Skip to content

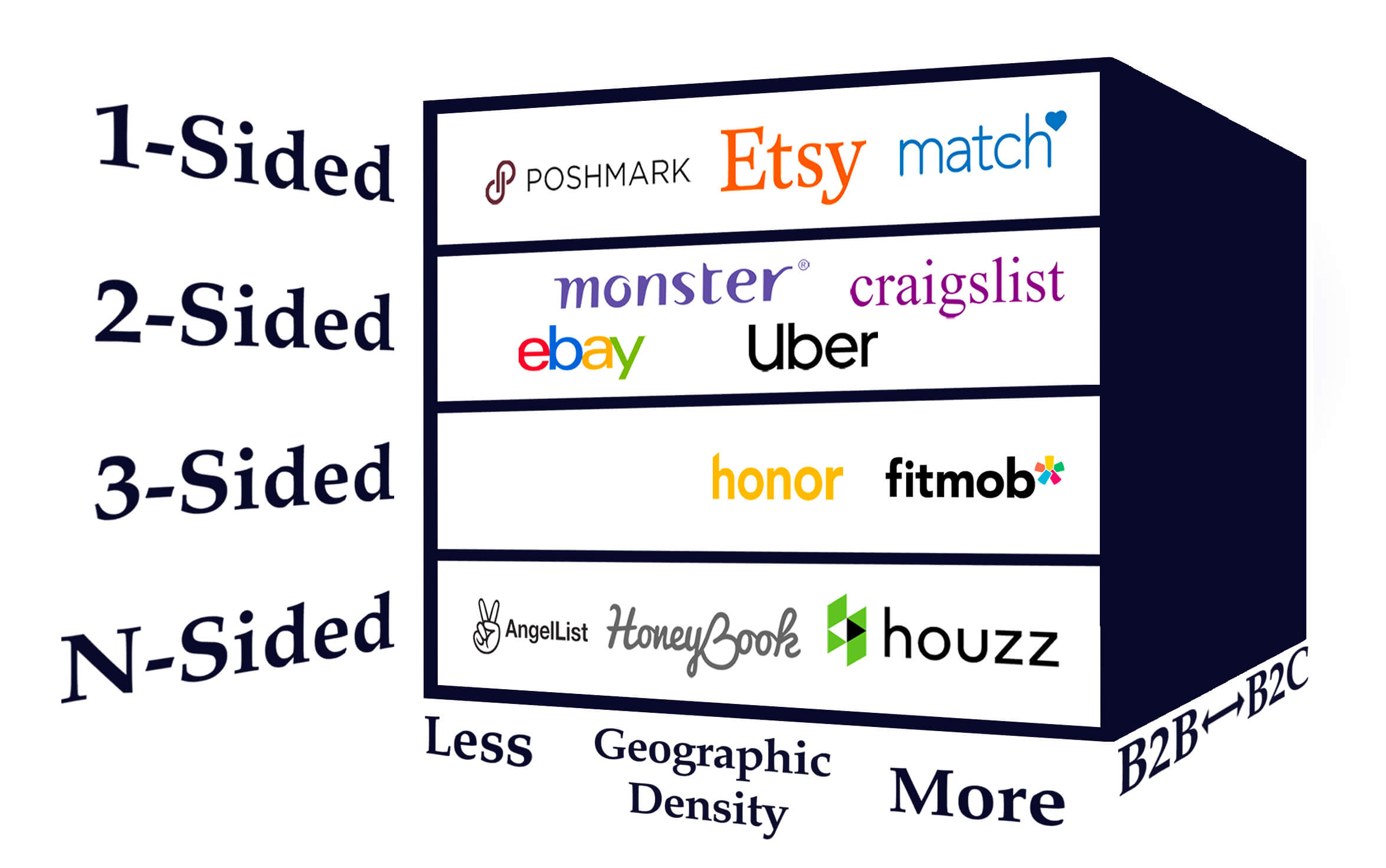

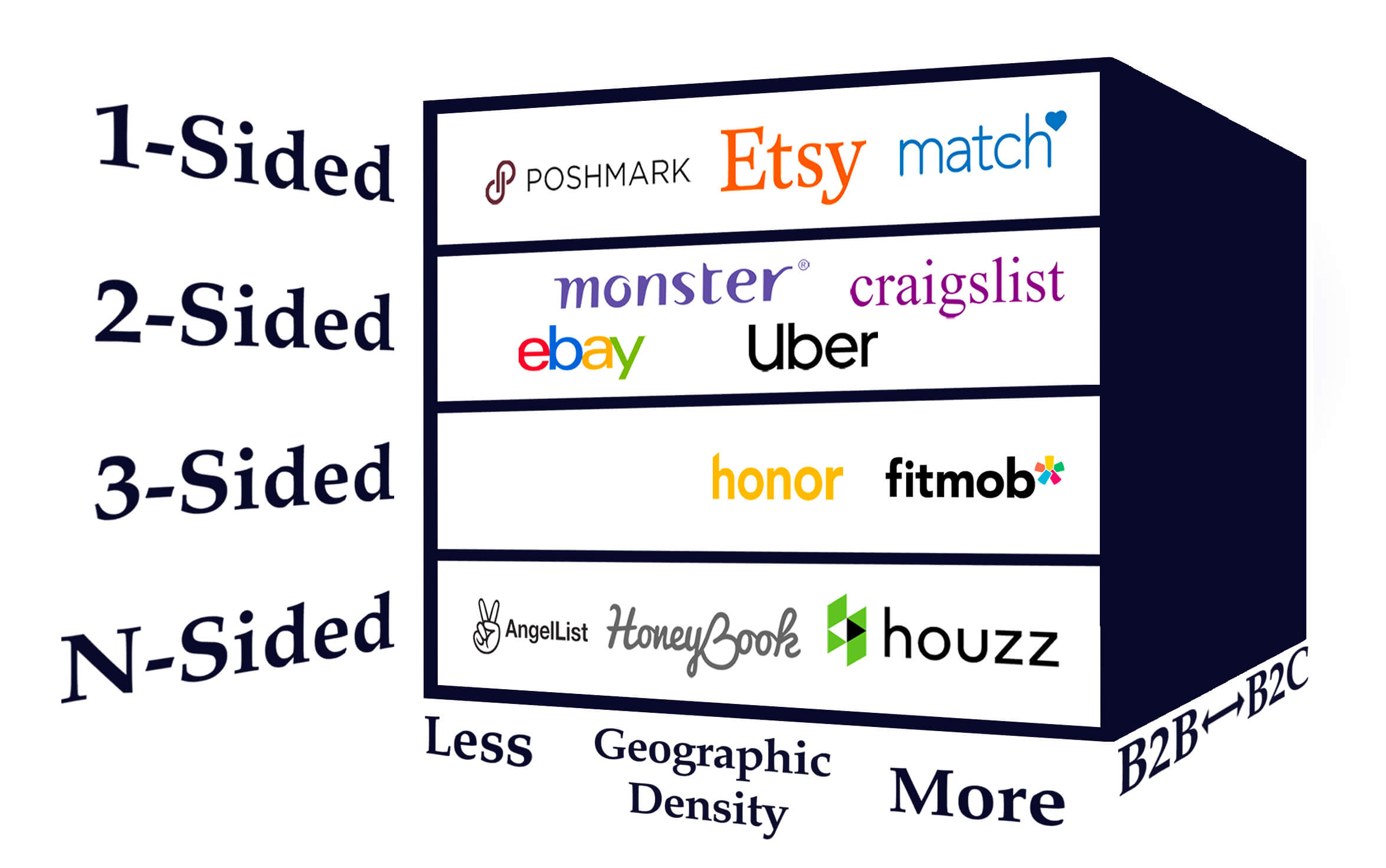

2-sided marketplace nfx: These are classic marketplaces between buyers and sellers. Examples: Craigslist, eBay, , . Note that within this “2- sided” nfx, marketplaces can effectively operate as a 1-sided marketplace, when all nodes sign on for the same thing like Match.com, or they can operate as a 3-sided marketplace when there are three distinct types of nodes with different behaviors. We don’t break those cases out as different nfx because whether it’s a 1, 2, or 3-sided marketplace, the retention mechanics and playbooks are similar.2-sided asymptotic marketplace nfx: This is where the value of increased supply starts to diminish relatively quickly, leaving them more vulnerable to competition because the defensibility of the network effect is lower. Companies have to . Examples: Uber, LyftN-sided marketplace nfx: Also called . These marketplaces are made up of a network of users who are all buying and selling services to each other in an industry community. They typically also feature a SaaS tool. Examples: HoneyBook, Houzz, AngelList

Is there an appropriate rake possible in this market and how good is it? Some marketplaces do well at 1.4% take rate on a transaction and others at 70%. So no one rake size fits all. But the rake dynamics are critical to test and understand.Is this a marketplace for stuff (Poshmark), for services (Uber), or for labor (Upwork). The playbooks differ greatly for each.Is there a risk of from too many items or too much information in the marketplace, and do we have appropriate UI/UX fixes for that?Do the products/services/labor fall easily into different tiers? Do the customers? How does the marketplace measure those tiers, appropriately bucket the supply or demand, and then how does it adjust the interface and/or pricing?

