feedback from users (even if they are internal)Marketing knows how the product works to better strengthen campaigns Sales better understands the problems the product solves when talking to customersExecutives stay involved in the day to day functionality of the productFitbod is a great example of this:Fitbod's co-founders Allen and Jesse originally built their product for themselvesOr, in other words, they were their own ideal customersIn this case: hardcore fitness enthusiasts with disposable income that wanted a data-driven approach to exerciseDo you know your one key feature and how that feature is being used?What is the main way that you use your own product? Fitbod's key feature was their workout recommendation engineThis was a machine learning model that would put together your next workout It was based on your preferences, past workout fatigue, available equipment, and moreWhen you know who your ideal customer is, what your key feature is, and you use the product yourself regularly You can build marketing campaigns and sales strategies around these markers25) Do you know how people are using your product?We've established that you and your employees are using your product... But are your customers using it in the same way?This goes back to the first point today - do you know who you are building for? Remember, winning founders understand their customers deeplyAre the features you think are most important the same ones that your customers think are most important?STEEZY uses their customer support tickets to inform their product roadmapAre customers having to work around clunky UI/UX that is making their lives harder in your app?If you are dog-fooding your own app you'll identify issues sooner and prioritize a fixBeing able to proactively tell a customer something like: "In our latest release, you can now save your most common view - you don't have to click this sequence of buttons anymore - it should save you 5 minutes every time you log in" This builds trust that you understand their problem and your own productAnd solving a problem your customer may or may not have known they had goes a long wayLook at the data whenever possible to understand your customersUnderstand who logs in and when What pages are they on longest?What actions are they taking? Where do they get stuck or lost and log out? Study patterns across usersGrouping your users into cohorts to track trends is helpful You can segment users based on when they signed up, the industry they are in, or any way that might be valuable to slice your user base for insights Quantitative data like this is extremely valuable But so is qualitative data... which leads us to: 26) Do you know how to conduct customer interviews?Are you talking to your customers regularly? Are you solving their problem? Winning founders solve big problems for their customersUse every interaction with your customers as a way to gather this dataYou do not need to provide a formal "interview" to gain valuable insightsA simple email to check in and see if they have any needs, thoughts, or questions can provide a lot of great informationWhen you release a new feature let your customers know about it and be excited FOR THEM... "I think you'll love this new feature, it is going to make your life easier by doing XYZ - would love to know what you think! What did we miss, what works for you?"You'll quickly get feedback without people even feeling the need to commit to an interviewBuilding relationships and checking in with customers before you "need" anything also builds good faith and confidenceOffering additional value and Providing great customer experience by being available is a way to stand out from competitorsAnd when you want to conduct interviews, people are more willing to participate if you have a relationship So, how to find the right customers to interview?Use the segmented customer engagement data we talked about beforeTake the different cohorts and select a random sample of customers This should range from your most engaged cohort to your least engagedReach out via email or phoneIf necessary, offer them a gift card, or something relatively meaningful for their timeYou want to hear from a wide variety of usersBut make sure to weigh your "super users" input more heavilyWhat kind of questions should you ask?Sample questions:What do you think about the product? What would you change about it? What does our product allow you to do that you couldn't before? How would you feel if you couldn't use our product anymore?What should we stop doing? Would you recommend our product to a friend or colleague? Have you? Why or why not?Listen to their answers and ask follow up questions that keep them talking"Can you say more about that..." "Can you explain what you mean by that..." "Would you elaborate on why..." Do not interrupt your customer's feedback!You can also conduct listening labsWhere you have the customer test out the app and think out loud while they exploreYou can ask them questions like"What are you looking for..." "Did that do what you expected it to do when you clicked on it... why?" "What do you need to do next..." You can also take interviews in another direction and create a Net Promoter Score survey... 