Skip to content

Share

Explore

Finéza

Finéza

Mutual Funds Made Easy

About

Finéza is an investment advisory firm that specializes in mutual funds exclusively. They provide personalised financial advice to their clients, including guidance on which funds to invest in, when to buy or sell, and when to rebalance and switch from Scheme A to Scheme B. They charge a monthly fee for their advice because they offer personalized recommendations based on your risk profile.

However, it's important to note that the best returns are achievable only if you remain focused on consistent long-term growth rather than attempting to get rich or lucky overnight. It is crucial to stay invested and maintain a long-term perspective.

Unique Selling Proposition

Your Trusted Advisory App — What sets Finéza apart is their unwavering commitment to providing you with the best recommendations. Through meticulous research and analysis, they identify the most promising opportunities and offer expert advice to manage your mutual funds portfolio, ensuring it aligns with your objectives for optimal returns and risk management.

Customer Centricity

Finéza follows a three-pronged approach to better understand its users. First, they gather information about who the users are, which includes details such as their marital status and whether they have children. Second, they assess the users' current financial standing, specifically focusing on their mutual fund investments. Lastly, Finéza aims to comprehend the users' financial aspirations and goals, determining where they desire to be in the future. By combining these three aspects—Who they are, where they are, and where they want to be—Finéza's intelligent system and expert analysts are able to match users with their desired financial destinations.

Audience

∙ 25-45 years

∙ High-income Group

∙ Looking to grow their

savings

∙ Lack of market

knowledge

∙ Have invested before

Fears

∙ Worried if they're

doing the right thing

∙ FOMO on opportunities

∙ Bad ROI

∙ Not meeting their life

goals

∙ Market volatility

Needs

∙ Ease of investment

∙ Assistance in

decision-making

∙ Good ROI

∙ Meeting life-goals

∙ Insights to grow their

capital faster

Vision

The idea I envisioned was to develop an app that could easily scale from the existing clientele of 400-500 users to accommodate a much larger user base. This meant that the product had to be capable of supporting a self-serve model to handle incoming traffic from new users effectively. Additionally, I aimed to build an experience where a significant portion of the personal exchanges between the finéza staff/experts and the users could occur entirely through the app. This would provide the user with the support they are looking for instantaneously while also reducing reliance on voice calls. However, the option to call finéza for a traditional phone call would still be available as usual. Furthermore, I wanted to explore the possibility of providing users with richly curated monthly reports and advice on managing their mutual funds.

User Flows

Sign Up

The primary goal of the sign-up experience was to make it as seamless as possible while requiring the least amount of data upfront. Instead of opting for an in-depth onboarding process at the beginning, we could collect only their name and phone number and use an OTP to sign them in. This way, they can either start the onboarding process immediately after signing in or decide to do it later. The rationale for this approach is to mitigate the risk of drop-offs, especially if they don't have their CAS number readily available or are pressed for time.

Later, we could send them a reminder to continue where they left off, along with an offer for a free one-month trial or a one-time evaluation.

Onboarding

For the onboarding experience, I focused on using the framework by Finéza to meet their users where they are, i.e., understanding who they are, where they are, and where they want to be. I created a master list of all the data to be obtained in order to get a full picture of the user and checked for all the data that could be obtained using their CAS number, which is something we require. This way, I could focus on creating a flow with minimal questions for the user.