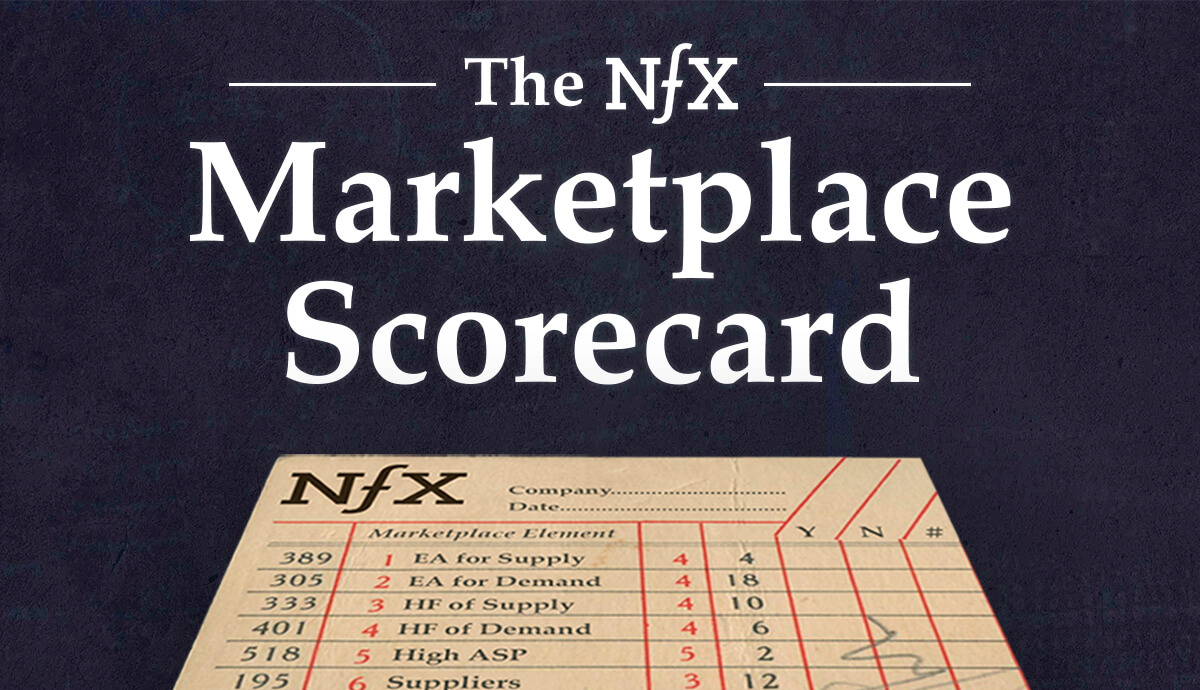

nfx score

nfx score

See Your Score: The NFX Marketplace Scorecard

By James Currier (). James is a General Partner at NFX, an early and seed-stage venture capital fund.

We’re often asked by Founders and other investors what we look for in marketplaces.

It depends, of course. Marketplaces are really very different from each other. They’re a bit like snowflakes, if you will.

We’ve founded and invested in 60+ marketplaces. We’ve started writing about some of the insights we’re gaining (e.g. and ).

But today we’re sharing the current internal methodology we use to invest or advise a marketplace: The NFX Marketplace Scorecard. This is the system we use to score marketplaces. The higher the score, the higher the potential of the marketplace. Not only does it help us make decisions about which marketplaces to invest in, but once we’ve invested, it helps us advise the teams while they are “flying the plane” – operating and growing fast.

If you’re a Founder and you’re fundraising, use this scorecard to communicate your business to us.

Fill out (below) to see how you score. Submit your scorecard for a chance to be personally evaluated by .

Or, if you would prefer not to submit your results but would still like the scorecard, enter your email below.

But first, Marketplace Type

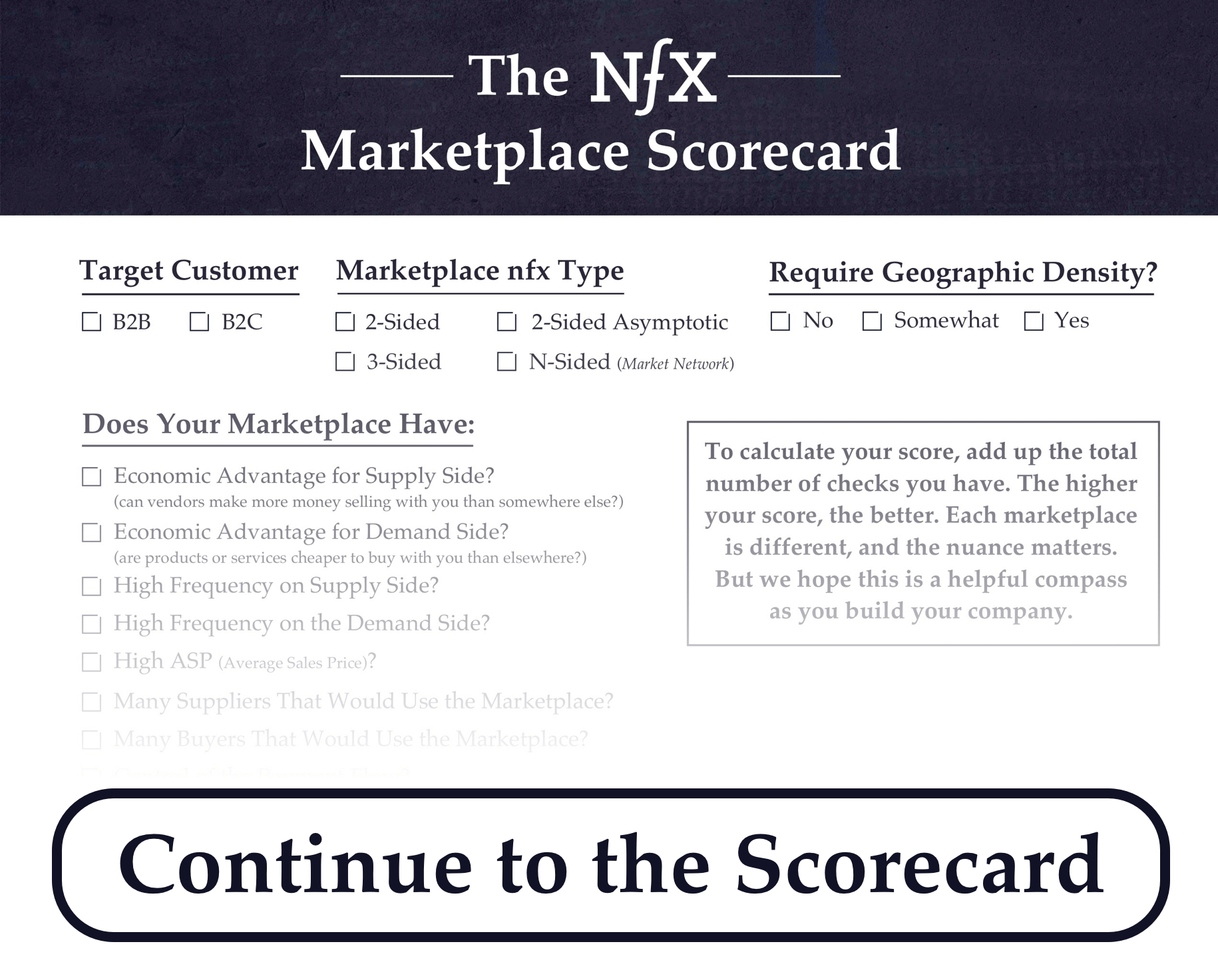

In order for The NFX Marketplace Scorecard to be useful, we have to correctly identify the type of marketplace we’re working with.