27) Do you understand Net Promoter Score?Net Promoter Score (NPS) is a way to measure customer experienceWinning founders are obsessed with metricsMeasuring, tracking, and making decisions based on data is importantInstead of the open ended discussion questions you can ask users to answer on a scaleThis makes it easier to compare answers and group resultsCustomers rate their experience with your company on a scale from 1-10Something like, on a scale of 1-10 how likely are you to recommend our product...Promoters (score 9-10) They are loyal enthusiasts who will keep buying and refer others, fueling growthPassives (score 7-8) They are satisfied but unenthusiastic customers who are vulnerable to competitive offeringsDetractors (score 0-6) They are unhappy customers who can damage your brand and impede growth through negative word-of-mouthYou find your NPS score by taking your percentage of promoters minus your percentage of detractorsThis means your NPS score can range from -100 to 100 You can use NPS results to anticipate churn or drive customer outreachingApple: 47Facebook: -21Starbucks: 77Delighting customers is the ultimate goalYou need to be able discover answers to questions like:What problem are you solving for them?Do they feel you are solving it adequately? What sets your product apart?Which features do they love? Which do they want removed? Do you make their job or life easier, faster, or better?Why do they use your product? What do they wish was better? Do the customers recommend your product to others? Why or why not?A savvy way to increase NPS through a growth hack is with referral programsRobinhood had one of the best referral programs everYou might know it as the "Free stock" programEvery time you'd refer a user to sign up, both you and the new user would get a free stock on the platform!This created a huge surge of sign ups in the early daysNo other brokerage had ever done anything like that beforeDelighting customers is a vital part of the Startup FlywheelCollecting customer feedback is a great way to gauge how you are doing28) Should you start with a free or paid product?This is a very common question And it depends on your business model Are you going to be a free app that generates all your revenue via ads?Think, Google, Facebook, etcAre you SaaS, consumer, or a marketing place that needs people to pay you to survive?It also depends on how much runway you have from the startIt is best to turn on revenue as soon as possibleIs growing customer base or growing revenue more important? Ideally you're growing both! Free users, without skin in the game often provide high frequency, low value feedbackFree users speak with their words and their engagementCustomers who are paying, have skin in the game and are invested in your productCustomers speak with their words, wallets, and engagementWhat signals should you look for that tell you it's the right time to turn on revenue?You've figured out the pain point your company solvesAnd are seeing early signs of product-market fitYou've run successful free or paid pilots with happy usersDuring customer interviews they indicate that they would pay to continue using your productYou have a waitlist that includes a price users will pay for your product How do you shift from a free to a paid product?There are ways to roll this outYou could offer a freemium version of your productAllow the free users to have access to part of your productIf they want full access they'll can start payingYou can offer early users a discount to continue using your productYou could grandfather legacy users in at an original price pointYou can just flip the switch, turn on paid and know that you might have a high churn month but you've identified your ideal customers as those who stuck aroundAnytime you have free users you should work on ways to convert them to a paid planLet them know what they are missing, and how it would be better if they paid a monthly fee29) Do you understand the technology adoption curveThere are 5 stages to think about in technology adoptionInnovators, early adopters, early majority, late majority, laggards  Anytime you are creating new technology you need to win over all five of the individualsThe technology adoption curve was introduced by E.M. Rogers in 1962And made popular in the book Crossing the Chasm by Geoffrey MooreInnovatorsThey take risks with new technologyTypically support a transformation within the company around new toolsEarly AdoptersLook to understand the technology fully before the support it vocallyThey like to be at the forefront but care about their reputationThis is typically your group of beta testersEarly MajorityThis group makes decisions based on data They support technology but want to see the proof firstLate MajorityRequire even more proof than the early majority Don't like risk and not that interested in change LaggardsSkeptical of new technologyGive up when a new tool doesn't work and revert to their old way of doing itIdentify the innovators and early adaptors and market accordingly to those users!30) When should you fire a customer?Do you know when to cut bait with disengaged users?Can your ideal customer shift as your product evolves?These users are giving you bad data also - if they're disengaged, you should NOT be building your product for themShould change your product to increase engagement? Are you prepared to tell paying customers, we're not for you?How do you manage the current relationships as you shift?How do you communicate that you are firing a customer? Is it better to fire them?Or let them continue using your product - knowing they might become upset and churn anyway?Remember, the people paying the least money are usually the most needy and have the most complaintsRemember the Superhuman example we covered earlier:Superhuman actually "fires" potential customers during the on-boarding process!Meaning, if a user doesn't fit the specific qualities of an ideal user, they won't even bring them on as a customer in the first placeSuperhuman is able to preemptively "fire" their customer because they understand their ideal customer profile SO deeply

