BASICS

How it works

How it works

How it works

Position opening

Short

Long

Short

Long

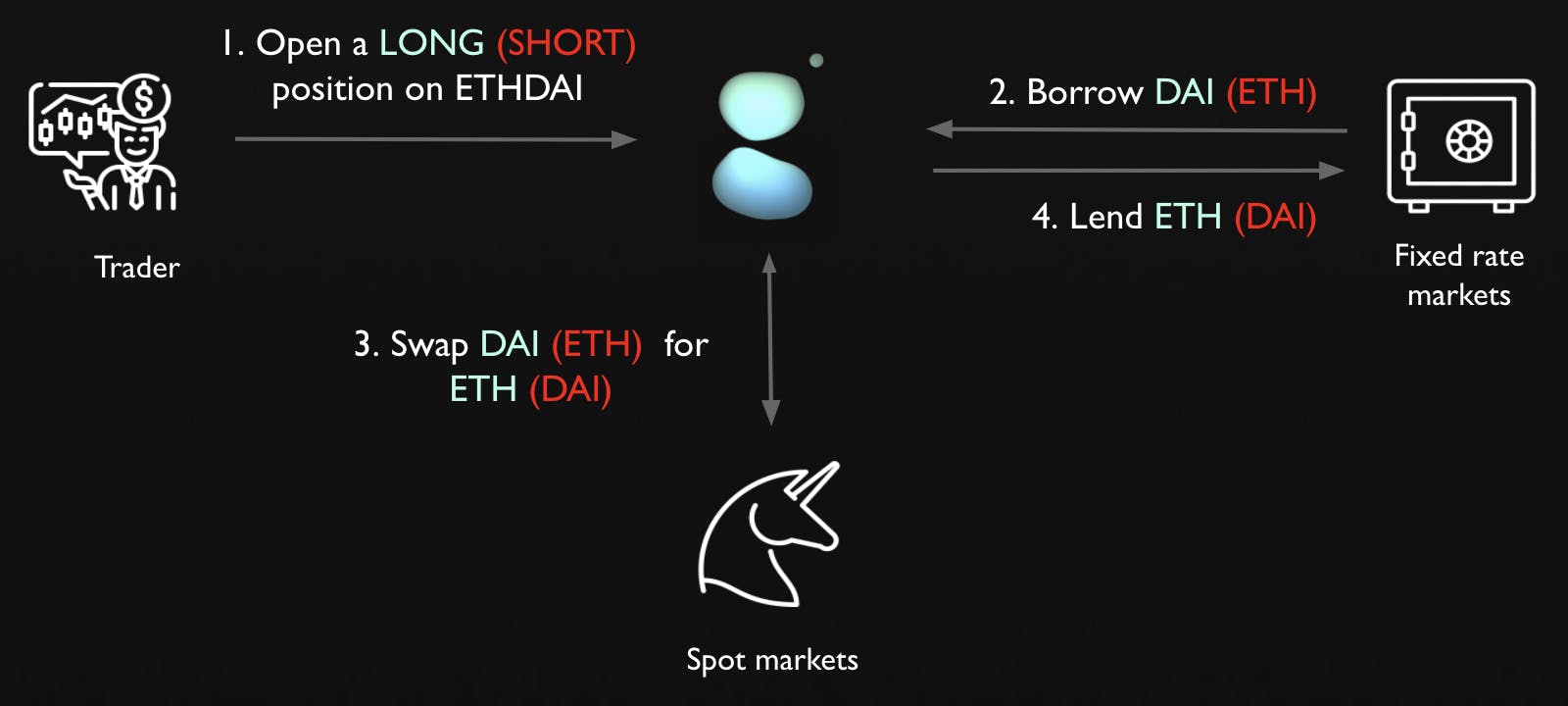

1

1. Trader sells a futures

1. Trader buys a futures

2

2. Protocol borrows the base currency

2. Protocol borrows the quote currency

3

3. Protocol sells the borrowed amount for an equivalent amount of the quote currency on the spot market to synthesize a sell short position.

3. Protocol sells the borrowed amount for an equivalent amount of the base currency on the spot market to synthesize a long position

4

4. The amount of the quote currency is lent

4. The amount of the base currency is lent

There are no rows in this table

Position closing

Short

Long

Short

Long

1

1. Trader sells a futures

1. Trader closes a long position

2

2. Protocol gets the principal and the interest from lending the quote currency

2. Protocol gets the principal and interest from lending the base currency

3

3. Protocol swaps the quote currency for the base currency on the spot market

3. Protocol swaps the base currency for the quote currency on the spot market

4

4. Protocol gives back the borrowed funds including the accrued interest

4. Protocol gives back the borrowed funds including the accrued interest

There are no rows in this table

Want to print your doc?

This is not the way.

This is not the way.

Try clicking the ⋯ next to your doc name or using a keyboard shortcut (

CtrlP

) instead.