Surprisingly, many Founders have yet to clearly define for themselves the type of marketplace they have. There are three things to look at when identifying your marketplace type: 1) which type network effect you have, 2) geographic density, and 3) target customers.

Marketplace Type: Network Effects

Always remember that marketplaces are . Nfx are the core of what makes a marketplace impactful. Start by identifying the type of network effects you have, and the network effects you’re trying to build. We’ve written about the , but the 3 nfx that apply to marketplaces are:

Marketplace Type: Geographic Density

How much geographic density does your marketplace require to achieve liquidity and become defensible?

Example: eBay and Lyft are both two-sided marketplaces, but they have different geographical densities. Lyft’s transactions take place regionally, whereas eBay’s take place all across the world. When we consider the geographical densities of these two-sided marketplaces, we can immediately start to see how their underlying mechanics differ and thus how their operating playbooks need to differ.

Another example: Match.com vs (an NFX portfolio company). They are essentially both 1-sided marketplaces: Most people on are both buyers and sellers, and 100% of people on Match.com are both buyers and sellers. But their geographic densities require different dynamics.

Marketplace Type: Target Customers

Is the business a B2B company, or a B2C company? Different types of customers require different approaches to building marketplace interface and dynamics. Typically, consumers are responsive to convenience, where business customers care about control and price which makes them more challenging to design for.

__________________________________________________________________________

See How It Works:

The NFX Marketplace Scorecard

The NFX Marketplace Scorecard helps us evaluate companies, and it helps us give advice to companies after an investment.

There are currently 23 elements we look at.

1) Economic Advantage for Supply Side

See #2 below for how we assess economic advantage.

2) Economic Advantage for Demand Side

Marketplaces must give at least one side an economic advantage, either a higher price, or a lower price, or some revenue when there was none otherwise. If we can’t see an economic advantage, then we figure out how to add it. Or we find another business.

Square, for example, gave vendors an economic advantage – a 20-30% bump in revenue – because their dongle opened up new demand.

Craigslist gave both sides an advantage over classifieds. For all but two categories, it cost nothing to post and there was no transaction fee. Also, the demand side gets to buy something for cheaper than they could anywhere else.

Airbnb also advantages both sides. The supply side gets brand new revenue from an under-used asset. The demand side pays less than they would for a hotel.

3) High Frequency on Supply Side

See #4 below for how we assess high frequency.

4) High Frequency on the Demand Side

High frequency usage by demand and/or supply is, typically, a strong signal for success. Medium frequency is OK, and low frequency is a red flag.

Last mile delivery. It’s almost all food and also a crowded space. Why food? Because people eat 3x/day, so a consumer might order food 2x/day. That’s the highest frequency thing that might be delivered. It’s for this reason that Uber, DoorDash, and GrubHub chose food as their first thing to deliver.

, a massive mobile-first clothing marketplace, has users who use the app 6+ times per day and buy and sell clothes 1-3 times per week. Also very high frequency.

Of course there are some marketplaces who’ve found success with low frequency transactions. Jobs marketplaces are used once per year or once every 5 years. They are successful despite that low frequency, for reasons described below.

Be clear about this: in general, high frequency is better than low frequency.

5) High ASP (Average Sales Price)

All things being equal, higher ASP is better. It’s a lot easier to turn a profit on big-ticket items. Another way of thinking about this is: how many do I need to sell in order to have a $100 million business?

NFX portfolio company $1,000+ ASP for renting an RV, and Hired’s $10,000 ASP for placing an engineer in a company make their businesses easier to build.

And if we can combine medium ASP with relatively high frequency then we get a company like Airbnb, whose ASP is more than $300 and market cap is >$30 billion.

Very broadly, we would say these are the ranges for ASPs:

– Low: $10- $99

– Medium: $100 – $600

– High: $600+

6) Many Suppliers Would Use the Marketplace

See #7 below for how we assess market size.

7) Many Buyers Would Use the Marketplace

Is this a marketplace that many people would use, or just a few?

Everyone in cities needs transportation. With transportation marketplaces, we might imagine more people would be willing to ride in a car than ride on an electric scooter, particularly in cold or rainy climates, but certainly many people would be willing to ride both because the scooter ride is more affordable. Probably fewer would be willing to ride an electric bike or an electric skateboard.

In a market for at home hair care services, that would mostly be female, mostly be urban and mostly affluent, so the number of people who might ever be on the demand side is small.

With Craigslist, nearly everyone might use it.

With a B2B marketplace for chemicals, the users of both sides would be very specialized, and in far smaller numbers.

8) Own/Control the Payment Flow

We’ve been surprised at how many marketplaces don’t intuitively understand this: always strive to be the platform the payment goes through. When payment flows through a marketplace it increases the platform’s opportunities to take rake, add on extra services, do up-sells, increase the ASP, etc.

When we’re coaching a Founder whose marketplace is not currently accepting payments we’re always looking for ways to hurry up and put up the payment wall, even if that means (for now) taking the money and handing it over to whoever it belongs to without a rake. Why? Because owning the payment flow opens up a lot more options down the line.

9) Cost/Time to Solve Chicken or Egg Problem

When we’re deciding on whether or not we’re going to invest in a startup we’re looking at whether or not the chicken or egg problem has been solved. If the problem hasn’t been solved, then we’re looking at how much time and money it will cost to be solved. There have been several promising companies that have failed simply because solving the chicken or egg problem has proved impossible, oftentimes due to time and costs. Few Founders fully understand the gravity of this classic problem.

We’ve shared our internal tactics for overcoming the problem in a past essay, see: .

10) Avoid/Block Multi-Tenanting on the Supply Side

See #11 below for how we assess multi-tenanting.

11) Avoid/Block Multi-Tenanting on the Demand Side

Marketplaces are stronger if they can avoid “” – which is when users participate in multiple marketplaces to fulfill the same kinds of transactions. Multi-tenanting erodes a company’s profits because it allows for competitors. The best way to keep people from multi-tenanting is to fulfill all of the users’ needs – that way they never have to go elsewhere (see #19).

Multi-tenanting on the supply side in action

In the rideshare industry, it’s easy for every driver and every rider to multi-tenant – drivers and passengers can be tenants of both Uber and Lyft (and often are). It will be interesting to see what happens and how they manage to turn profits.