Anytime you are creating new technology you need to win over all five of the individualsThe technology adoption curve was introduced by E.M. Rogers in 1962And made popular in the book Crossing the Chasm by Geoffrey MooreInnovatorsThey take risks with new technologyTypically support a transformation within the company around new toolsEarly AdoptersLook to understand the technology fully before the support it vocallyThey like to be at the forefront but care about their reputationThis is typically your group of beta testersEarly MajorityThis group makes decisions based on data They support technology but want to see the proof firstLate MajorityRequire even more proof than the early majority Don't like risk and not that interested in change LaggardsSkeptical of new technologyGive up when a new tool doesn't work and revert to their old way of doing itIdentify the innovators and early adaptors and market accordingly to those users!30) When should you fire a customer?Do you know when to cut bait with disengaged users?Can your ideal customer shift as your product evolves?These users are giving you bad data also - if they're disengaged, you should NOT be building your product for themShould change your product to increase engagement? Are you prepared to tell paying customers, we're not for you?How do you manage the current relationships as you shift?How do you communicate that you are firing a customer? Is it better to fire them?Or let them continue using your product - knowing they might become upset and churn anyway?Remember, the people paying the least money are usually the most needy and have the most complaintsRemember the Superhuman example we covered earlier:Superhuman actually "fires" potential customers during the on-boarding process!Meaning, if a user doesn't fit the specific qualities of an ideal user, they won't even bring them on as a customer in the first placeSuperhuman is able to preemptively "fire" their customer because they understand their ideal customer profile SO deeply

31) Do you know what problem(s) your product solves?The answer to this question can guide your product roadmapAnother way to phrase this is "Why does your product exist?"Examples:Superhuman exists to make email fasterUber exists to connects riders with drivers for faster and cheaper ridesShopify exists to make entrepreneurship easy on the InternetHow important is that problem to your customers?How are they currently solving it?Ex: Gmail? Yellow cabs? Excel?How is your solution better than the current solution?When building a technology company, the answer should always be some combination of faster, cheaper and betterUber helps people get rides faster and cheaper (which is better!)Superhuman makes email faster and better (but not cheaper)Remember: Winning founders know this is a race for credibility - do you deliver what you say you will?32) Can you build an MVP?MVP stands for minimum viable productAn MVP is the most basic version of a product that you can launchDon't be precious about your MVPRemember what friend of the podcast Reid Hoffman says: "If you're not embarrassed by the first version of your product, you've launched too late"Some things to keep in mind before building your MVP:Are you a builder?Can you code?If not, are you familiar with Bubble, Webflow or other tools?Do you have UI/UX experience?If not, do you KNOW what good user experience is?Do you have a growth/sales background?If not, do you know how to build a growth modelDo you know how to create a go-to market plan?How minimum is minimum? You need be able to solve a customer's problemHow viable is viable? Will customers actually pay you for it?Is a landing page enough?It depends on how complex the problem you're solving isI've seen people create an MVP with a landing page and typeformBut you will want more functionality in most cases to see real tractionHow far can no-code take you? If you can get to an MVP using no-code, that means you can get tractionAnd if you can get traction, that means you can get meetings with investors33) Is your product simple to use?Can a user quickly understand how to navigate and use your product?Does your product highlight your main feature?You want your product to be incredibly simple from the home screenDon't make it difficult for users to navigate your product, that could result in more churn!CalmZero FastingYou should make it incredibly easy and delightful to be a user of your productAgain, the harder your product is to use the less likely a customer is to use it34) Does your product have world-class design?Achieving "world-class design" may sound like a high bar, but it's more doable now than ever beforeNo-code / low-code platforms like Bubble, Webflow, and Squarespace all have great templates that you can use as a starting pointYou can draw inspiration from any of these placesThere are some web 1.0 companies that have had mediocre design grandfathered inExample: Craigslist, AmazonThese platforms have hit such massive scale that they can't really change anything on the UI sideIf Amazon overhauled their e-commerce interface, they would get millions of complaints in minutesBut, first impressions still play an important roleAlso, users are savvier than ever and will pick up on janky design instantlyIf the product is clunky, slow, and hard to navigate you'll have trouble getting users to engageThink of how simple and easy it is to use your favorite productsRobinhood used a great interface and no-fee trading to upend the entire stock brokerage industryDesigner co-founders have a great track record in building massive consumer-facing companiesExamples:Airbnb (Joe Gebbia) - $100B market capCanva (Cameron Adams) - $40B valuation in most recent roundInstagram (Mike Krieger) - Sold to FB for $1B in 2012Pinterest (Evan Sharp) - $30B market cap currentlyYouTube (Chad Hurley) - Sold to Google for $1.6B in 2006And world-class design doesn't just apply to consumer-facing companiesRemember, Stewart Butterfield (a designer) built Slack and started the "Consumerization of SaaS" movement35) Does your product have "One Killer Feature"In other words: the key feature that your product is known forExamples:Snapchat's ephemeral messaging and storiesFacebook's news feedInstagram's filtersSpotify's entire catalogue of music for one low monthly feeRobinhood's no-fee tradingA major mistake that first-time founders make is focusing on new features over ones that are already workingRemember, new doesn't always equal betterPrioritize perfecting your killer feature before you start expanding your productFounders get into a mindset that if they add a new feature then traction will improveNo! Identify your key feature - get users, listen to them, delight them Double down on what is working!36) Does your product have a "hook"?Nir describes the product hook cycle in four stages:TriggerSomething that gets a user to take the first actionWhat makes you open an app in the