Skip to content

ITIN Secure Mortgage Program

ITIN Secure Mortgage Program

ITIN Secure Mortgage Program

Chapter 1 - General Loan File Delivery Requirements

1.1 - INTEREST CREDIT

1.1.2 - PRINCIPAL CURTAILMENT

1.1.3 - ASSUMABILITY

1.1.4 - PROPERTY INSURANCE

1.1.4.1 - COVERAGE REQUIREMENTS

1.1.5 - COMMERCIAL GENERAL LIABILITY INSURANCE: 2-4 MIXED USE PROPERTIES (If Applicable / Currently suspended)

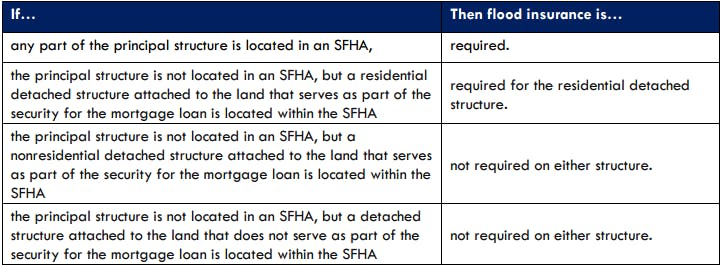

1.1.6 - FLOOD INSURANCE

1.1.6.1 - ACCEPTABLE FLOOD INSURANCE POLICIES

1.1.7 - TITLE POLICY REQUIREMENTS

1.1.7.1 - TERMS OF COVERAGE

1.1.7.2 - EFFECTIVE DATE OF COVERAGE

1.1.7.3 - AMOUNT OF COVERAGE

1.1.7.4 - MORTGAGE ELECTRONIC REGISTRATION SYSTEM (MERS)

1.1.7.5 - OTHER REQUIREMENTS

1.1.7.6 - CHAIN OF TITLE

1.1.7.7 - CONDOMINIUM OR PLANNED UNIT DEVELOPMENTS (PUD)

1.1.7.8 - TITLE EXCEPTIONS

1.1.7.9 - MINOR IMPEDIMENTS TO TITLE

CHAPTER 2 - ITIN MORTGAGE

SECTION 2 - PRODUCT MATRACIES (12/31/22)

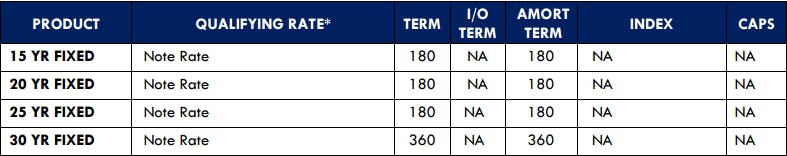

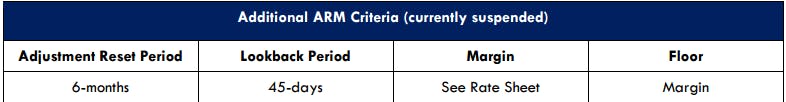

2.1.0 - ELIGIBLE PRODUCTS (12/31/2022)

2.1.1 - QUALIFYING PAYMENT

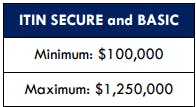

2.1.3 - LOAN AMOUNTS

2.1.4 - MINIMUM CREDIT SCORE

2.1.5 - SOLAR PANEL REQUIREMENTS

2.1.6 - PRIVATE MORTAGEGE INSURANCE (PMI)

2.1.7 - LOAN DOCUMENTATION

2.1.7.1 - NOTE AND SECURITY INSTRUMENT FORMS

2.1.7.2 - HYBRID CLOSING

2.2.0 - AGE OF DOCUMENT REQUIREMENTS

2.2.1 - CREDIT REVIEW DOCUMENTATION

2.2.2 - APPRAISAL

2.2.3 - CLARIFICATION

2.3.0 - BORROWER ELIGIBILITY

2.3.1 - NON-PERMANENT RESIDENT ALIEN

2.3.2 - NON-OCCUPANT CO-BORROWERS

2.3.3 - FIRST-TIME HOMEBUYERS

2.3.4 - TITLE VESTING AND OWNERSHIP

2.3.4.1 - POWER OF ATTORNEY

2.3.5 - OCCUPANCY TYPES

2.3.6 - BORROWER STATEMENT OF OCCUPANCY

2.3.7 - BORROWER STATEMENT OF BUSINESS PURPOSE (INVESTMENT PROPERTY)

2.4.0 - TRANSACTION TYPES

2.4.1 - ELIGIBLE TRANSACTIONS

2.4.1.1 - PURCHASE

2.4.1.2 - RATE/TERM REFINANCE

2.4.1.3 - CASH-OUT

2.4.1.4 - DELAYED FINANCING

2.4.2 - LISTING SEASONING

2.4.3 - NON-ARM’S LENGTH TRANSACTIONS

2.4.3.1 - NON-ARM’S LENGTH TRANSACTION

2.4.3.2 - ELIGIBLE NON-ARM’S LENGTH TRANSACTIONS

2.4.3.3 - NON-ARM’S-LENGTH RESTRICTIONS

2.4.4 - INTERESTED PARTY CONTRIBUTINS (ORIGINATOR/SELLER CONCESSIONS)

Want to print your doc?

This is not the way.

This is not the way.

Try clicking the ⋯ next to your doc name or using a keyboard shortcut (

CtrlP

) instead.