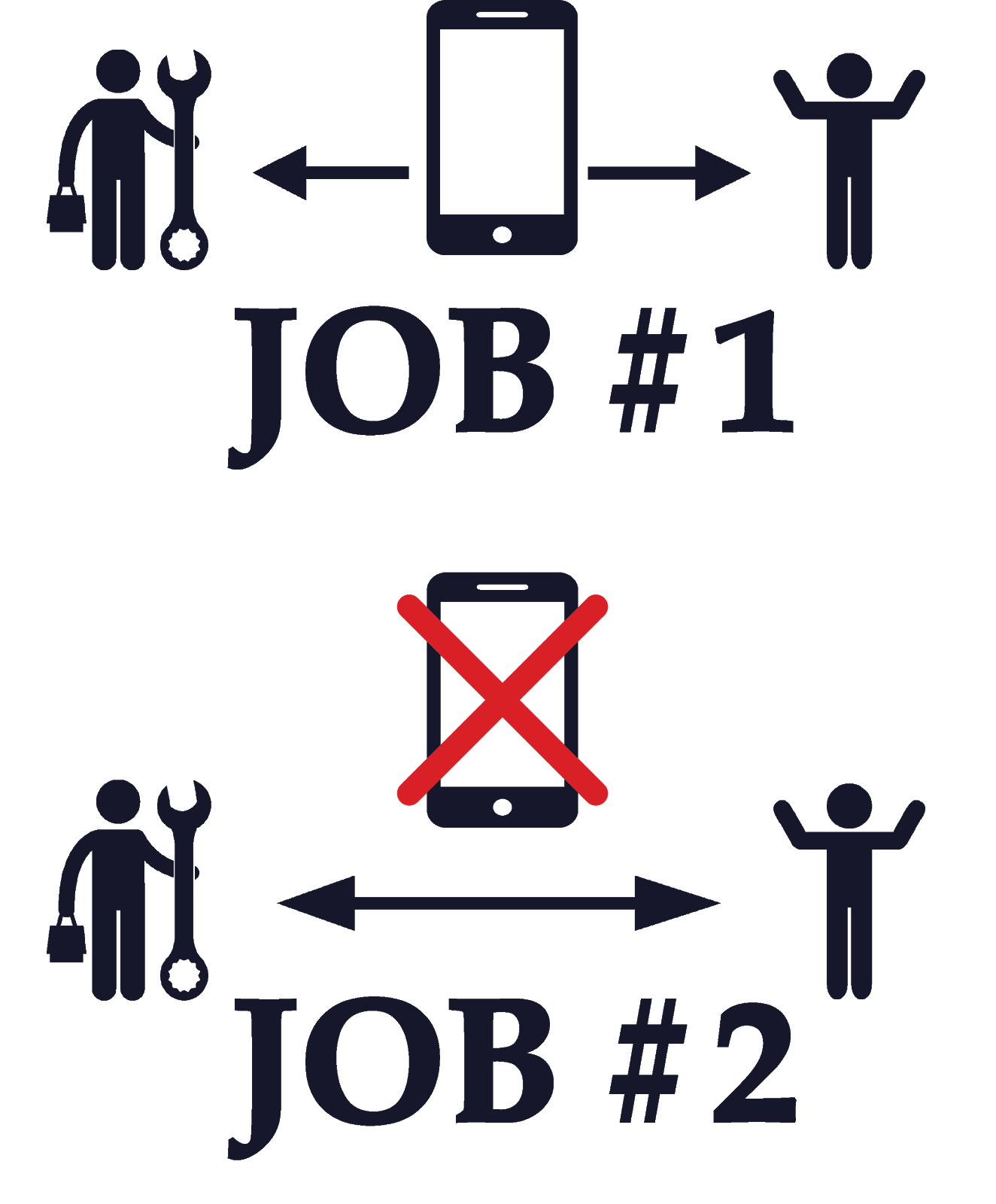

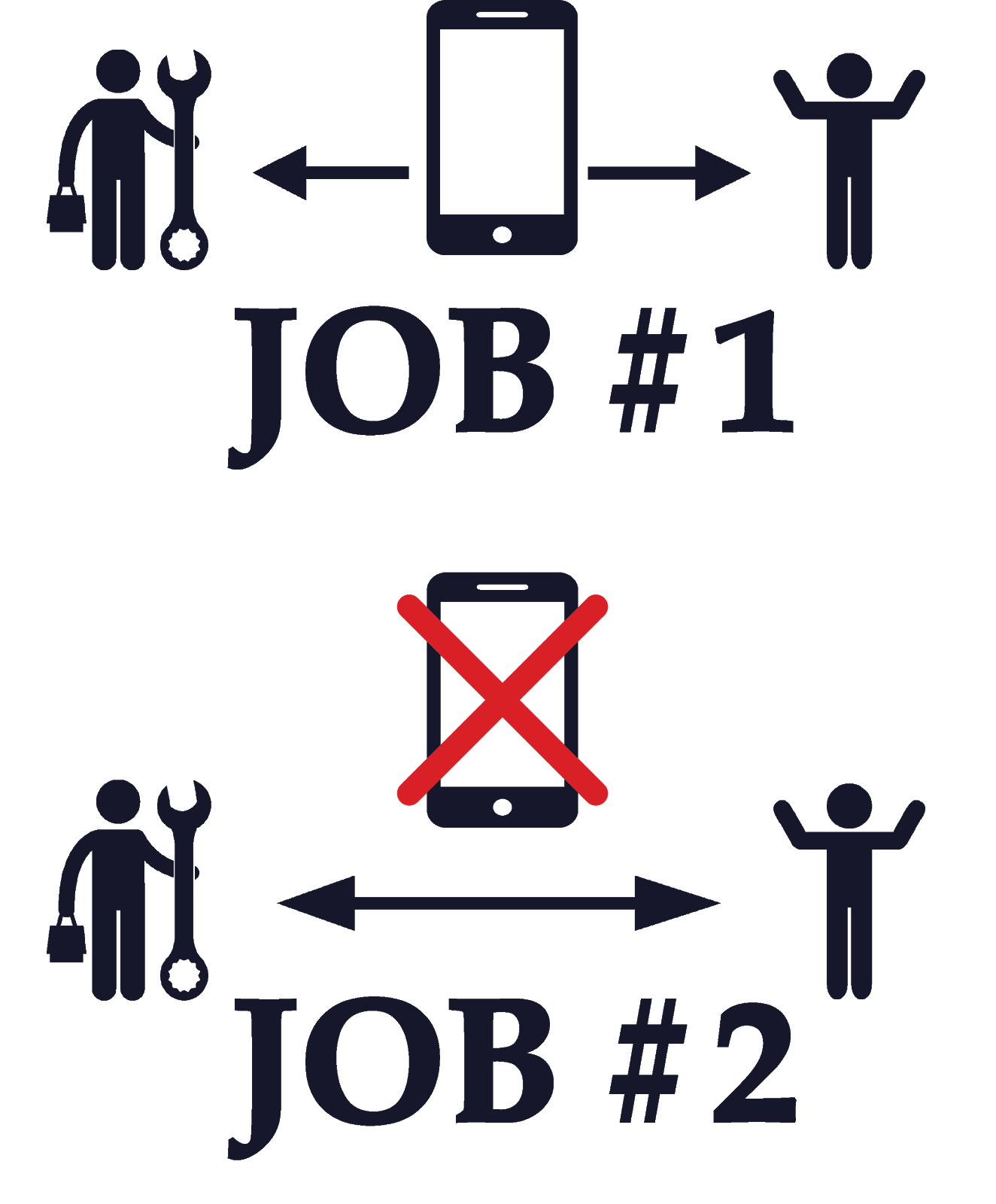

12) Avoid Disintermediation

Some marketplaces naturally tend toward creating strong relationships between buyers and sellers, which allows them to establish business directly and cut out the marketplace from future transactions. This is often the case for platforms that facilitate real-life labor transactions.

For instance, HomeJoy, the home cleaning startup that raised $40 million before shutting its doors, never found a playbook to block disintermediation. TakeLessons in San Diego was founded in 2006, raised $19M, and has a great management team, but has fought this issue all its life.

Tactics include:

– Lyft and Uber masking the phone numbers of their drivers and riders to intercept disintermediation.

– Tutor.com taking a 50% rake from the first transaction, and reducing the rake on every subsequent transaction after that to remove incentives to go around the platform.

– Hired.com’s ASP is $10,000, a pretty big incentive for the employers to disintermediate. The platform famously overcame this by gifting their job seekers a $150 bottle of champagne when they got hired, and in the process of telling Hired where to send the champagne, the job seeker revealed the name of their new employer to Hired so they could send the $10K invoice.

13) Fragmentation / Concentration on the Supply Side

See #14 below for how we assess fragmentation.