first place?On his website, Nir Eyal uses the example of a user getting "hooked" into browsing on PinterestIn this scenario, the trigger would be a link back to Pinterest on another social media site like Facebook or InstagramActionUser takes an action that will eventually get them a rewardFor example, click the link, open the app, register for the product, etcIt is key to have as little friction as possible hereIn the Pinterest example, the link to the Pinterest app for a product they are interested inVariable rewardKey word here is "variable" - so user does not lose interestUsers are forming a habit and if they always know the reward, then they will get boredIn the Pinterest example, the user is "rewarded" by similar images and products to the item that brought them over, and now they can discover new productsInvestmentRequires the user to contribute back into the productPart of what makes IKEA so successful is that the user feels pride in what they builtFinishing the Pinterest example, the user "pins" items that interest them, which gives Pinterest better data on what to showFitbod example from LAUNCH's portfolio:Co-Founder and Head of Growth Jesse Venticinque described his products "hook" on Here is Fitbod's product hook cycle:Fitbod's Trigger: User has a psychological need to know how to exercise effectively, and Fitbod automatically generates a new workout for usersFitbod's Action: User launches Fitbod to start their workoutFitbod's Reward: Fitbod sets incremental and achievable goals that leave users feeling achieved after a workoutFitbod's Investment: Users spend time entering data on Fitbod for better personalizationMore data improves Fitbod's workout recommendation engineWhich then increases switching costs and reduces potential churnAfter your workout ends, Fitbod immediately generates your next workout, which restarts the cycle (that's the "hook"!)37) Do you have a viral loop?You can also think of this as: is one user incentivized to create more users?Remember, on episode three we talked about Robinhood's free stock referral programIf you invited a user to sign up you get a free stock and they get a free stock The trigger and action are clearThe reward is variable - you don't know what stock you'll get... could be Apple, could be a penny stockHere is why this was the best viral loop of all timeVia Robinhood's S-1:Over 50% of users are first-time investorsSo over half of Robinhood's 17.7M MAUs (at the time of their IPO earlier this year) were first-time investorsAsk yourself: What would be the hardest part about getting a first-time retail investor engaged in your brokerage?Likely answer: Linking a bank account, depositing funds, and actually making their first investmentSo to fix this, Robinhood said "Here's a free stock" now YOU have skin in the game and are instantly engaged!And the results of the free stock referral were staggering:Via their S-1, over 80% of users were acquired organically or referredCan you leverage your product to create a viral loop as great as Robinhood's?Dropbox did it with free storage: Dropbox Basic users got 500MB of extra storage for every user they referred, up to 16GB!The app "Words with Friends" is another example:A user can easily challenge a friend to play Scrabble If that user doesn't have the app, WWF generates a download link to send themNow that they are in they can invite their friends to the platform38) Do you have a strategy to retain users?User retention is a big topic, let's start with a simple example:LinkedIn has an amazing user retention strategyAfter you have gone a few days without opening the app, they will send you an email reminder to log back inThis is NOT a non-personalized, generic, "we miss you" emailThey actually say "80 people are viewing your profile" to pique your interestThen, when you go to the site, they let you know who was viewing your profileTwitter does something similarIf you don't log in for a few days, you'll get a push notification: Don't miss tweets from *your most engaged with accounts*So if Twitter knows Jason engages with Knicks and VC content the most, they'll say "Bill Gurley and Knicks Film School are tweeting - don't miss it!"These are all in-app ways to retain users, BUT customer success teams are becoming more popular as wellWe'll touch on this more on a future episode called "Building Your Team" Many people like a human touch39) Do you know which product-focused metrics to track?Remember - these metrics are "product-specific" so we're not going to include burn rate, runway, etc this time. We'll cover those on a future episode!So here are the four product-focused metrics that matter:1) Active User GrowthIf your product is providing value, you're going to start growing users quicklyAre you tracking your daily, weekly, and monthly active users?DAU - Daily Active UserWAU - Weekly Active UserMAU - Monthly Active UserCan you define an active user?Remember, sometimes founders can get cute with how they qualify an active userNextdoor disclosed in their SPAC investor presentation that they count anyone who opens an email as a daily/weekly/monthly active userThis is not good hygiene - an active user is someone who opens your app and uses itFounders should model their reporting after Twitter - who only reports on "Monetizable Active Users" - if a user can't be monetized (by being shown ads), they will NOT count themMeasuring and growing active users is crucial for startup success2) Revenue (or MRR/ARR if you're selling software on a subscription basis)If you're growing users and you have revenue turned on, you should also be growing revenue!MRR = Monthly Recurring RevenueARR = Annual Recurring Revenue (MRR x 12)Note - Founders can get a little cute with ARR sometimes, especially if you had a recent jump in revenueJason always asks founders for their last three months of revenue to see the raw numbersRevenue growth is the engine that drives your business3) CAC: Customer acquisition costHow much does the average customer cost you to acquireMy bestie David Sacks' CAC formula: Divide sales and marketing expenses in the prior