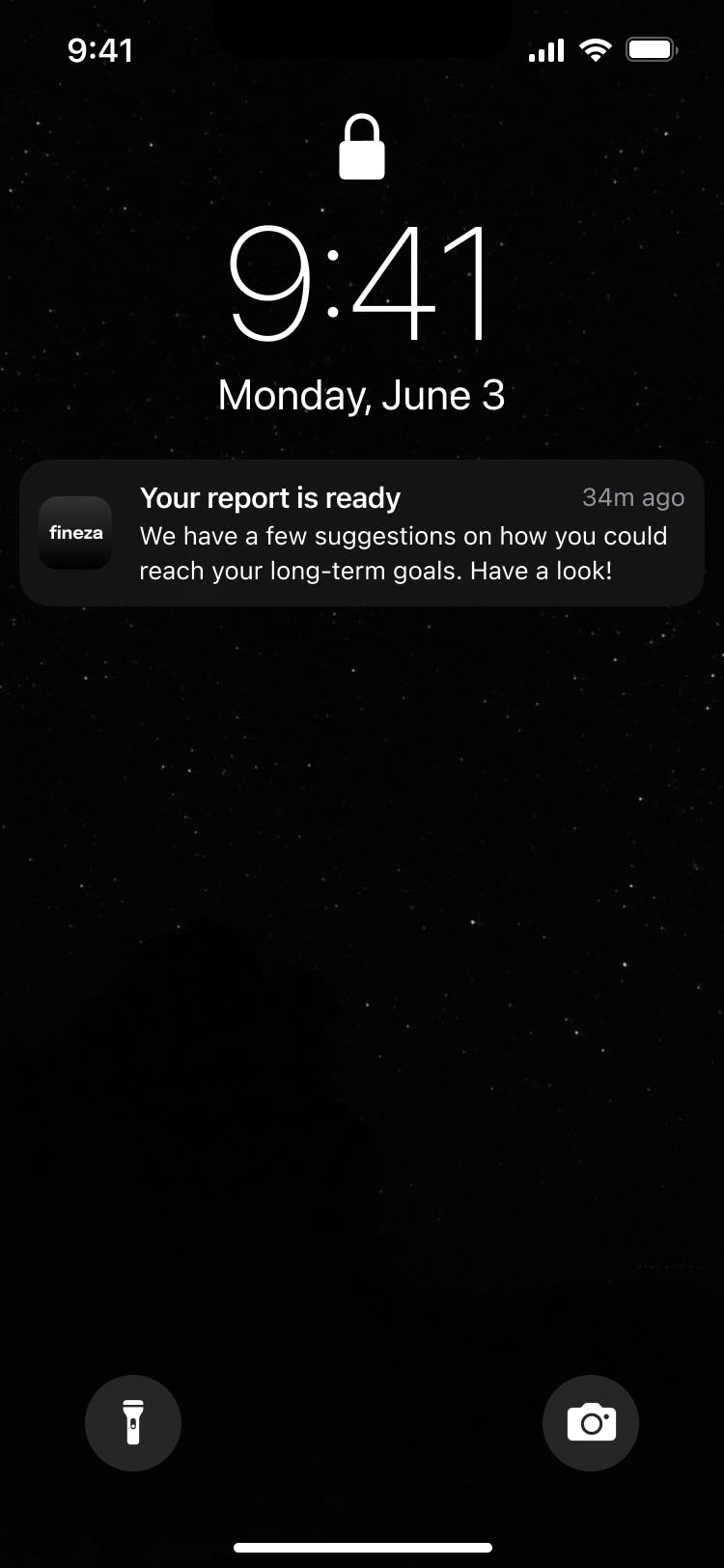

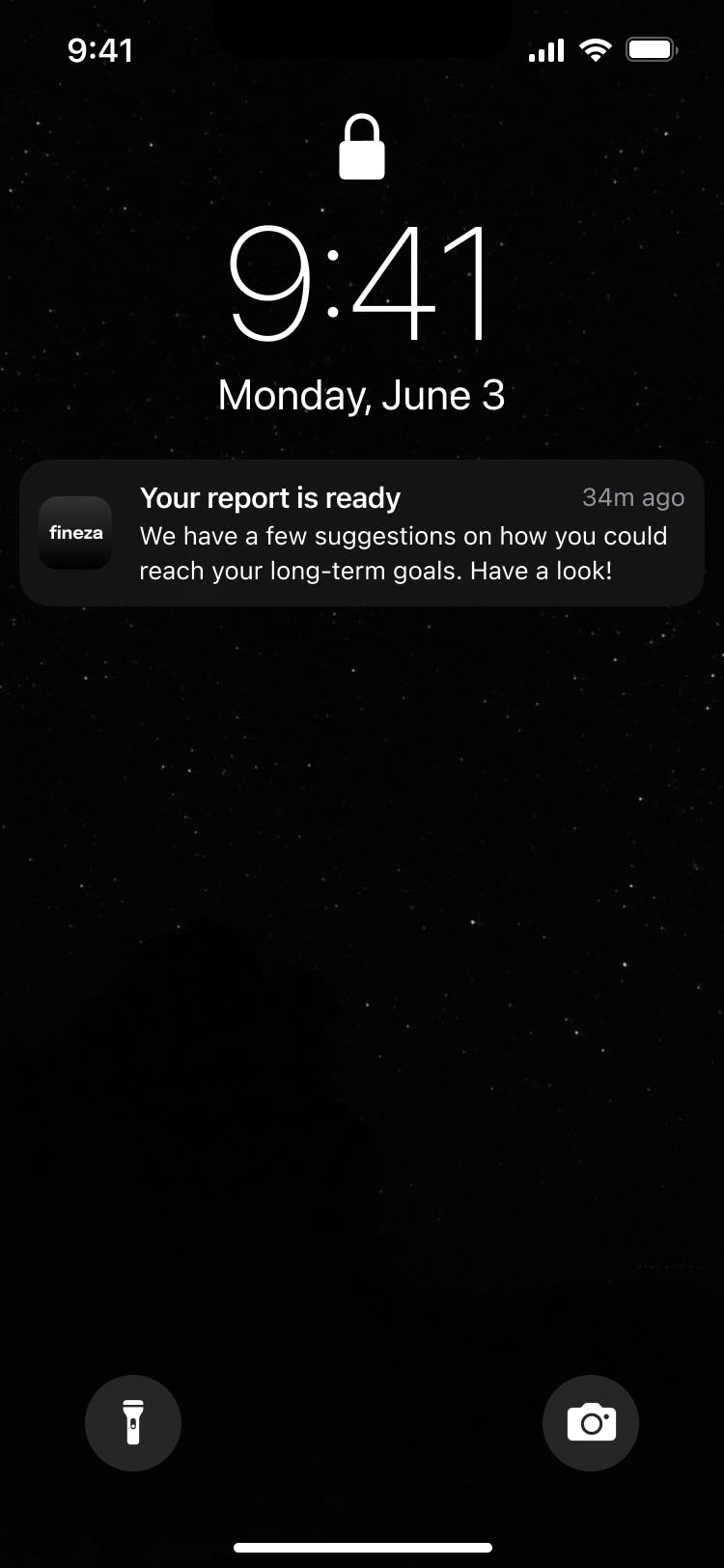

Investment Report

Designing the investment report was crucial to the overall experience, involving meeting the user at various touch-points and providing ample decision-making information. In addition to stating recommendations, I aimed to offer an intelligent yet intelligible report, segmented into primary, secondary, and tertiary information for easy access. While traditionally done via phone calls, my vision was to enable future buy-ins through the app, while still giving users the option to reach us directly for a seamless experience as our audience grows.

Solution

I. Offering reassurance and transparency as a dependable guide [Prototype]

My objective was to address the users' concerns and offer support in their decision-making process. I strived to create a centralized space with all the necessary information to help them make informed choices. Recognizing that some users might have limited market knowledge, I aimed to present the reports in a straightforward and easily understandable way, regardless of their previous investment experience.

In addition, I wanted to provide a clear comparison between their current mutual funds and recommended options, tailored to their financial goals of 'where they are' and 'where they want to be.' My goal was to assist them in making the best decisions for their financial future without sounding boastful or overconfident about the service I provided.

Tldr: User needs we aim to address with this — Ease of investment, Assistance in decision-making