14) Fragmentation / Concentration on the Demand Side

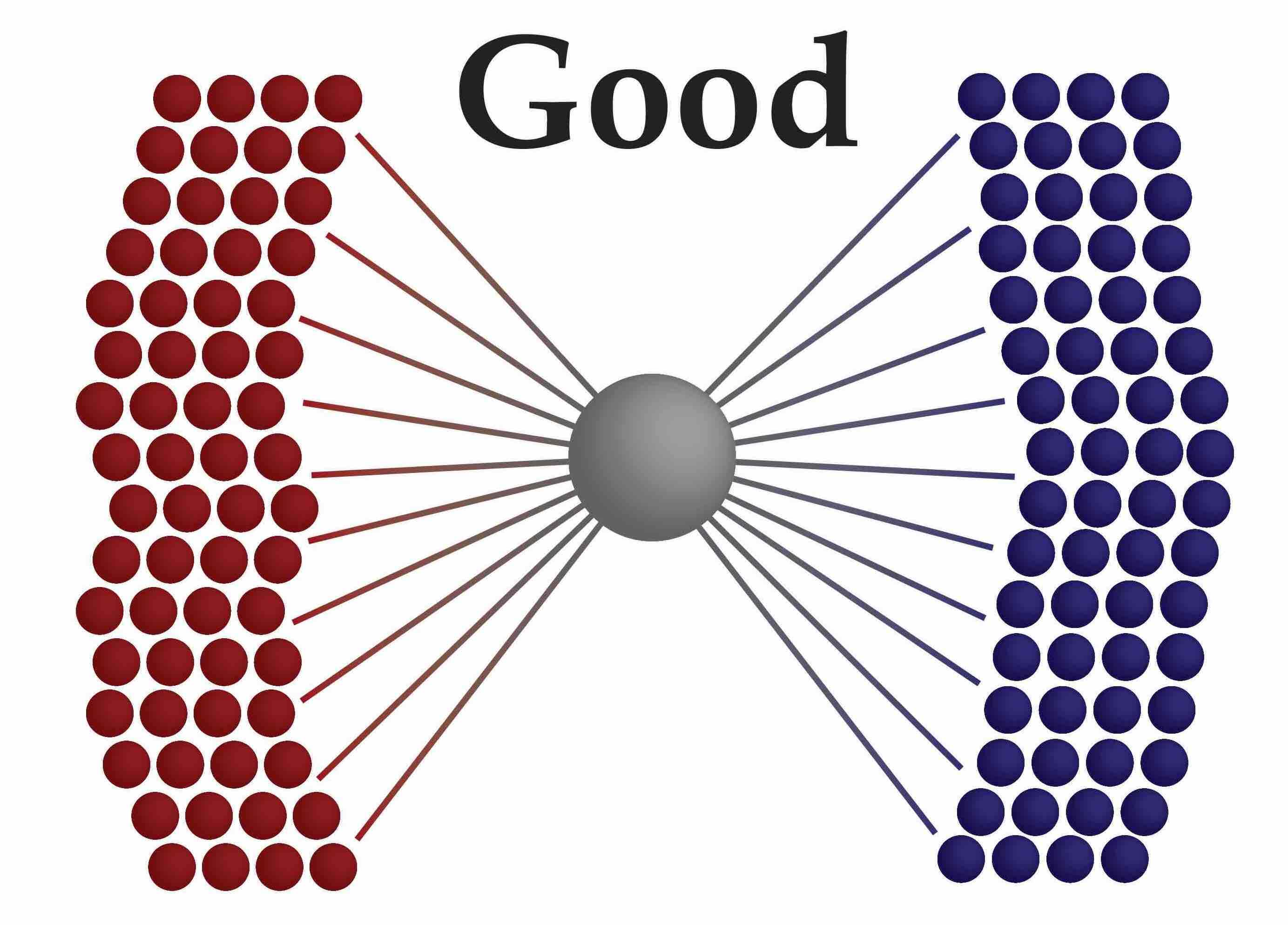

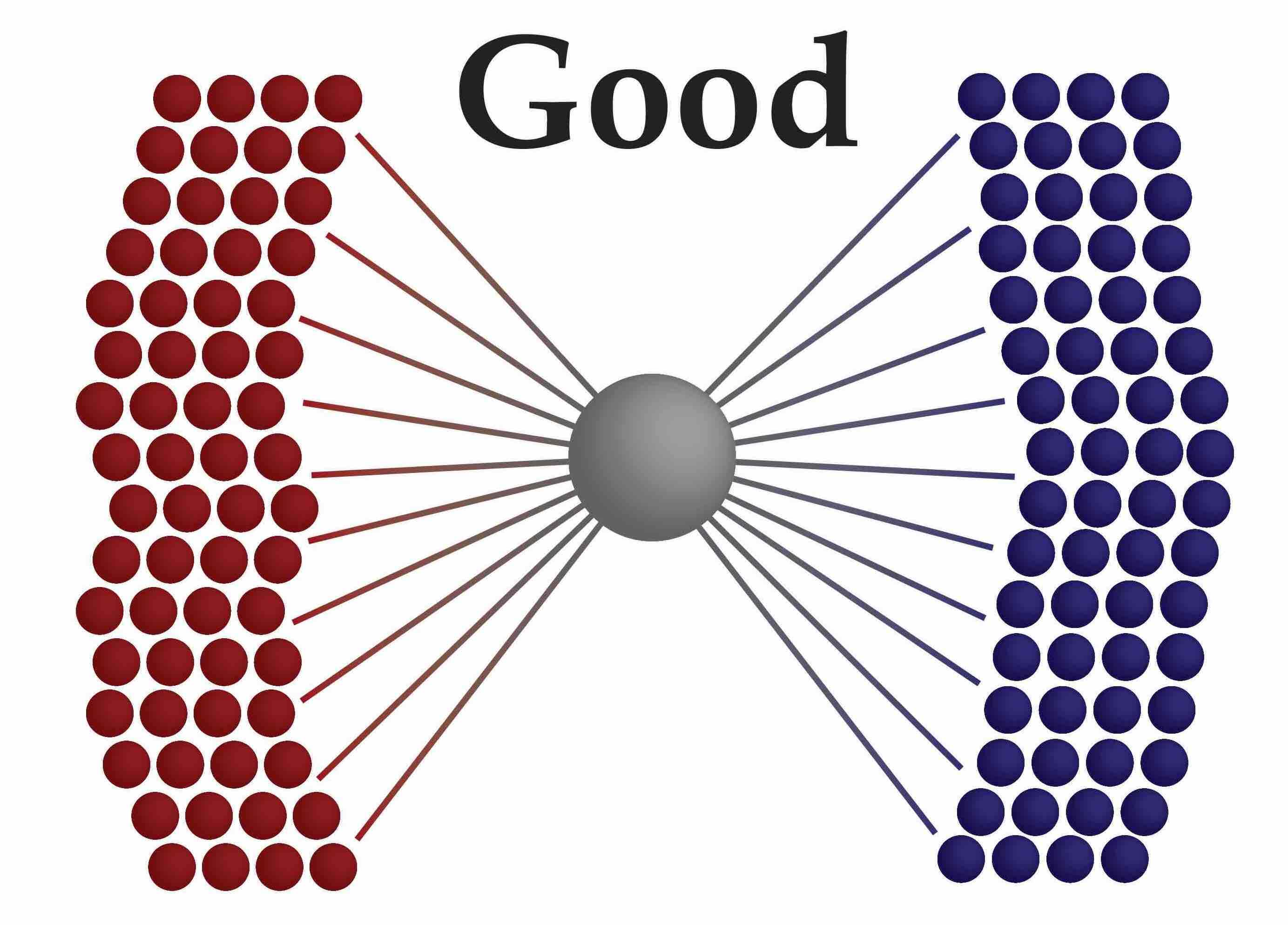

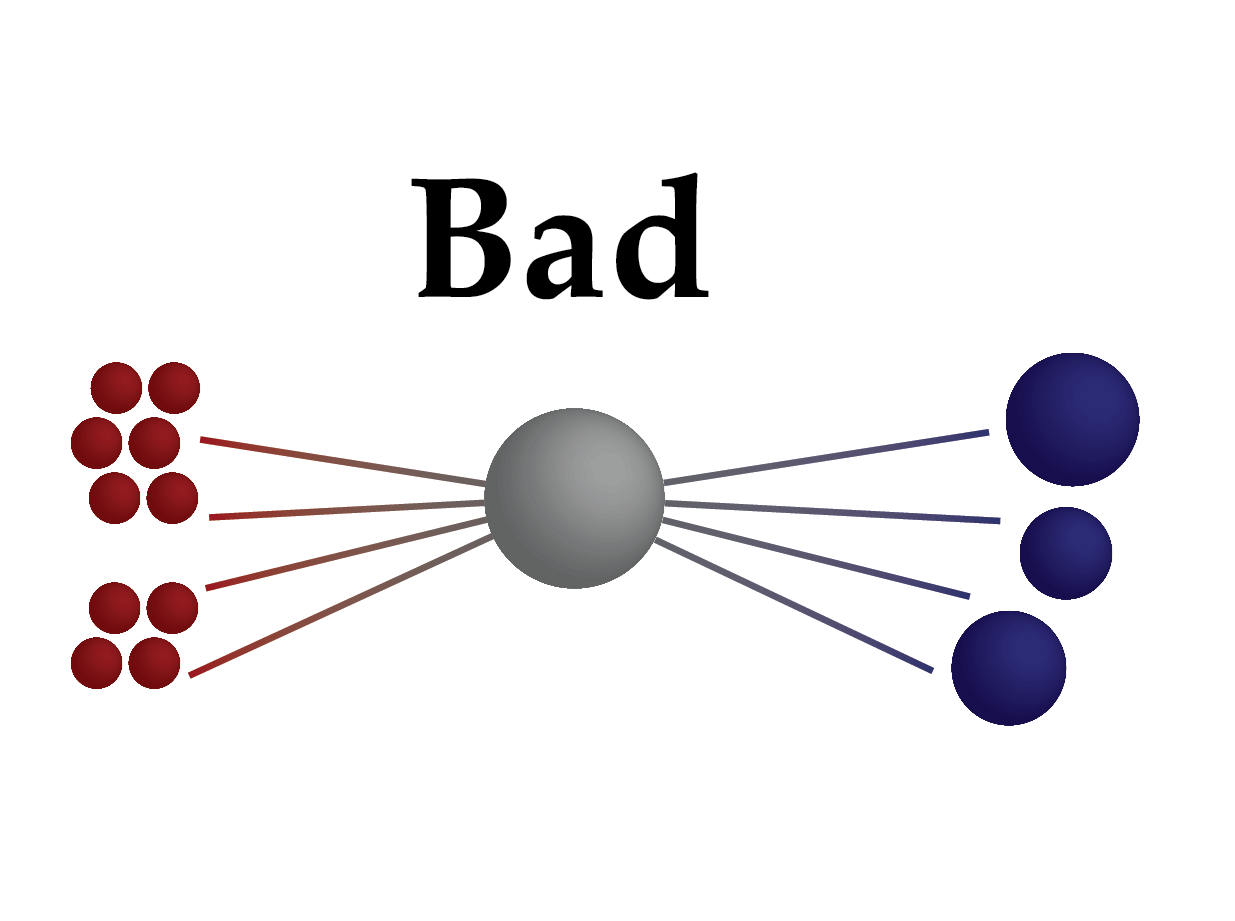

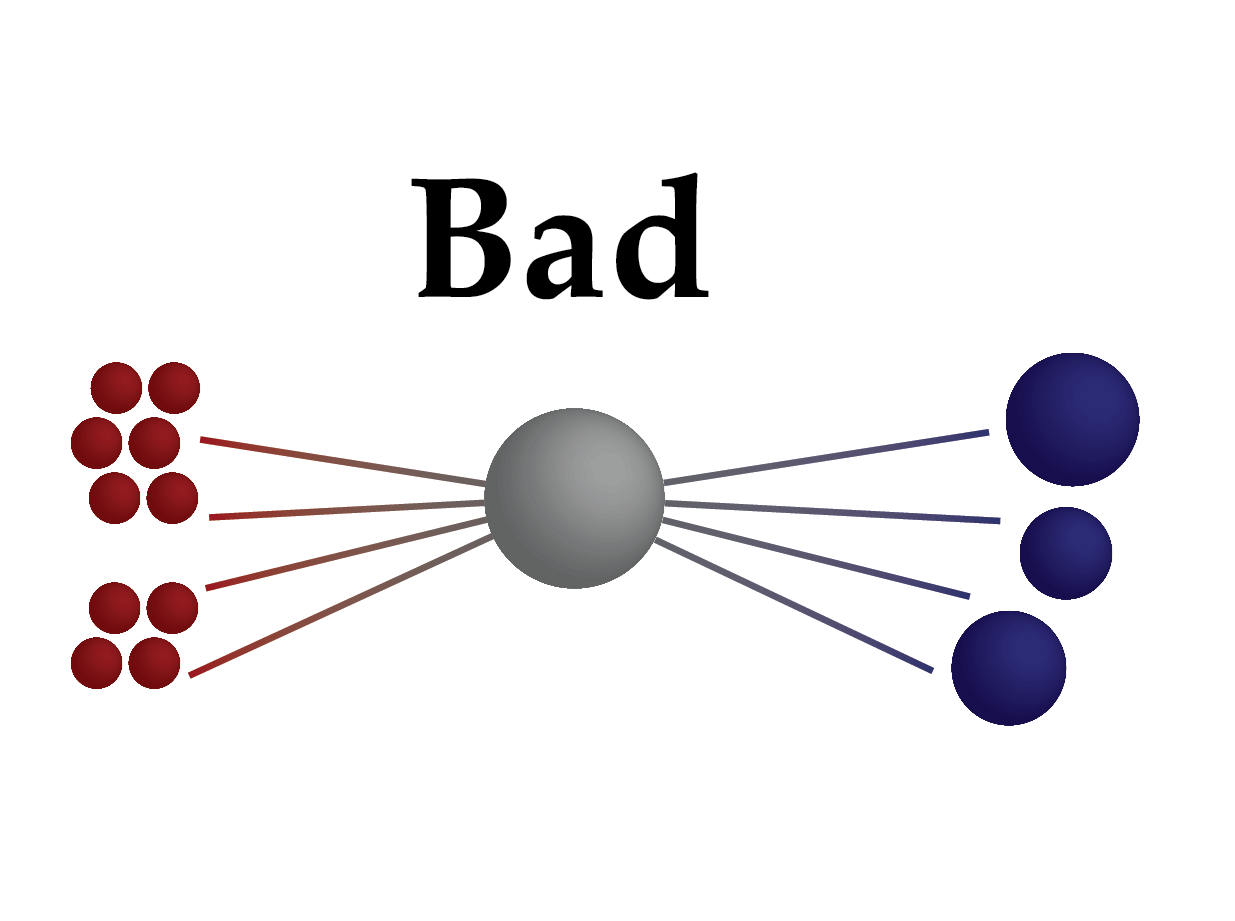

We typically look for high fragmentation of both supply and demand, meaning with many hundreds or more of suppliers, and many thousands or more buyers, there are not a few dominant players on either side. The high fragmentation indicates high competition, so the players will be encouraged to use the marketplace to compete with each other.

Low fragmentation means the opposite. The powerful players on either side will leverage their market power to keep the marketplace from getting traction or disintermediating or multi-tenanting over time. Plus if there is a player on either side who is too powerful, their defection from the marketplace can cripple a marketplace.

15) Asymmetries To Leverage for Growth

When considering a marketplace we like to identify the asymmetries that can be catalyzed.

This is done by finding the imbalances across and within the supply and demand-sides of a marketplace.