month by the number of new paid customers in the current monththe one month lag is to reflect the time it takes for sales and marketing to materializeRemember - Amazing viral loops and word of mouth will acquire you users for FREE4) LTV: Lifetime value of an average userHow much value are you getting out of an average user?This is the total revenue brought in from a customer in a certain cohortYou can divide your LTV by CAC to get an accurate picture of how much profit you're making (or how much money you're losing) from an average customerRemember, churn has a huge impact on LTVThe more value your product provides, the less frequently your customers will churnLess churn = larger LTVGoes into great detail and breaks down high level metrics40) Do you know when to sunset a feature?How much time should you give a new feature to breathe?What if it goes mostly unused?Ex: Uber PoolUber Pool was launched in 2014Pool was a new type of ride where passengers could get cheaper rides by carpooling with others on a similar routePool was supposed to be better for the environment, cheaper (so more people could use Uber), and more efficient for drivers (multiple riders along one route)Pool never was able to turn a profit since it was lower margin than regular ridesUber sunset the feature in 2020 during the middle of the pandemic due to safety reasonsIt's been theorized that Uber was going to sunset Uber Pool anyway, and the pandemic just sped up that processIt took Uber six years to sunset Pool

41) Do you need a co-founder?If you are a first-time founder - YES!Starting a company can be stressful and lonelyhaving a co-founder is helpfulit's good to have a partner to divide and conquer, especially when you are fundraising, which is a full-time job.Plus, VCs will want to see you have a co-founderWhy? Because if you quit someone else is still there to work on the ideaMany startups don't work outPlacing a bet on a solo founder adds risk to an already risky situationInvestors like to see complementary founding teams (ex: technical founder + sales-oriented founder)If you have already started a successful company and have the credibility, it isn't as important to have a co-founderHow to pick a co-founder? Identify the skills you have and the skills you need to build a successful companyYou want a co-founder that has a complimentary skill set to your ownIf you have a sales background - you want to find a builderIf you are a builder you might need someone who is a marketerHave you worked with them before? Do you know how they work day to day? How do they handle stress when things go wrong? Do you trust them?Where to find a co-founder? Start with your network and people you knowHave you worked with anyone on projects that went well?Do you know anyone that has the skills and background you're looking for?Attend events, conferences, and network Finding a co-founder is essentially your first sell If you can't find one person to join you that is not a good early sign42) Do you know when to make your first hire?When can you justify paying someone to do the job(s) you are currently doing as co-founders?Ask yourself - how much would it cost to have someone else do this?Will the quality stay consistent without my constant input?What else could I be working on as a founder with this time?JMC: Is there a benchmark level of revenue you should hit before hiring an employee?JMC: What percentage of spend is typically set aside for salaries?JMC: What amount of burn is smart to take on for employee salaries?JMC: Should founders make their first hire before raising money funding?43) Do you know which positions to hire for first?What are the priorities for your startup when building out your team?A deep AI, machine learning application may require different hires than a fashion marketplacesDo you know what qualities or skills are important in early hires?General rule of thumb:If you have less than 10 employeesHire GENERALISTSOnce you have more than 10 employeesHire SPECIALISTSAre there specific roles every startup needs to hire sooner than later?Developer (sooner)Finance/accounting (can outsource early if needed)PR (don't need it in early days, then outsource if needed)HR (outsource at first, can hire when company scales to ~50 employees)Lawyer (outsource)'Bar Raiser' hiring process at AmazonEvery person hired should be better than 50 percent of those currently in similar roles. What to ask in an interview:You want to ask questions that help you understand how the the individual works & if they'll fit your team.For example, What is a new skill you've learned in the last year?Do you think it's more important to be talented or hardworking?Teach me something in two minutes (The Chamath question)Highlights their passion, ability to be concise, ability to convey information, etcHow do you handle having multiple assignments at once?44) Should you build a distributed team?When hiring in today's landscape, is offering remote positions a requirement? Finding talent is going to be a challengeStartups can give themselves an advantage by offering flexible working situationsThis can help small competitors outrun larger companies who have sunk cost in real estateAnd if you aren't offering flexible options, you may put yourself at a disadvantageHow can you build culture and accountability with a remote team?What we do at LAUNCH with a remote team: Slack huddlesWeekly team callsQuarterly team retreats (planned)JMC: Can a co-founder (or early employee) be located in another country? 