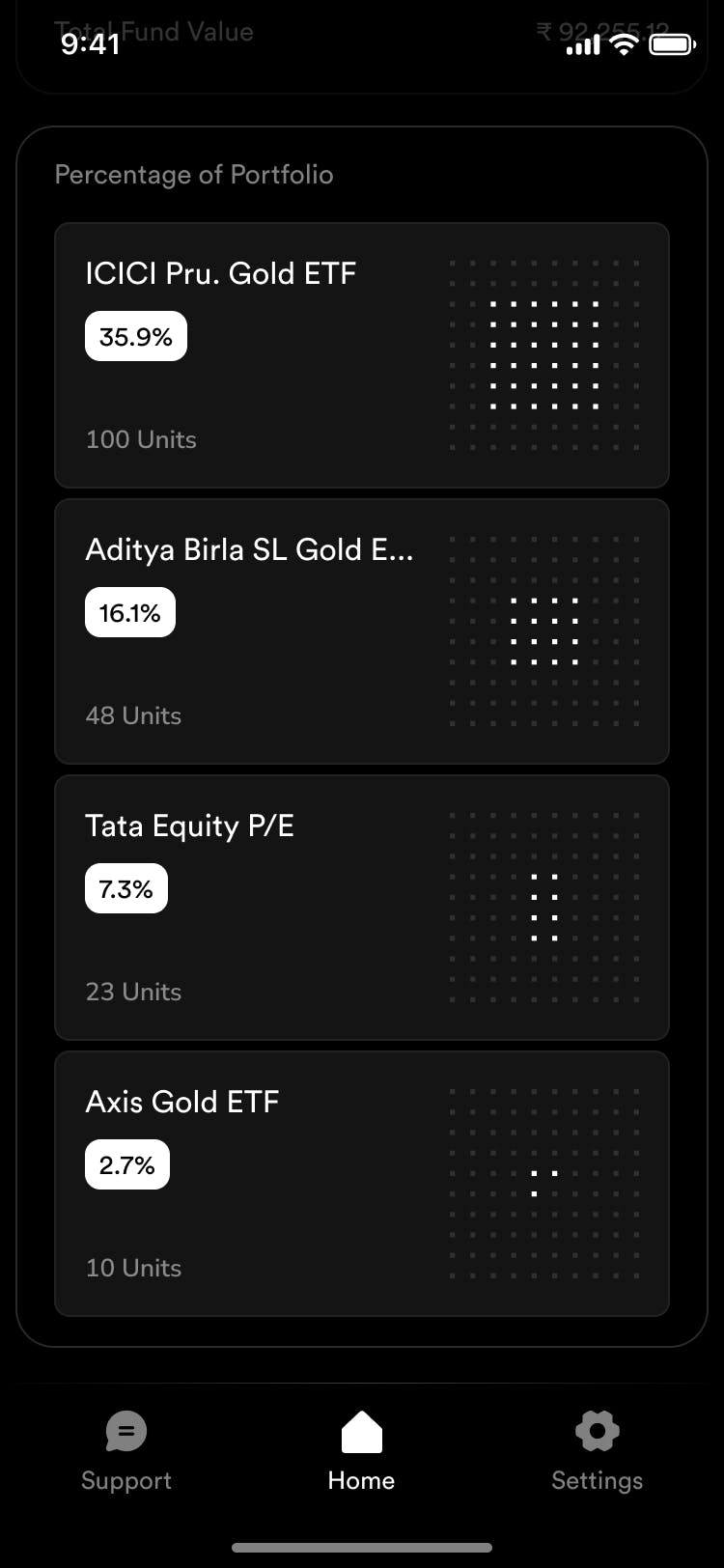

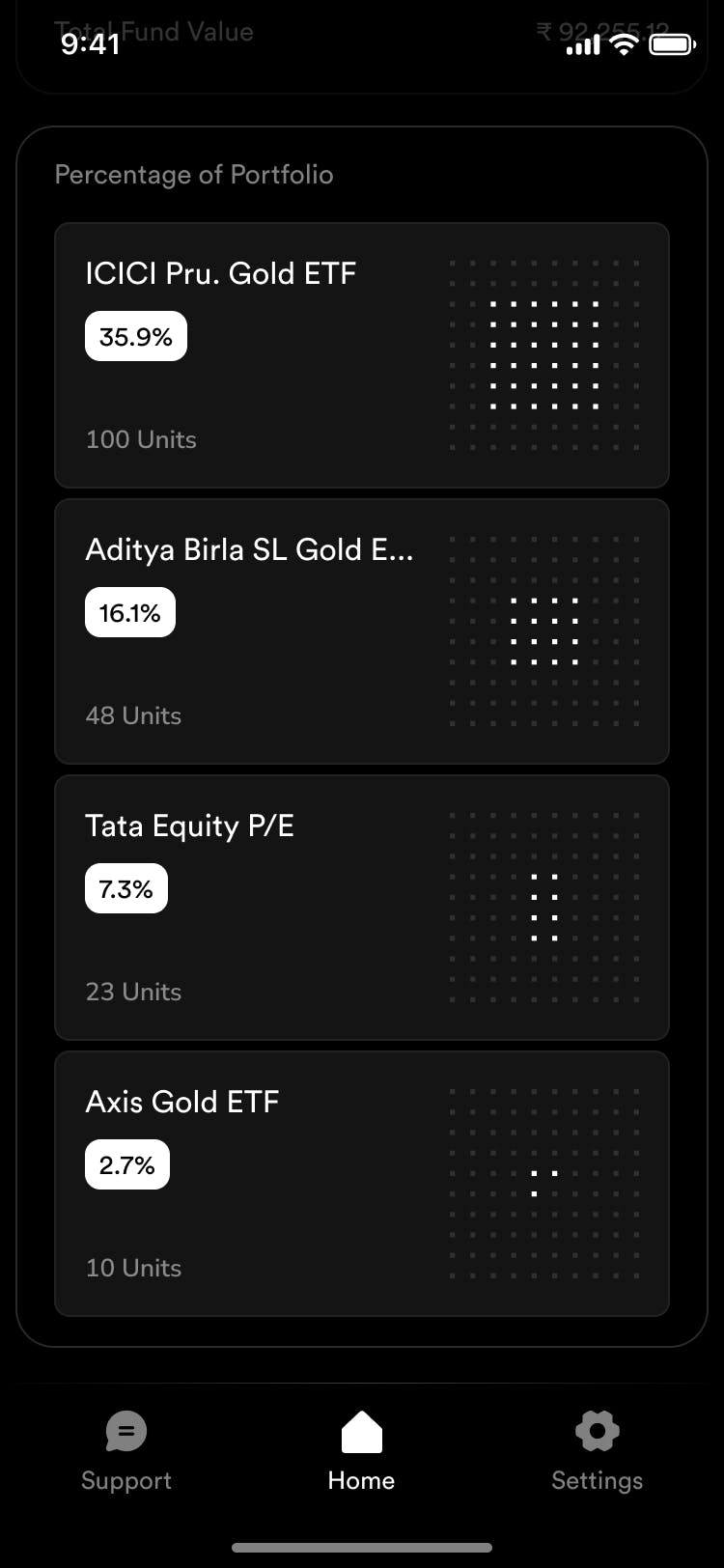

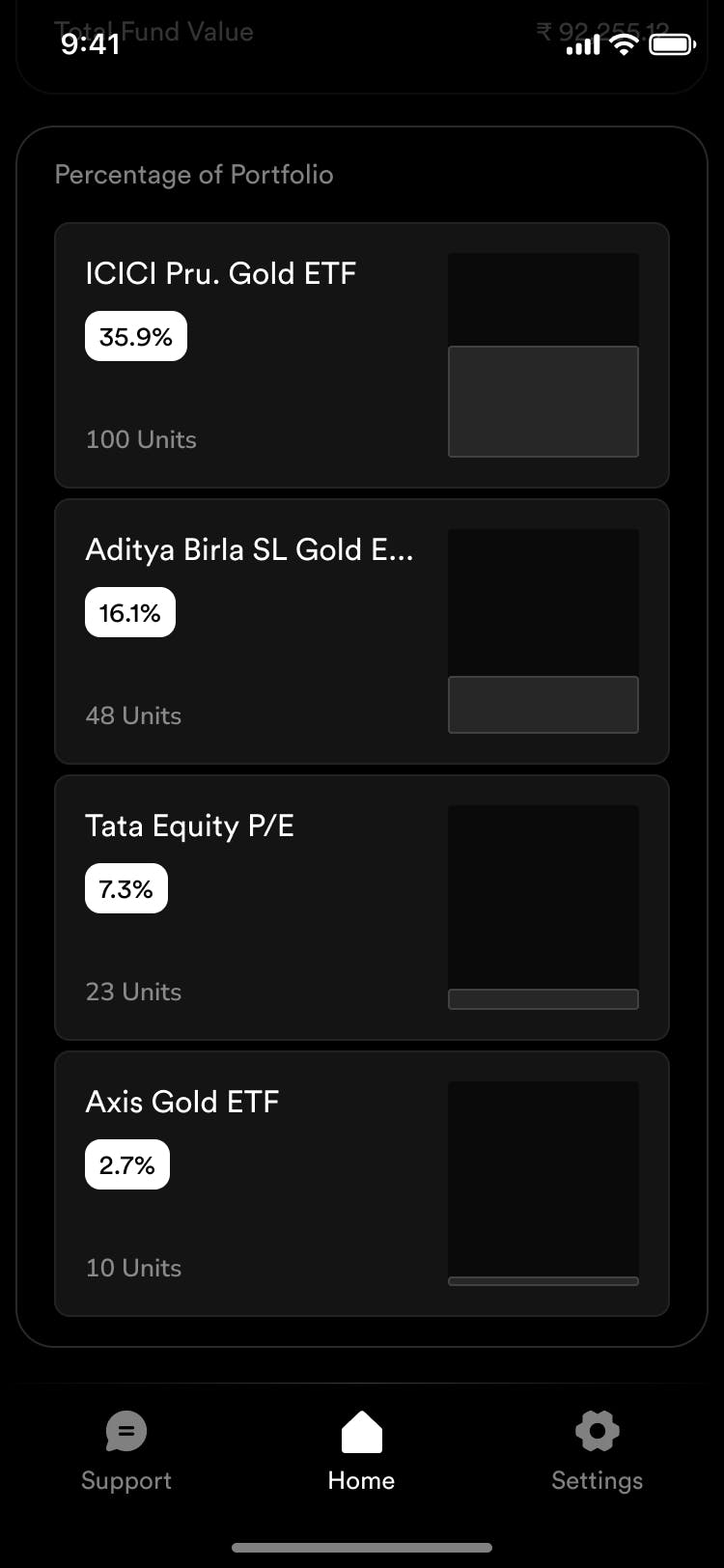

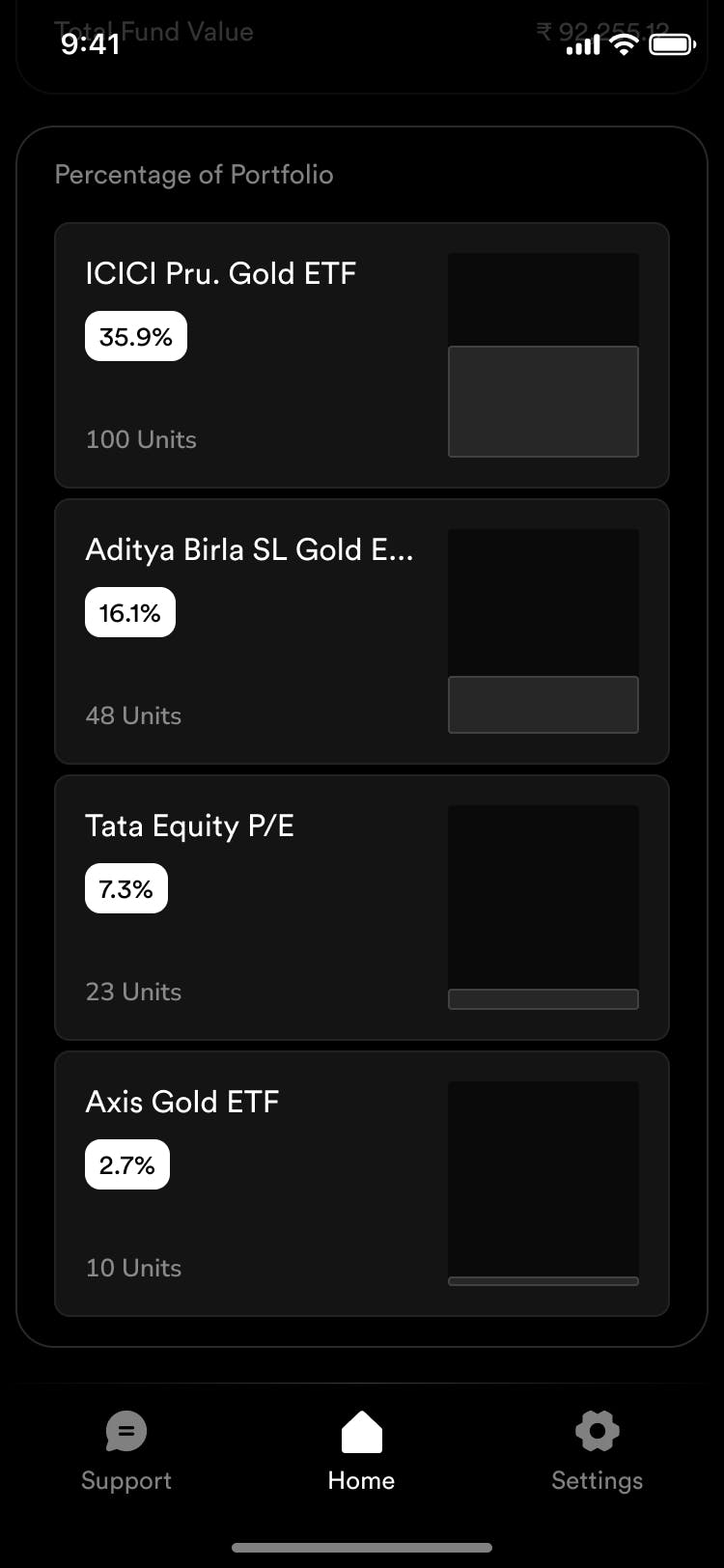

II. Finding the best way to tell a story

Mutual funds and investment apps rely heavily on data. My goal was to enable users to grasp data quickly and effortlessly. To achieve this, I aimed to convey a compelling story through the reports, helping users understand why a particular recommendation or solution is beneficial for them. This approach not only facilitates faster decision-making but also aligns with research indicating that people generally comprehend data better when presented visually rather than just as raw numbers. Even individuals with limited market knowledge can easily access information, view trends, and recognise patterns through these reports.