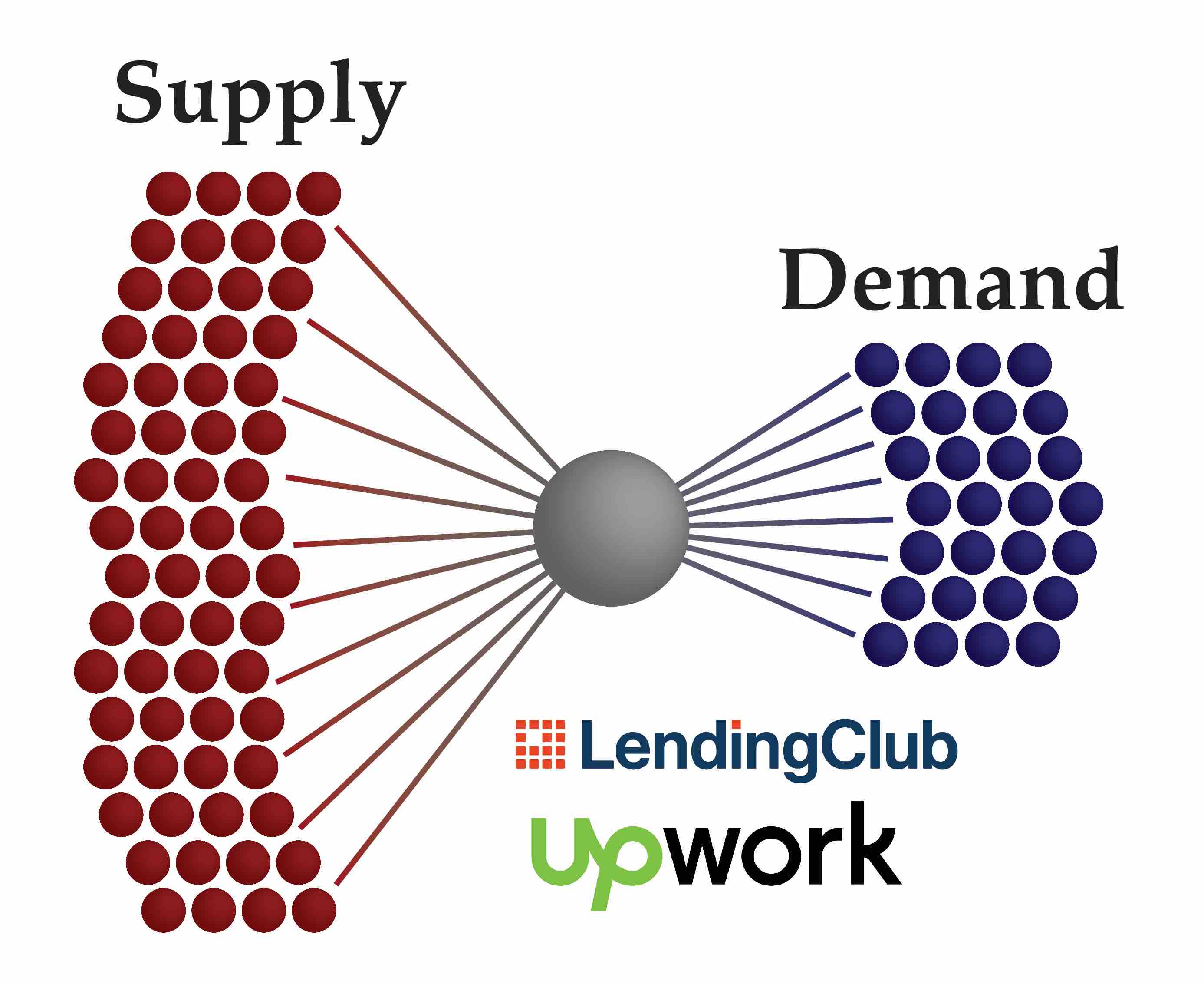

Take a situation where there is a surplus of supply and a limited demand, as is the case with companies like LendingClub and Upwork. has plenty of engineers in their supply around the world, but they’re constantly working to increase the demand. LendingClub has plenty of capital to give people loans, but they’re constantly looking for people to actually take the loans. In both these cases, growth can come from focusing on growing demand. That asymmetry simplifies building a two sided marketplace.

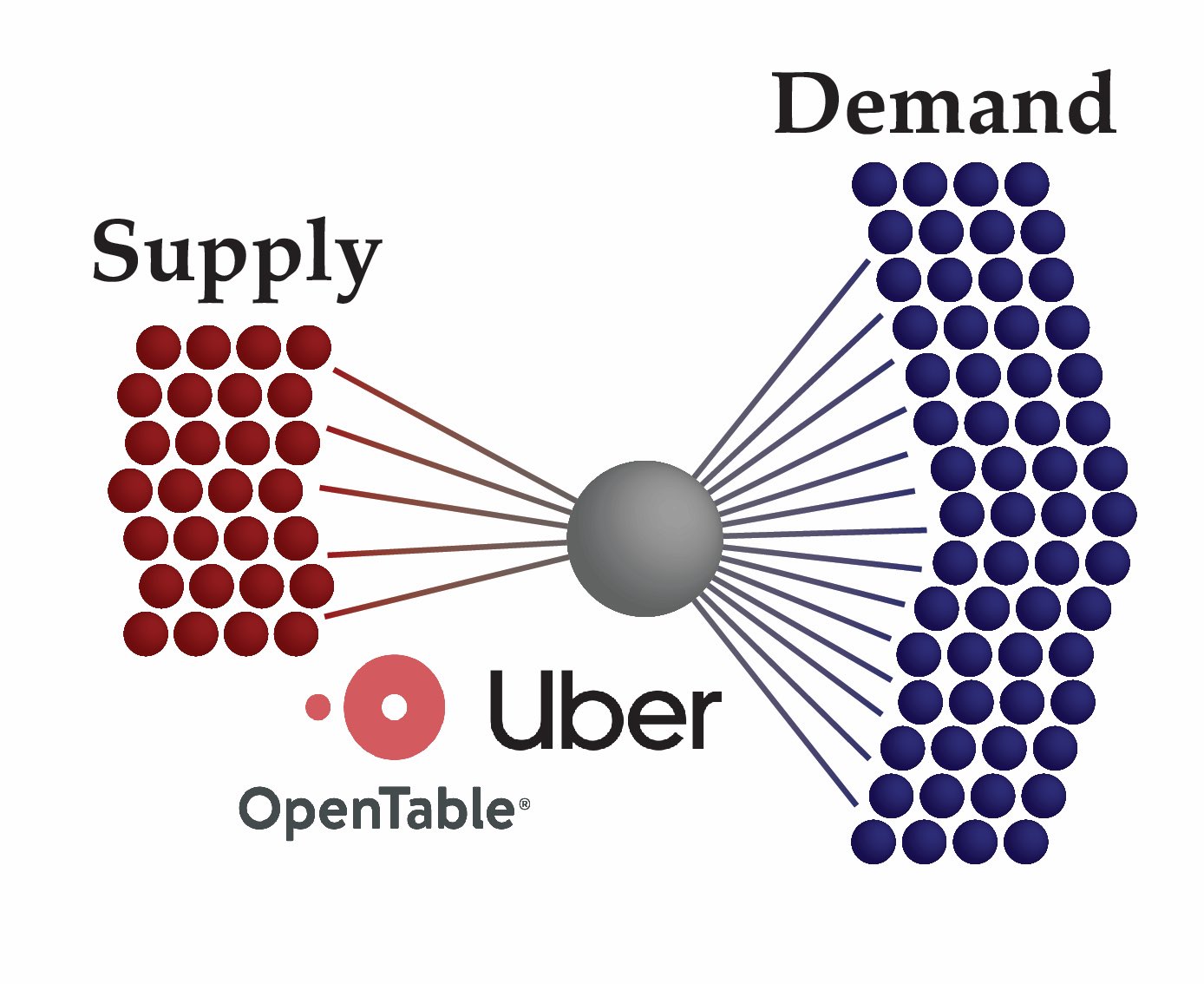

Here’s what the opposite looks like: Uber spends most of their time on the supply side (getting more drivers) because there is a surplus of people who want the rides. It took OpenTable 7 years to open the supply-side up to the demand side.