45) Do you know what to outsource to freelancers?What kinds of projects can you outsource as an early-stage startup?If it is strategic - keep it in houseIf it is administrative or repeatable - outsourceHow outsourcing looks to investors:Outsourcing product development / engineering (BAD)Outsourcing sales (BAD - sales should be founder-led in the early days!)Outsourcing HR (GOOD!)Outsourcing other administrative work (GOOD!)Remember: Product, customers, teamWorry about perfecting these three things...and find ways to outsource things that do NOT impact the startup flywheelUtilize SaaS instead of contractors where you canAsk yourself, is there a SaaS tool that can simplify a process? For example, HR tools or softwareHelps to create a repeatable and consistent process What are the pros to outsourcing? Free you up to do other tasksFocus on the parts of building a startup you're best atFreelancers typically are efficient with their timeWhat are the cons to outsourcing? There is risk they don't understand your visionThis can lead to loss of time and money Not a priority - your project is likely one of several the individual/company is working onCommunication Constant communication eats up time - the top thing you were trying to save by outsourcingLack of communication can lead to unnecessary errors and delays46) How much do you pay early employees? "Don't make compensation a conversation"Have a plan earlyKnow at what stage of growth each key hire needs to be madeVP of sales when you hit X amount of revenueVP of marketing when you hit X amount of revenueHead of PR when you hit XDo your homeworkKnow what is fair value for each major roleWhat goals does your startup need to hit to be able to afford top talent?Get creative with hiringWith remote work - you can get MORE QUALIFIED employees more affordablyHow do you balance experience & high compensation vs. affordable & high potential?You probably can't afford the best developers on salary aloneBut you can sell them on your vision and offer equityYou can also find mid/junior developers with potential that you can groomMany startups will have a senior dev that helps to upskill more junior level individuals early on47) Do you know much equity to give to early hires?What percent makes sense to reserve when the time comes? It can vary but some back of envelope numbers may look like: A third co-founder might get ~10%A VP that joins to lead sales or marketing may get ~1-2%Senior engineers who are building your product can get as much as ~0.7%-1%Mid-level engineer ~0.45%Junior engineer ~0.15%Junior business hire ~0.05%Equity is limited - so be smart with it One major mistake of founders is giving away too much of their company earlyThis will mess up the cap table - making it hard for others to invest later onEstablish and communicate ownership with your teamSet an employee stock option plan (ESOP)If you want to go super deep into employee stock options and liquidation preferences:check out and click on the stock options episode with Wilson Sonsini's Becki DeGraw!One MAJOR take away from that episode:We talked about selecting the 83(b) provision which is CRUCIAL for founder and employee stock optionsthis is because it gives you the option to pay taxes on the total fair market value of your stock options AT THE TIME OF GRANTINGif you don't elect this option, you'll owe taxes on your stock after every new round of fundraising!Implement Vesting schedules4 year commitment with a 1 year cliff is commonThis means you need to work at a startup for 1 year before any ownership is givenAt that point you get 25% of your totalThen 1/48th (48 months over the 4 years) for each month after your first yearBuild an org chart & adapt as you grow48) Do you know when to start thinking about culture?Culture starts at the beginningA culture will emerge regardless — so you need to set and guide it intentionallyValue hard work & reward your high performersWhen your team is small everyone needs to carry their weight!One way to do this is allow multiple members of the team to interview new hiresThis goes back to Amazon's Bar RaiserIt is good to have a 3rd party (non-member of the internal team) sit in on interviewsFor example, a member of the ops team helps interview for a podcast roleThis helps give an unbiased view of the candidateAnd helps ensure cultural consistency across the organizationAnd this actually happens at LAUNCH:Nick had Ashley and Jacqui meet with producer Rachel and producer Justin before extending offers!As founder, lead by example and set the tone earlyDo not wastefully spendYou don't need the expensive downtown officeYou don't need swagNo one is going to buy your product because of a t-shirt they saw at a conferenceIf you want your team to take days off you have to take days offYour team will follow your leadInstill a culture of accountability Have the team hold each other accountable for their workDon't allow unsatisfactory work slide Address it head on You may learn about blockers that make everyone else more efficientRemove cultural killersAt a startup with 3, 5, 10 people you can't afford to have dead weightYou have to fire people who aren't contributing 49) Do you know when to fire an employee?"The one that got you here aren't necessarily the ones to get you there" Create a performance improvement plan (PiP)Document everythingBe graceful and professionalCommunicate the decision with the teamMake sure you understand employment laws of the state of your employee50) Are advisors valuable?Advisors are NOT full time employees but might offer ideas or answer questions a few hours each monthCan you find experienced individuals who believe in what you are building? Will they offer you valuable insights? They are typically paid with equityA few basis points is commonSay 0.1% to 0.3% equity for an advisorAre the insights they provide worth a stake in the company? The hope is that at least one of your advisors can provide enough value to justify having a few on board

