Share

Explore

April 2023 Product Report

April 2023 Product Report

Summary

Positives

Negatives

Q2 Product Team Objectives

Zapier Adoption

Description

We really want to prioritize zapier adoption this quarter and moving forward. To help drive adoption, we released a new in-app integration page that helps users get started with ZapierProgress

000

100Surpass 5% NUAR

Description

Right now our NUAR sits at around ~2.5%. We should be able to move this with the following projects:

Progress

000

60Product Feedback

Description

In Q2 we want to capture product feedback on core user workflows to iron out what exactly works vs doesn’t work in V1. This enables us to scope V2 Beta to meet our core customers needs.

Progress

000

20V2 Prototypes

Description

In Q2 the product team is shifting focus to V2. Initially this means a hault to V1 Project Scoping.

In regards to V2, we are working on the following

Progress

000

40

User Cohorts

Product Metrics

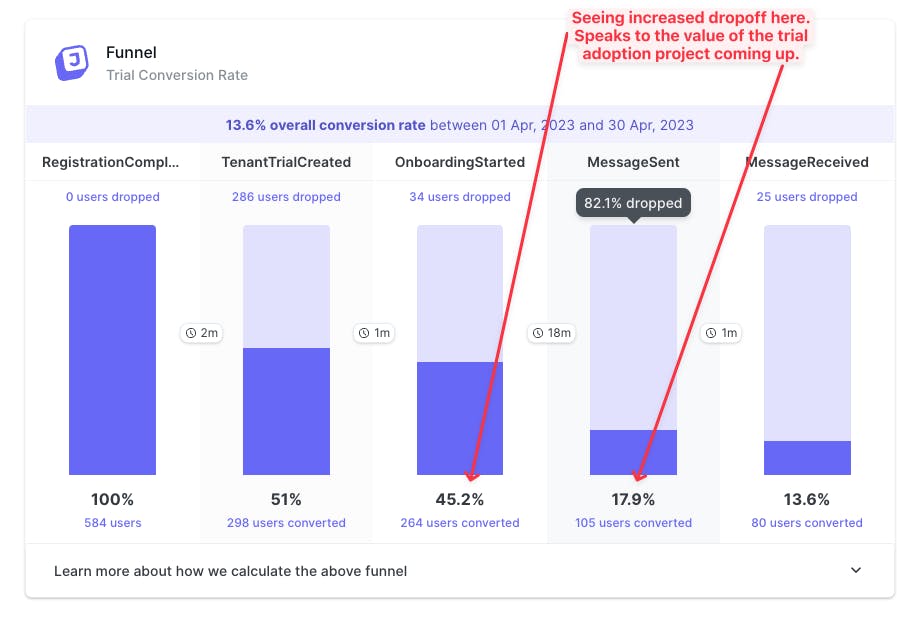

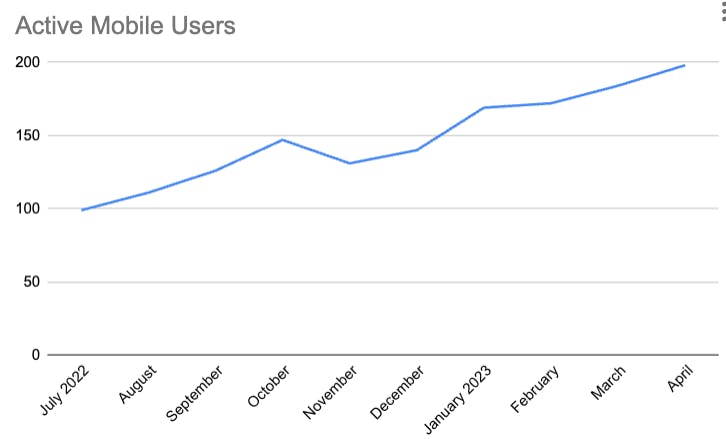

This speaks to the phone number aspect of our Trial Adoption Project

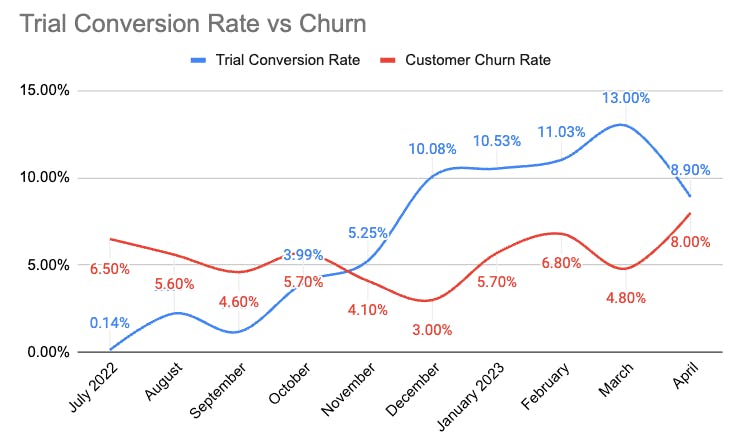

April was an alarming month due to churn rate. First time since we shift business models that churn was anywhere close to trial conversion rate

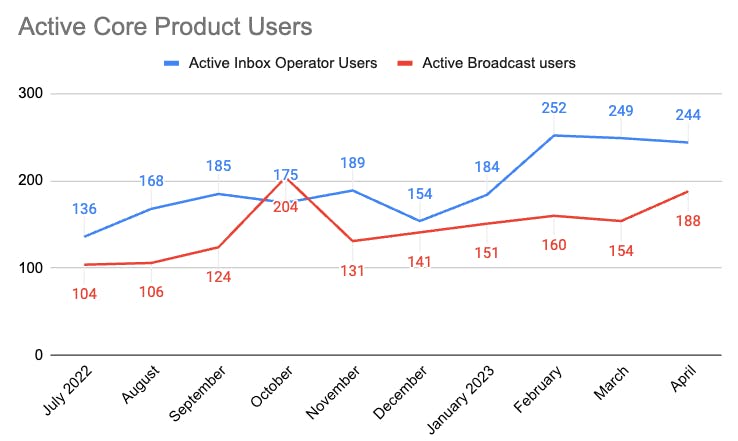

We’ve now gone 2 straight months with negative growth for our Inbox User Cohort

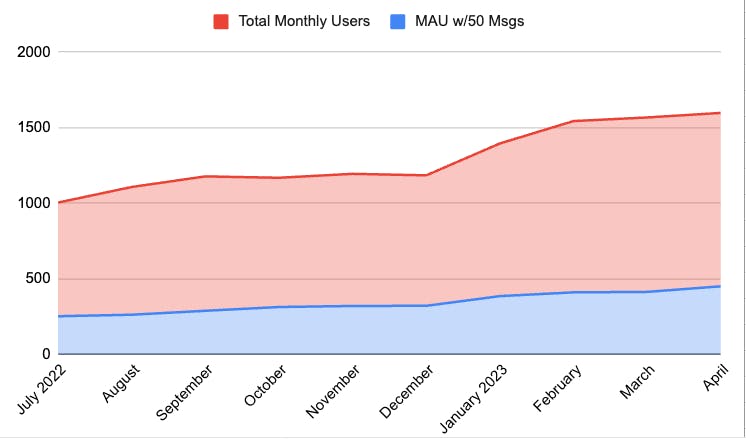

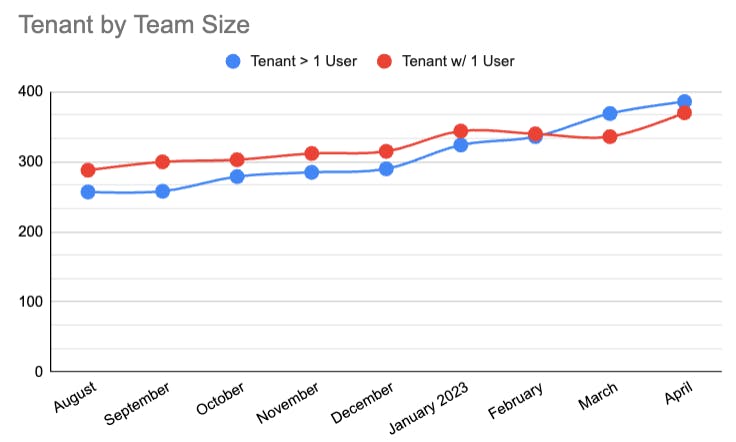

we’ve continued to see a shift where more tenants are multi-user tenants. Overall this is good news. the large increase in single-user tenants may be related to spam

Want to print your doc?

This is not the way.

This is not the way.

Try clicking the ⋯ next to your doc name or using a keyboard shortcut (

CtrlP

) instead.