Tldr: User needs we aim to address with this — Lack of market know-how, Assistance in decision-making, Gaining insights to help grow their capital

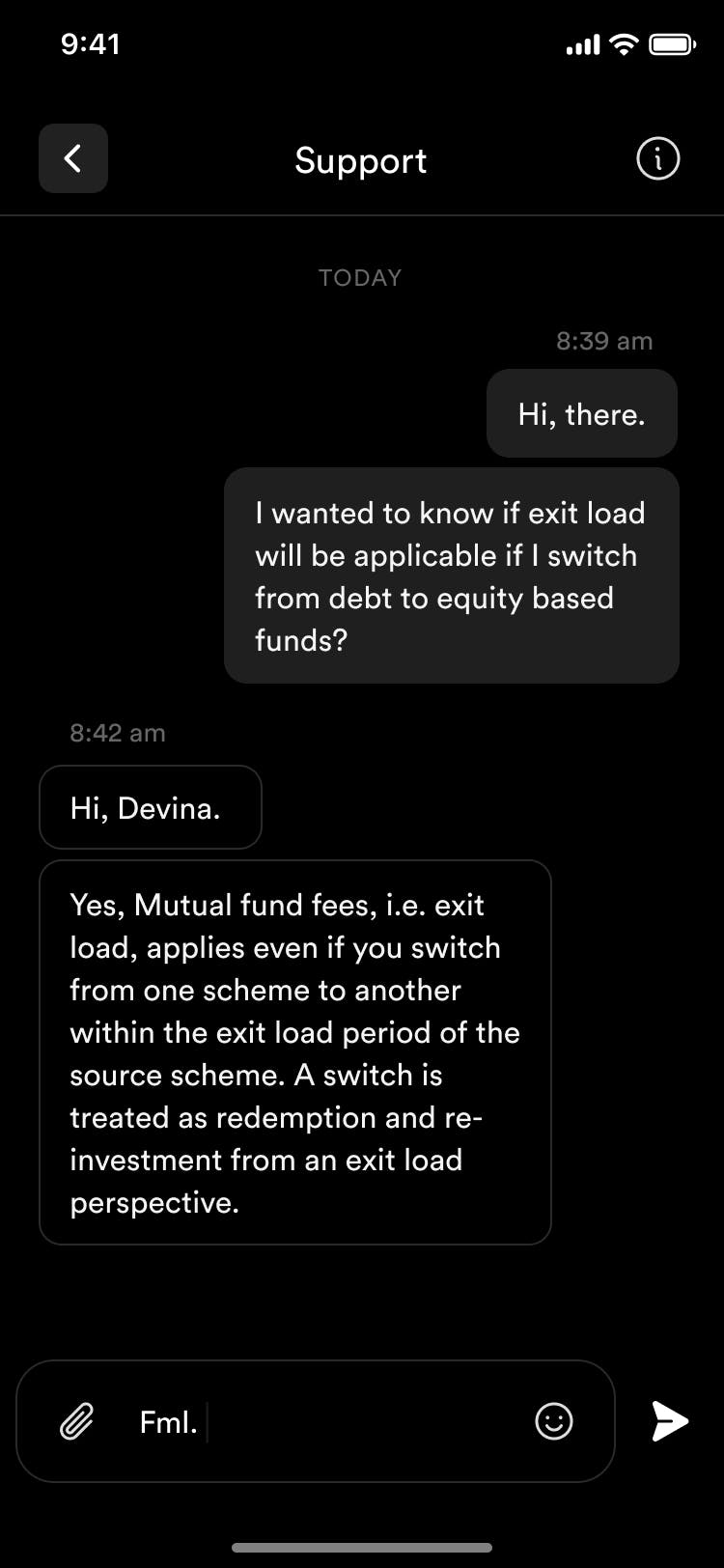

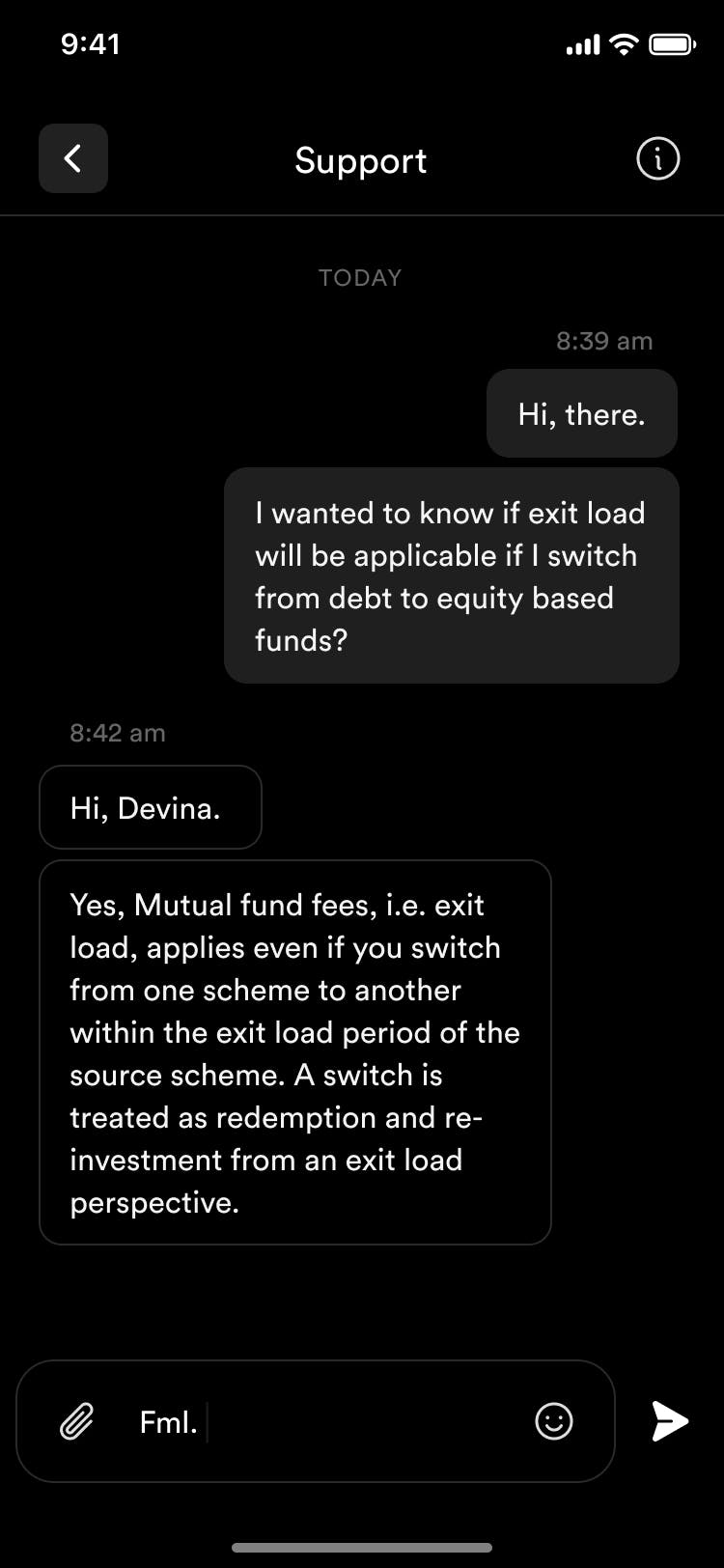

III. Support — Live Chat, FAQs, and Experts Calls

Previously, this business relied on direct phone calls with customers. My vision for the app was to introduce a self-serve experience, allowing users to upload their portfolios, receive recommendations, access the knowledge base or communicate with the support team for queries, all within the app and in real-time, slowly phasing out the need for phone calls and ensuring instant interactions. The main business benefit of this approach is the seamless scalability it offers. The app's chat feature can also handle reminders, progress updates, and various user interactions that typically require a team to call the customer. As a result, the support chat automates many processes, streamlining operations further.

Tldr: User needs we aim to address with this — Good ROI, Not missing out on opportunities, Assistance in decision-making, Gaining insights to help grow their capital

IV. User Journey — Snapshots

Here is the user journey across all touch points. My goal was to ensure a seamless and satisfying journey for the users. I aimed to meet their needs, streamline processes for efficiency, and create a clear, intuitive flow. Consistency and empowering users to make informed decisions were also key considerations. Additionally, I aimed to personalize recommendations to help users achieve their long-term financial goals and facilitate clear feedback and communication channels for user support.

V. Figma File

Want to print your doc?

This is not the way.

This is not the way.

Try clicking the ··· in the right corner or using a keyboard shortcut (

CtrlP

) instead.