51) Market: Are you creating a new market or servicing an existing one?Let's use two consumer subscription companies as examples for this:Spotify and CalmThe market for Spotify was clear - everyone loves musicConsumers would LOVE all the music in the world catalogued and instantly accessible for a small monthly feeThe issue with Spotify was figuring out the rights issues that plagued music startups in the pastSpotify KNEW their market existed (everyone loves music), they just had to figure out how to not make the same mistakes as NapsterFor Calm, their market did not existThey helped create their own market by launching a great product at the perfect timejust as the general population became more aware of self-careCalm did not know for sure that there was a pot of gold at the end of the rainbowbut their product was so good it helped create the market they now exist inGREAT PRODUCTS CREATE MARKETS:UberAirbnbCalm52) Market: Understand the difference between "Lazy TAM" and "Bottom-Up TAM"Early-stage investors typically don't need to see a TAM slide"Lazy TAM" is a term I coined after having hundreds of founders show me an uncorrelated Gartner number on their TAM slideLet's use an example:Imagine a startup was pitching me...They are an IT setup marketplace that's used by startups and SMBsIf they used this $4.4T number in their TAM slide, that would make no sense!Founders: Do NOT do this, it makes you instantly lose credibilityThe great early-stage investors don't care about an insanely huge market sizeWe care about the flywheel:Great productGreat teamObsessed customersBUT - if you do want to impress an investor with a TAM slideBottom-up TAM is another term I coinedWhy? I want founders to start with REALITY and build UPWARDS from thereThis is the right way to calculate your TAM in the early stagesIf you do this coherently, you will increase credibility with investorsMade up startup example:Acme Corp sells SaaS software to dentist officesThey charge $1000/month per officeFirst, let's do a LAZY TAM example:According to an ADA () report from June 2020, the total projected dental spending for 2021 was between $123.9B and $154BLazy TAM would be taking the average of these two numbers ($139B) and pitching that as your yearly market size"We can capture 10% of this market, and if we were at scale in 2021 our yearly revenue would have been $13.9B"This calculation would completely miss the mark, and lose you credibility with investorsBOTTOM-UP TAM example:Remember, you're only selling to dentist offices, so find that number firstBut there are only 187K total dental offices in the US in 2021, 's projectionsThis makes sense, as some offices have multiple dentistsOut of the 187K dental offices, what % can you convert to customers?Let's say you think you can capture 10% of the market in ten yearsThat's $1000/month x 18.7K = $18.7M/month OR $224M/year in revenue$224M in revenue is a GREAT business!And if you walk investors through your TAM bottom-up style, you will look really prepared and consideredMake sure to emphasize that you're only going after the customer segment that fits into your business, not the ENTIRE marketEx: The Acme Corp selling into dental offices does not care the total dental revenue of toothbrushes, oral hygiene products, etc.You can also put a "looking ahead slide" where you talk about potential markets you can expand into in the futureExpanding into different markets has made great companies go supernovaEx: Amazon building AWSthrough the first 9 months of 2021, AWS accounted for ~70% of Amazon's profits ($13B out of $19B)And AWS had only 13% of Amazon's total revenue ($44B out of $332B)Another Ex: Uber first expanded from black cars into Uber X's, then expanded into deliveryThe first expansion (offering Uber X) basically created the gig economy on a global scale and kicked Uber's business into hyperdriveThe second expansion (delivery) made Uber's business anti-fragile and kept them growing throughout the pandemic as rides shut down for a few months53) Market: Have investors had success in your market before?Also called the "Scar tissue issue"OR - is the market opportunity appealing to investors?Can dozens (or hundreds) of VENTURE SCALE businesses be built in your market?Being in enterprise SaaS is MUCH more investable than owning a bunch of laundromats or restaurantsWhy? The path to creating a $1B company is EASIER in enterprise SaaSVenture scale means "can your startup can get to $100M in revenue or a $1B valuation in under 10 years"When Calm first started out, they were not viewed as a "venture-scale business"Investors were skeptical that Calm's market size was larger than people who were currently into meditating (which would NOT have been a venture scale business)Once Calm added Sleep stories, mental recovery for athletes, and other products, the market expandedAsk yourself: Can you get to $100M in revenue in 10 years in your market?In a February 2017 blog, Elad Gil () described a trick to assess if your market was a good one to be in:Elad calls this "The 2% and $1 Billion Rule"QUOTE: "In general, you want to be in markets where multiple companies could afford to buy you for $1 billion, or where 2% of their market cap is at least in the hundreds of millions of dollars."Ex: If you're a startup that's building tools to help creators monetize, you could be acquired by...Google: ~$2T market capFacebook: $950B market capSnapchat: $88B market capTwitter: $43B market capAsk yourself: "what are the market caps of the biggest companies in my space"?Ex: Consumer internet: Google is ~$2T, Facebook is $950BEx: Enterprise software: Microsoft $2.5T, Adobe $315B, Salesforce $300BIf the market caps are huge, this will help you in three ways according to Elad:1 - These market caps reflect market opportunity since they're based on total revenue, growth rate, and margin2 - Large incumbents are competitors BUT they're also potential acquirers (they will create exit opportunities)3 - High market cap and cash rich companies tend to be great strategic investors at the later stages for a company54) Market: Do you know your competitors?If an investor asks about competition:You should be able to name your top 3-5 competitors and how much money they have raisedAnd you should also be able to explain how and why what you're offering is better for customersIf you were building a video game platform and your #1 competitor was Roblox, you could say:"Roblox takes a 30% fee and they're focused on kids, we take a 15% fee and we pay creators MORE than anyone else"It's also a bonus if you know ballpark revenue numbersThis information is typically pretty easy to find through Crunchbase or PitchbookHere is a scenario that happens often when founders are pitching me:I ask them: "Who are your main competitors"And