Even if asymmetries between the demand and supply are easily discernible, you can always find asymmetries within each side. Typically, there are certain buyers or sellers who will create more value. The way to leverage this is to identify what we call “the white hot center” of activity within the supply or demand. Look for the same types of asymmetries on the opposite side, and then try to connect those two.

Training your eye to see the asymmetries will help you prioritize the right customers –– supply or demand –– and come up with with the best playbook for growth.

16) New Experience for Supply

See #17 below for how we assess new experience.

17) New Experience for Demand

Being able to offer a fresh UI to an old market can be category changing. A clever UI can be proof that a market will drastically increase over time, and delight customers along the way.

eBay transformed flea market buying, which historically revolved around getting in your car and driving to a market, into a click+buy experience. , an that offers fixed-price legal services, is expanding access to the judicial system through a new interface which is a smartphone app. created a new interface for buying and selling hospital equipment that is revolutionizing the category by putting the business on a web interface rather than phone calls and faxes.

Marketplaces that deliver a strikingly fresh approach to an old market also reap the growth benefits of organic word-of-mouth, and have an increased ability to grow the market from what it was in the past.

18) Solve Complete Needs of the Supply

See #19 below for how we assess solving complete needs.

19) Solve Complete Needs of the Demand

The best way to avoid multi-tenanting is to solve the complete needs of at least one side of the market. One way that happens is to get your users to use your marketplace all day.

, formerly an NFX portfolio company and now a part of Houzz, built a SaaS tool to manage interior designers’ clients. The designers were using the software many hours per day as their SaaS workflow tool, which inserted Ivy into the payment flow and helped them avoid multi-tenanting.When we look at marketplaces we’re always finding ways to get customers to spend longer periods of time on the platforms.

20) Size of the Market (Total Addressable Market)

Oftentimes, the basic rule among investors is “Only invest if you see: 1) Founder excellence and 2) a large TAM (total addressable market).”

We agree with that, so TAM is on our Scorecard.

But there are caveats, especially for marketplaces.

Small-ish markets tend to bleed into other markets really quickly once their “white-hot center” has been found. Starting with books (Amazon) or black cars in SF (Uber), or air beds in extra rooms in apartments (Airbnb) can deliver the momentum a marketplace needs to move into adjacent markets quickly.

So while a recognizable TAM is a good thing, often, the true TAM isn’t recognizable at first look during the seed and Series A rounds.

21) Market Expanding Properties

The fact that a marketplace (service) exists can, in some cases, prove that a marketplace can double, triple, or even quadruple its TAM.

Lyft and Uber are good examples of this: more people are taking rides now than they were 10 years ago because these platforms exist. is another. Many more women are selling their used clothes out of their closets than they used to, about 4 million more women.

If this market expanding property can be proved early on, it generates a lot of enthusiasm from savvy investors because it means the market is a lot bigger than most other investors think it is.

It’s rare, but marketplaces can also create entirely new markets. Airbnb created a new market – people had never paid money to rent spaces in other people’s homes before.

New markets are tricky, and it’s hard to know with certainty that the timing is right. We’ve written about that in the past, see .

22) Affordable, High Volume Growth Channels for Supply

See #23 below for how we assess growth channels.

23) Affordable, High Volume Growth Channels for Demand

It’s pointless to have a marketplace if it can’t be grown to fast enough and large enough to reach sufficient liquidity for users to then stick around.

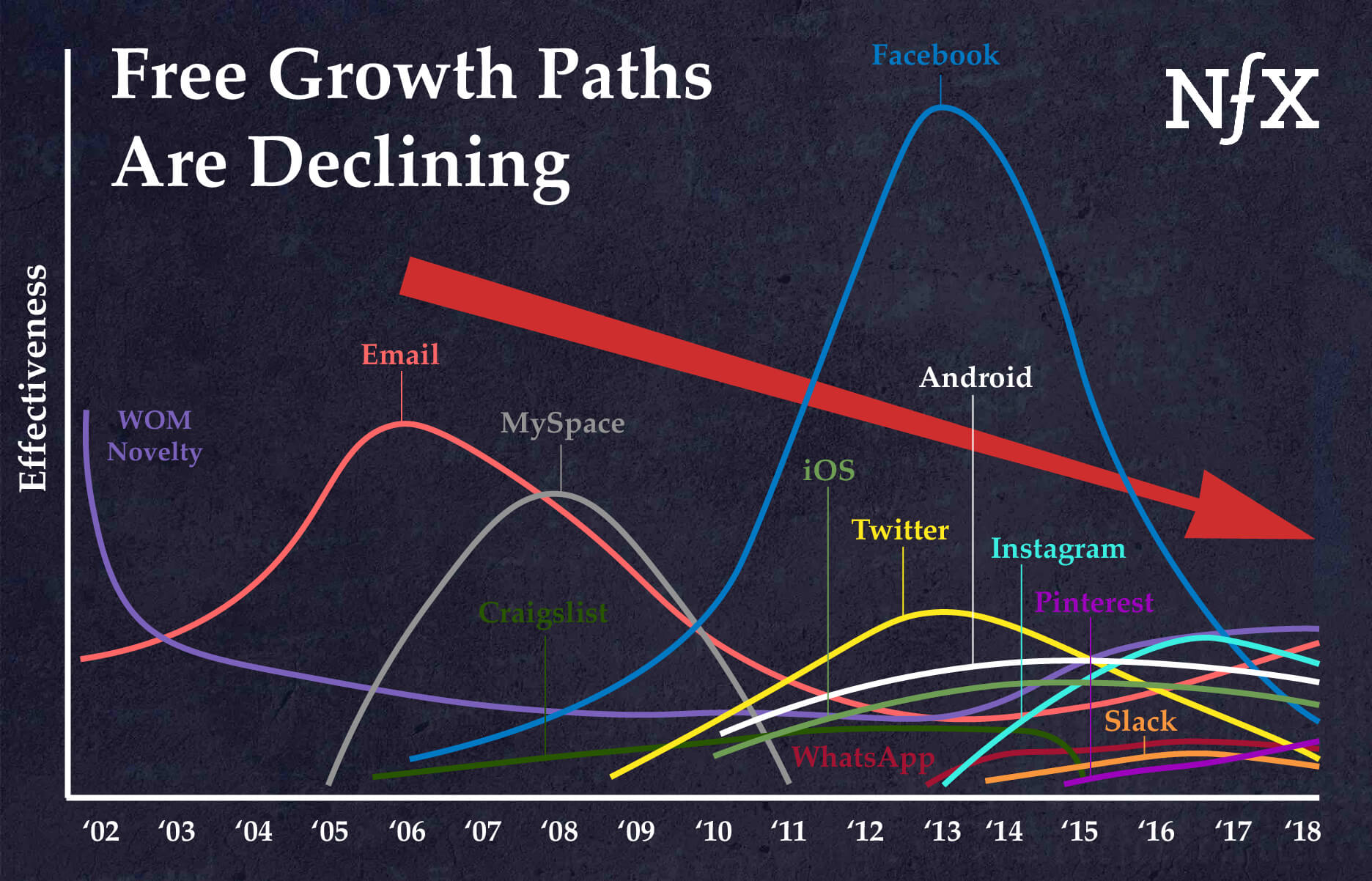

Companies can either grow organically or through paid channels. Of course, organic is obviously better – most of today’s giant marketplaces grew organically. However, it’s a lot harder to find effective and affordable growth channels today than it was 5-years ago. Facebook and Google own a majority of traffic and they’ve found effective ways to put up tolls.

Some marketplaces find small pockets of user acquisition to get going initially, but unless they find truly scalable channels, they often wither.

We want to see at least one affordable channel for marketplaces to get sufficient scale, because that’s what it takes to establish an impactful marketplace.

Other attributes we consider:

There are additional attributes we look for in marketplaces, but since they aren’t always better or worse, we didn’t include them on the scorecard list:

Find out your score on the NFX Marketplaces scorecard below and use your score to better communicate your business’s strengths.

Want to print your doc?

This is not the way.

This is not the way.

Try clicking the ··· in the right corner or using a keyboard shortcut (

CtrlP

) instead.