they say: "We don't have any competitors"You ALWAYS have competition!Even if nobody is going after the same customer segment, there will still be other companies in your verticalEven Uber - who basically created a new industry with the gig economy - had competitors: they were originally competing against yellow cabsIf you know the ins and outs of your competition, you will come across VERY credible to investorsAnd when you're trying to raise money, increasing credibility key!55) Market: What are the barriers to entry in your market?For most tech industries, the barriers to entry are pretty low - examples:E-commerceEnterprise softwareConsumer softwareMarketplacesMost of the regulations are common sense stuff - no lewd content, no securities fraud, don't lie to investors or customers, etc. In crypto, there are almost zero headwinds (until you get caught)Ex: Tether has been operating a stablecoin for years that's now worth ~$70B without every undergoing a real audit or disclosing the makeup of their commercial paperIn enterprise software, some headwinds start to exist around security and compliance once you get to scale (signing contracts worth six figures and up)In healthcare, housing, and education, there are massive barriers to entry:federal regulations for healthcarezoning and building permits for housinglocal regulations for educationAll of these barriers take TIME and MONEY to passThat's why VCs are skeptical about those businessesMusic was also viewed as a really tricky market, until Spotify figured it out (and the prize was huge: they are a >$50B company)Another headwind: Is your market limited by factors out of your controlEx: Oculus developers can only build software for the hardware they are givenAND their games will only go as far as the market for VR headsets takes themBut keep in mind:The bigger the barriers to entry, the deeper the moat56) Branding: Is your company name easy to say and spell?Does your company name pass the "bad telephone test"?If not, you might be doomed from the startThis especially matters for consumer-facing companiesRemember the classic Bezos story from Brad Stone's book :Jeff Bezos originally wanted to name his company "Cadabra"To convey how magical online shopping wasBut Bezos's lawyer convinced him that the name sounded too similar to "Cadaver" after he couldn't understand the name over the phoneBezos took his advice and named his company AmazonHow many great consumer-facing companies do you know that have really complex, weird names? Not a lot!Look at how great and simple these names are:UberCalmAirbnbNetflixSpotifyGoogleAmazonPinterestRobinhoodSoundcloudNow let's look at some great enterprise names:ZoomSlackShopifySalesforce57) Branding: Do you have a great domain name?Great domain names build trust and prove to investors that you are able to negotiate something of valueIf they can negotiate a six or seven figure domain name away from the owner, that's a big tell that the founder can be successfulIf you can't get the domain name, there are a few easy things you can do:GetCalm.comTryCalm.comBeCalm.comGoCalm.comThis goes for social handles as well!58) Branding: Logos: When and how?What comes first - the MVP or the logo?Logos are hard to get rightYou shouldn't shoot for a 10/10 immediatelyYou can be comfortable with a 7-8/10Classic example of bad early design but great product: Uber! The product was so good that the terrible design didn't matter59) Branding: Is your website beautifully designed and clear?Terrible websites destroy your credibility with investorsIf you're selling to enterprise customers, your website's landing page will be the first place many people interact with your company and brandIf your website is ugly, clunky, and hard to navigate...You are leaving a really bad first impression on potential customers/investors!LAUNCH Example:Mahreen (who runs Remote Demo Day) had a founder tell her that a bunch of high profile VCs were interested in investing so LAUNCH needed to move fast to investMahreen checked out their website and product... and it looked like it was from 1999the founder immediately lost some credibility60) Branding: Do you have a concise company mission?What is the goal of your company?Why do you get up for work everyday?This should be a simple sentence that describes your missionExamples:Robinhood: Democratize financeLAUNCH: Support founders and inspire innovationJetson (the E-VTOL startup we covered earlier this week): Make anyone a pilotAirbnb: "Create a world where anyone can belong anywhere"Uber: "Create opportunity by setting the world in motion"Amazon: "We strive to offer our customers the lowest possible prices, the best available selection, and the utmost convenience"

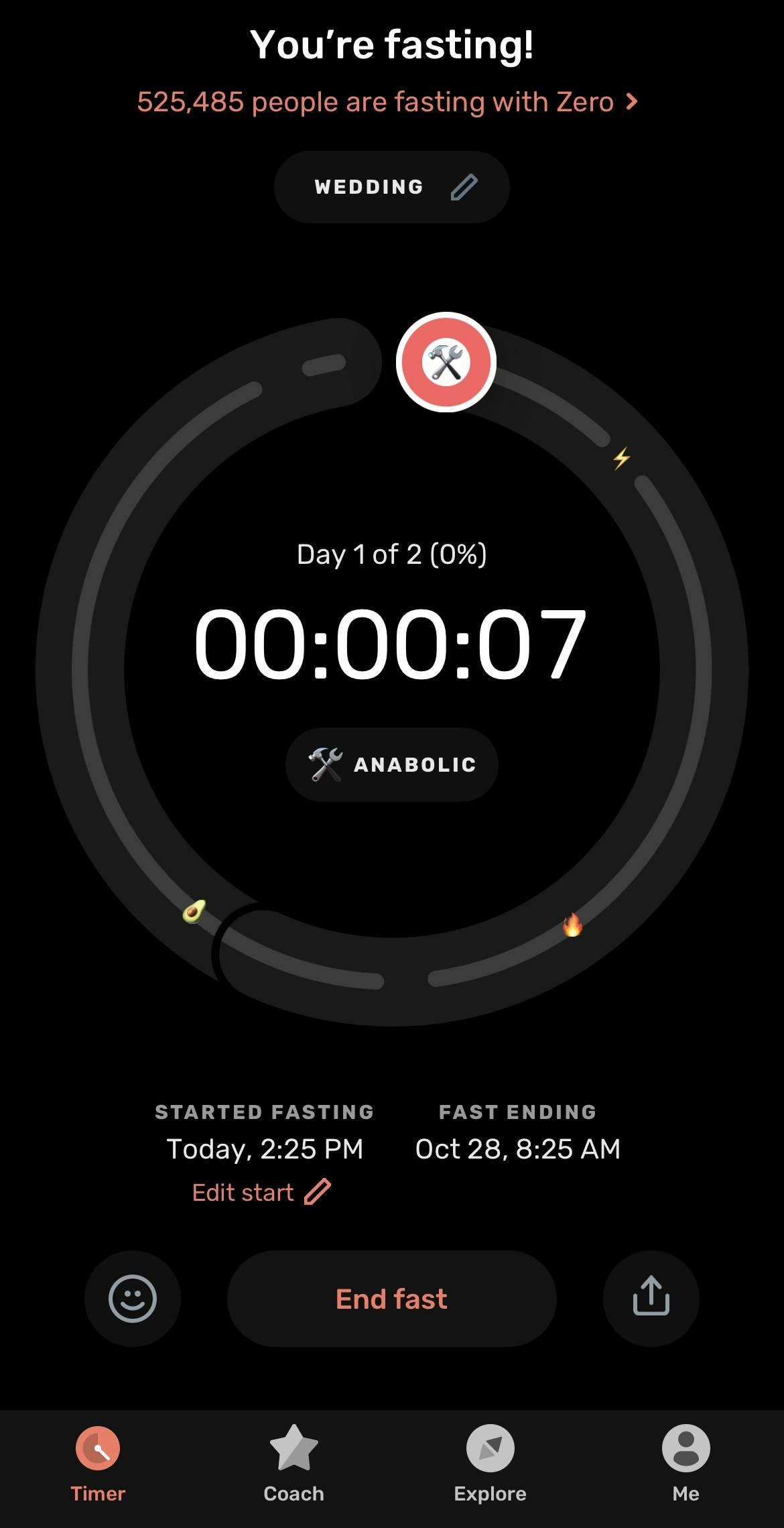

The product was so good that the terrible design didn't matter59) Branding: Is your website beautifully designed and clear?Terrible websites destroy your credibility with investorsIf you're selling to enterprise customers, your website's landing page will be the first place many people interact with your company and brandIf your website is ugly, clunky, and hard to navigate...You are leaving a really bad first impression on potential customers/investors!LAUNCH Example:Mahreen (who runs Remote Demo Day) had a founder tell her that a bunch of high profile VCs were interested in investing so LAUNCH needed to move fast to investMahreen checked out their website and product... and it looked like it was from 1999the founder immediately lost some credibility60) Branding: Do you have a concise company mission?What is the goal of your company?Why do you get up for work everyday?This should be a simple sentence that describes your missionExamples:Robinhood: Democratize financeLAUNCH: Support founders and inspire innovationJetson (the E-VTOL startup we covered earlier this week): Make anyone a pilotAirbnb: "Create a world where anyone can belong anywhere"Uber: "Create opportunity by setting the world in motion"Amazon: "We strive to offer our customers the lowest possible prices, the best available selection, and the utmost convenience"